Mike Shedlock's Vacuous Deflation Market Calls Busted

Economics / Deflation Nov 22, 2010 - 09:33 AM GMTBy: Robert_Murphy

Over the last two years, I have gotten perhaps dozens of requests to "deal with" the deflationist approach of Mike "Mish" Shedlock. On his popular financial blog, Mish has been repeatedly patting himself on the back for correctly calling all the major trends in contrast to those economists (like Gary North and I) who naively think Bernanke has the power to raise prices if he so chooses.

Over the last two years, I have gotten perhaps dozens of requests to "deal with" the deflationist approach of Mike "Mish" Shedlock. On his popular financial blog, Mish has been repeatedly patting himself on the back for correctly calling all the major trends in contrast to those economists (like Gary North and I) who naively think Bernanke has the power to raise prices if he so chooses.

In the present article, I want to explain why I have not been persuaded by Mish's alternate framework. To be clear, I'm not arguing that Mish's fans should abandon their hero. Rather, I will simply point out that Mish's "calls" have not been nearly as prescient as he so often claims. Furthermore, I still believe that the Federal Reserve has the power to destroy the dollar next Thursday if it really wanted to.

In the present article, I want to explain why I have not been persuaded by Mish's alternate framework. To be clear, I'm not arguing that Mish's fans should abandon their hero. Rather, I will simply point out that Mish's "calls" have not been nearly as prescient as he so often claims. Furthermore, I still believe that the Federal Reserve has the power to destroy the dollar next Thursday if it really wanted to.

Mish's Framework: Credit, Deflation, and Gold

A good summary of Mish's views comes from a September 2010 blog post — it was this one that spurred me to write the current article, egged on by a reader who enjoys both Mish and my own work. Mish writes,

Day in and day out I hear it from readers who insist that we are not in deflation and will not be in deflation because prices are rising and continue to rise. …

Such comments come from those who are not thinking clearly about what's important. Here's why:

In a fiat credit-based financial system, when credit is plunging businesses are not hiring. There are currently 14.9 million unemployed who want a job but do not have a job because businesses are not hiring. … This is all related to the ongoing credit contraction.

When credit is plunging so do yields on treasuries and in turn yields on savings accounts. …

When business earnings are under pressure or when business owners face uncertainty over consumer spending trends, businesses cut back on benefits, especially health care. Those with health care benefits are asked to chip in more of the costs. This too is a function of deflation.

When profits are weak and business uncertainty high, stock prices do not act well (at least in the long run). Those with 401Ks or personal investments are affected.

With credit falling and wages stagnant or falling, anyone in debt is likely to have a harder time paying back that debt. Foreclosures rise so do bankruptcies and divorces. Entire families have gone homeless. …

Expanding credit (inflation) created an enormous housing bubble, a commercial real estate boom, a rising stock market, and an enormous number of jobs.

Contracting credit (deflation), burst the housing bubble, burst the commercial real estate bubble, burst the stock market bubble, resulting in millions of foreclosures and bankruptcies, millions of broken homes, millions on food stamps, 26.2 million unemployed or partially employed, and countless additional millions who are underemployed.

People notice food and energy prices because they tend to be somewhat sticky. Everyone has to eat, heat their homes, and take some form of transportation at times, but is that what's important?

No!

In the grand scheme of things, nominal increases in food and energy prices are but a few grains of salt in the world's largest salt-shaker compared to the massive effects of rising or falling credit conditions.

So we see that Mish takes great exception to those Austrians (especially Peter Schiff) who have been warning of inflation. Rather than focusing on statistics such as the monetary base (which has exploded since the crisis in the fall of 2008), Mish defines "inflation as a net expansion of money supply and credit, with credit marked-to-market. Deflation is a net contraction of money supply and credit, with credit marked-to-market."

The Rumors of Mish's Success Have Been Greatly Exaggerated

Although I am not a regular reader of Mish, I've skimmed enough of his posts to know that he frequently writes things like this (December 2008):

Those who think inflation is about prices alone were busy shorting treasuries, and looking the wrong direction for over a year. Only after the stock market fell 50 percent and gasoline prices crashed did the media start picking up on "deflation." Only those who knew what a destruction in credit would do to jobs, to lending, to retail sales, to the stock market, to corporate bond yields and to treasury yields got it right. (emphasis added)

As I say, Mish has been saying this repeatedly in the two years since TARP and the Fed's extraordinary interventions. And yet, if we don't simply take his word for it, and scour his archives, we'll find that he didn't "get it right" as much as he seems to think.

Before continuing, let me make a disclaimer: I am not arguing that Mish is a fool. If I spent two hours combing through the archives of any financial analyst who stuck his neck out making predictions, I would come up with all sorts of doozies. Mish knows this; he plays the game too. (Let me save Mish fans time and point you to my worst call, at the bottom of this article.) So the reason I am going through this exercise is to rebut the notion that Mish has guided his readers through the storm and gotten the major trends right, all along the way. That's simply not the case.

The Case of Oil

Now the "inflationistas" (Mish's derogatory term) will point to gold prices as proof that Bernanke is about to wreck the dollar. Yet Mish incorporates that into his deflationist framework by arguing that "gold is money." Okay, fair enough. Let's switch to oil prices then.

In the standard Mishian framework, oil prices should be crashing in a deflationary environment. And indeed, Mish points with pride (see the block quotation above) to the collapse in oil from the summer to the winter of 2008 as vindication.

But after crashing and bottoming out in December 2008, oil has steadily risen. Did Mish anticipate this? After all, if we were still in a deflationary environment, then the dollar should have continued to strengthen (or at least remain strong), and the real economy should have sputtered along. Both those forces together means falling (or at least stagnant) oil prices.

Although I had trouble finding explicit predictions, the few scattered remarks from that time frame confirm my interpretation. For example, on March 13, 2009, he wrote,

Many were of the belief that the trade deficit would widen as the US recession strengthened. The only way that could have happened is if oil prices stayed stubbornly high. While the price of oil may have bottomed, odds of it shooting up towards $100 again in the near future are slim.

So how did that (tentative) prediction play out? During the week he published that post, the average price of crude oil was $46 per barrel. Three months later it was $71. So does that 54 percent increase in price, in a mere three months, count as "shooting up towards $100 again in the near future"? I'll leave it to the reader to decide.

Incidentally, while we're on the subject of oil I have another Mish prediction, presumably the (partial) product of his deflationist worldview. On May 16, 2009, he wrote, "All things considered, oil prices are due for a pullback and gasoline prices at the pump are likely to follow."

Now the week that Mish wrote that, crude oil averaged $58 per barrel. From the time Mish made his "pullback" call, oil prices rose for the next four weeks to $71. (That's a 22 percent increase in under a month — not quite what I would call a pullback.)

And Mish's fans can't even say he got the longer-term trend right; to this day oil has never fallen back to its level in mid-May 2009. In other words, Mish's call on crude oil, quoted above, was exactly backward. Instead of pulling back, oil continued its steady march upward. Six months after making the pullback call, oil was trading at $78, for a 34 percent increase in half a year.

The Case of the Dollar

Let's do one more, and then move on to more theoretical issues. On July 16, 2010, Mish called for a "dollar bounce," primarily because his nemesis Peter Schiff was calling for the dollar to fall:

Politically I align with Peter Schiff. The financial sector bailouts were obscene, as are all of the stimulus efforts. There will be hell to pay for both.

However, investment-wise I cannot and do not agree with Schiff. His hyperinflationary rants are simply unfounded. The reason he cannot see the forest for the trees is he fails to consider the role of credit in a fiat-based credit world.

Credit dwarfs money supply. Much of that credit cannot and will not be paid back. Schiff got that part correct, in spades, predicting as many others did a collapse in housing. His mistake was in assuming the dollar would crash with it. …

Down the road, Schiff is correct that the problems facing the US dollar are enormous. However, investors must separate down-the-road conditions from what matters now.

What does matter now is the continued consumer credit implosion that dwarfs monetary printing and fiscal stimulus. That not only affects US stock prices but commodity prices as well, and in turn currency prices of commodity producing countries.

Factor that all in, and the possibility of the US dollar rising to 1.15 or even to parity vs. the Euro is not out of the question.

In the meantime, the US is back in deflation factoring in credit-marked-to market. Hyperinflation remains a pipe dream.

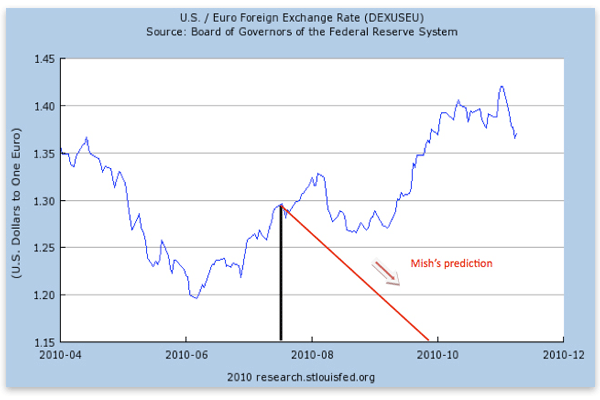

So let's go to the chart:

When Mish made his call on July 16 (indicated by the black vertical line), the price of a euro was $1.29. As the quote above reveals, Mish was predicting that the rising euro was just an aberration, and that the euro would continue its long slide against the dollar. In terms of the chart above, Mish predicted that the blue line would fall down to the bottom of the graph (i.e., a euro price of $1.15), or even down to $1.00 — which I can't even graph because it is literally "off the charts" compared to what actually happened.

To put it in other words, back in mid-July Mish was predicting that the euro would fall anywhere from 11 percent to 22 percent against the dollar. Instead, as of this writing the euro has risen 6 percent. Now it's true, because of the Irish debacle and the European debt crisis more generally, perhaps Mish's prediction will come true. But thus far, he has been wrong — the dollar has weakened (since Mish's call for it to strengthen) against the euro, and this is apparently due to the growing certainty that the Fed would engage in a second round of "quantitative easing." This is awkward for Mish, since he has been telling his readers that it is wrong to focus on the actions of the Fed when guessing which way currencies will move.

Vacuous or Wrong?

The biggest problem I have with Mish's whole approach is that it is either vacuous or just plain wrong. On the first option, here's what I mean: Suppose a financial bubble bursts, meaning that asset prices start crashing, various businesses start losing money, and workers get laid off. In that environment, of course banks and other lenders are going to write down the market value of their outstanding loans. So you would of course see falling "credit marked-to-market" go hand in hand with those other trends. If that is all Mish means, then I've been converted.

But I think Mish is saying far more than that. I believe he's arguing that the shrinkage of credit causes those other things. After all, he has to be arguing that the change in credit is an independent variable in order for him to keep congratulating his predictive powers.

Yet Mish's story doesn't fit the basic facts. For example, in this post Mish uses the St. Louis Fed's data series "Total Bank Credit" to indicate whether we are having inflation or deflation. (As Mish says many times, credit dwarfs the money supply.) He wants to use this variable to explain the other trends, including the stock market. In fact, here's what Mish wrote on January 6, 2009:

Looking ahead in 2009 here are some things I see as likely.

Obama will pass a stimulus package of $850+− billion but $300 billion will be "tax relief" amounting to $19 a week at most. $19 a week per household is not going to stimulate much of anything but it will add to the budget deficit. People will use that money to pay down bills, which is exactly what they should be doing with it.

The first 3–5 months are going to be extremely weak on the jobs front with 400,000 or more jobs lost each month. Obama is going to need to create 2–3 million jobs just to counteract job losses in first half of the year. There is no way he is going to create jobs that fast given implosions in state budgets and retailers.

In 2009 consumers will continue to retrench, housing will continue to decline, and as many as 100 small or regional banks will implode over falling commercial real estate prices. The Fed may arrange shotgun marriages with these banks instead of letting them go under.

I am sticking with a thesis that says we are currently in a sucker rally in the stock market that will end soon after inauguration or moments after Obama signs a new stimulus package. My target is 600 on the S&P but 450 is not out of the question. However, it is better to think of this in ranges and that range would roughly be 450–700. (emphasis added)

When Mish wrote the above, the S&P 500 was 935. As the quote above tells us, at this time Mish was predicting that stocks would then fall down to 600 or maybe even 450. Instead, the "sucker rally" kept going, such that exactly one year later, the S&P 500 stood at 1137. To switch to percentages, this means that in early 2009, Mish was calling for stocks to drop anywhere from 35 percent to 52 percent. Instead, stocks steadily rose 22 percent. That's a phenomenally bad prediction.

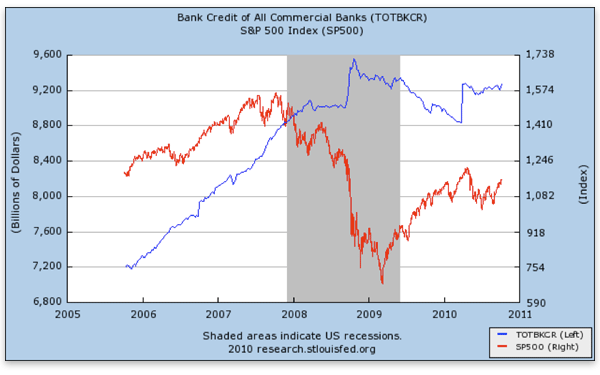

But it gets worse for Mish. He can't even say that he misjudged which way credit would move. Look what happens if we superimpose the S&P 500 index on "Total Bank Credit":

Now if I understand Mish's model correctly, the movements in the S&P 500 index (red line) are supposed to follow movements in total credit (blue line). But if anything, they move in opposite directions: starting in the fall of 2008, the red and blue lines are pretty close to mirror images of each other.

Throughout 2006 and most of 2007, total bank credit rose in tandem with the stock market. So far, so good for Mish's framework. Yet the stock market crashed while total bank credit stagnated and then shot up. Then, as bank credit trickled down, the market bounced back.

Of course, Mish and his fans could explain the above chart by saying that the Fed intervened a few times to try to offset the deleveraging process. But my point is that Mish's basic story doesn't fit the facts; the variable he himself used in one of his posts — "Total Bank Credit" — doesn't move with the stock market the way Mish claims that it does.

And, as the block quotation above indicated, Mish was utterly wrong about what the stock market would do in 2009.

Conclusion

I have had some harsh things to say about Mish's analysis in this article. In closing, I want to reiterate that I am not trying to "blow up" the viewpoint of the credit deflationists. I am merely pointing out that they have not called the major trends throughout the crisis, as they keep claiming. Moreover, it is still true that the major shifts in the stock market and the dollar can very plausibly be attributed to the various rounds of massive Fed intervention

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2010 Copyright Robert Murphy - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.