Gold, Stocks, Bonds and Economy, No One Loves a Pessimist

Stock-Markets / Stocks Bear Market Nov 18, 2010 - 03:58 AM GMTBy: Brian_Bloom

Generally speaking a congenital pessimist is regarded as being anti-social. The “every silver lining has a dark cloud” attitude to life is not appreciated by people who consider themselves to be mentally healthy.

Generally speaking a congenital pessimist is regarded as being anti-social. The “every silver lining has a dark cloud” attitude to life is not appreciated by people who consider themselves to be mentally healthy.

But the flip side of this is that whilst an “every cloud has a silver lining” attitude tends to raise ones profile in the popularity stakes, it is likely to be just as inaccurate in its conclusions.

… which is why one should rely more on facts than on emotions when assessing questions relating to market direction.

Possibly one of the more important charts is the one below – the monthly chart of the gold price (courtesy decisionpoint.com)

There are two aspects to this chart which bear comment:

- Whilst the chart itself was rising, the rate of price increase has been noteworthy for its less than enthusiastic endorsement – as evidenced by the PMO oscillator. Indeed, over the past four months, when the price spiked to a new high, the oscillator barely rose above its June high – which is far below its March 2008 high.

- There is a downside gap in the bar chart – which has a reasonable probability of turning out to be a breakaway gap. i.e. The gold price might be facing some significant downside within a primary bull trend.

What is the relevance of this?

If we look at the Baltic Dry Goods Index we get our first clue (source: http://investmenttools.com/futures/bdi_baltic_dry_index.htm )

Baltic Exchange Dry Index (BDI)Recent,

|

|

Note how freight rates have plunged in recent weeks. Importantly, this is not a reflection of what businesses are thinking. It is a reflection of what businesses are doing (or not doing).

Another not-so- random fact caught my eye a few days ago. It referred to an unexpected sharp fall in the New York Manufacturing Index by around 27 points to minus 11.1. The index for new order fell by 37 points (Source: http://online.wsj.com/article/SB10001424052748703670004575616923749660124.html?mod=googlenews_wsj and http://www.newyorkfed.org/survey/empire/empiresurvey_overview.html )

Perhaps it was the sudden rise in optimism of manufacturers regarding the future that prevented the NYSE from falling apart – possibly arising from the election results. But whether one is a glass half empty or a glass half full kind of person, it’s hard to see how a shift towards Republicans is going to cause manufacturing activity to suddenly jump – unless manufacturers are expecting the dollar to collapse; which will have the effect of making local manufacturers more competitive.

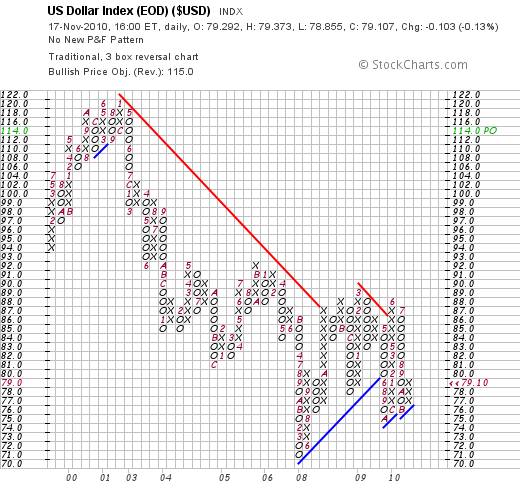

So let’s have a look at a couple of charts of the US Dollar Index.

The first chart is a Point & Figure Chart, courtesy Stockcharts.com

The fact is that this chart is in a bull mode. (See rising blue trend line). Of course, the dollar could turn on a dime – if you’ll excuse the expression – but the current direction of movement of the dollar index is “up”

Interestingly, the weekly bar chart of the dollar index (courtesy DecisionPoint.com) broke above its falling trend line and the oscillator looks like it wants to turn up

Interesting times ahead. If the dollar rises then imports will become cheaper. So why are manufacturers feeling optimistic? Republicans rule? Seems a bit like wishful thinking to this analyst.

Well, why don’t we look at what the industrial markets are telling us?

Interestingly, the 30 stock Dow and the 500 stock S&P are sending out subtly different signals

The weekly Dow chart below (courtesy Decisionpoint) is showing that a “false” breakout is currently rectifying itself – as was being forecast by the falling tops on the oscillator. When that breakout manifested I stopped writing these editorials. No one loves a congenital pessimist.

By contrast, the $SPX never got through its previous high.

The dashed line shows the resistance level and the bearish “double top” formation that emerged when the market pulled back.

Could the Obama/Bernanke Stimulus plans be heading for trouble?

Well, if what the Fed says it will be doing (printing squillions of dollars) and what the Fed actually does do not reconcile then, perhaps, we might be heading for an era of capital shortages. Under this scenario, the price of money (interest rates) might rise.

Yup! The chart below – of the 30 year yield – is pretty clear

The 30 year yield has broken above both its 17 week and 42 week moving average and the oscillator also gave a modest buy signal

To get things into perspective, we might have a look at the monthly chart

No cause for panic just yet, but it certainly looks like 4% will be viewed as a reasonable level out in the future. Arguably, the fact that the oscillator top reached its highest level in 22 years is something that needs to be taken very seriously. Arguably, a rising price of money will support the dollar. Arguably, this is why the gold price is looking vulnerable. Arguably, this bold talk of QE2 is just whistling in the dark.

But there is a potentially serious issue. If rates rise and business activity stagnates (if it does not contract) because of lack of follow through on the promise to inflate to buggery then what will happen to the industrial markets?

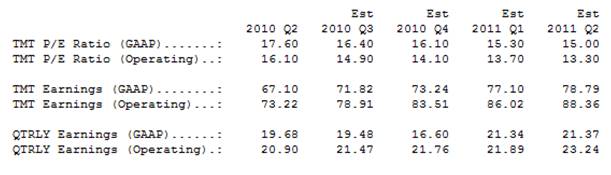

The following table shows the level of Earnings on the SPX (courtesy DecisionPoint)

Hmmm? There seems to be the makings of a potentially serious disconnect. Estimated GAAP P/E ratio for Quarter 3 is 16.4 and earnings are expected to rise from that level.

Well, here’s the question:

If the facts are that business activity is contracting (Baltic Dry Goods freight rates and New York Manufacturers Index) and if the facts are that the markets are placing upward pressure on both the US Dollar and interest rates, then why would earnings rise from here?

It used to be that the US Consumer accounted for 70% of GDP. When that went away, profits remained robust because the government borrowed something like $3.5 trillion dollars between October 1st 2008 and September 30th 2010 and pumped that money into various carefully selected sectors of doubtful value from the perspective of Joe Sixpack. In short, Joe didn’t really benefit from this activity and employment has not risen.

Therefore, it follows that if corporate earnings are to continue rising, the Federal Government will have to continue to man the pumps.

All of which makes sense – except for the “fact” that the charts are casting doubt on this outcome.

So, what is the likely outcome if earning shrink from this level?

Although no one likes a pessimist, there is little objective cause for optimism at this point in time. Professor Obama has been exposed as a great feel-good orator with no real “beef”. Whilst he may genuinely believe that what he and his team have done has served to avoid a depression, all that really happened was they wallpapered over the cracks and the financial services industry was saved from disaster in the process. Great looking wallpaper, but wallpaper nevertheless. Unfortunately, the Republicans are throwing rocks but don’t have anything really constructive to offer.

Conclusion

The bottom line is that where the world economy now finds itself will take years to repair. The bottom line is that this particular grey cloud appears to have a grey lining. In 1998 we had a wonderful opportunity to fix the economy before it fell apart – which went down the gurgler because vested interests in the energy industries managed to prevail.

Short and to the point: There is no such thing as a free lunch. The idea that we can print our way out of an economic contraction is nothing but a pipe dream. We can expect a Second Down Leg in the GFC to arrive imminently.

Author’s comment

Regular readers will recognise that I have been consistently (sometimes boringly) pounding the same drum for almost eight years now. In June 2008 I published Beyond Neanderthal. The first chapter of the novel forecast the GFC, the next few chapters explained why it was inevitable and the balance of the book painted a vision of what might be done in the longer term to get things back on track.

Taking a less “visionary” view, I am now about 60% of the way through a more hard nosed look at what we might do to get through the next few years. Again via a storyline – this time a more intriguing storyline - this second novel takes a far more pragmatic view of the world and I am targeting to complete the manuscript by April 2011.

My personal outlook in life is that a problem is just a solution in disguise. Those of us who are able, need to start rolling up our sleeves. We need to kick the parasites out of both high office and big business and we need to take back control of our lives. There’s nothing wrong with the concepts of capitalism and democracy. What has been missing has been ethics and integrity. We need to re-establish the ground rules and severely punish those who have had the arrogance to flaunt them. The concept of a CEO – any CEO – earning well over a hundred times the income of an average employee in his/her organisation is, in my view, a jailable offense. It is theft, pure and simple. The concept of a politician “buying” his way into office by pork barrelling is fraudulent. The concept of lobby groups ensuring that political nominees will represent their interests above the interests of the voters is also a jailable offence in my view. There is no such thing as a free lunch. Someone has to pay. Well dear reader, now we know who has been paying. Ordinary folk like you and me. The time has come to draw a line in the sand. We ordinary folk need to take back control of our lives. Society needs to reassess its priorities. The big time thieves need to be locked behind bars and the keys thrown away.

Brian Bloom

Author, Beyond Neanderthal

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2010 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.