Stocks, Gold, and Oil Crude Remain Range Bound

Stock-Markets / Financial Markets 2010 Dec 04, 2010 - 05:51 AM GMTBy: J_W_Jones

Pre-Market trading on Friday morning was wild as the S&P 500 did not react well to the latest jobs report. Sellers stepped in and pushed down the e-mini contract by over 10 points in less than 15 minutes which is a pretty drastic move. It is critical to note that before the jobs announcement, the S&P 500 had put in a new high in the pre-market drawing in bulls and leaving many of them trapped. Today's price action will be interesting as Fridays are usually pretty quiet.

Pre-Market trading on Friday morning was wild as the S&P 500 did not react well to the latest jobs report. Sellers stepped in and pushed down the e-mini contract by over 10 points in less than 15 minutes which is a pretty drastic move. It is critical to note that before the jobs announcement, the S&P 500 had put in a new high in the pre-market drawing in bulls and leaving many of them trapped. Today's price action will be interesting as Fridays are usually pretty quiet.

At this point in time, the S&P 500 and most of the underlying sectors are in an extremely overbought condition. While the pullback taking place Friday morning seems significant, for bulls a pullback would be healthy by potentially allowing the S&P to regroup to challenge new highs for the year. From a bearish standpoint, the S&P 1225 level was the last stand to keep this rally in check. As has been the case for the past few weeks, price action continues to maintain a range on the S&P 500 between 1170 and 1225. Until either level is broken with strong confirming volume and/or a daily close well above/below the key support/resistance levels, we will likely remain range bound.

S&P-500 – SPX

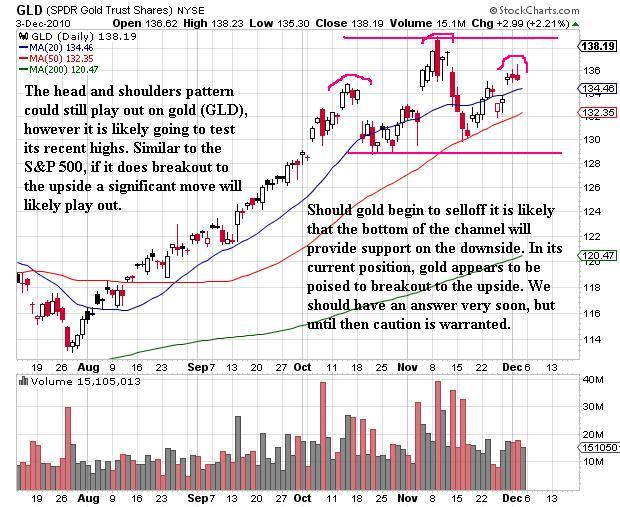

GOLD - GLD

Gold futures moved inversely when compared to the S&P 500. The poorly received unemployment report sent gold surging higher. Previous analysis has indicated a head and shoulders formation on gold's daily chart, however if gold's price continues higher it may challenge recent highs and overhead resistance. With continued concerns in Europe and the pullback that we have seen the past several days in the U.S. Dollar, it would not be shocking to see gold continue to rally to new highs. However, at this point in time there really is no low risk trading setup for those that are sitting on the sidelines.

Oil - USO

Light sweet crude oil futures sold off when the unemployment data was released. However, recent price action has suggested that oil may test the top end of the trading range. As stated before, long term I expect oil to break higher, but until we get a confirmation supported with strong volume I will remain skeptical. If oil were to test the recent highs it should be met with strong resistance, but if that resistance fails to keep oil prices in check it is likely that oil will breakout and could potentially test $100/barrel sometime in 2011, if not sooner. Time will tell, but if crude oil breaks out of the long term base it is in prices will like rise quickly.

30 Year Treasury - TLT

The 30 Year Treasury Bond futures soared after the dismal jobs report. As of the writing of this article it appeared that treasuries are beginning to top out this morning. While a bounce is likely due to the oversold nature of treasuries, they remain under their 50 period moving average on the daily chart. As long as the price remains beneath the 50 period moving average the 30 year treasury bond will continue to be under selling pressure. If interest rates continue their ascent eventually it would put downward pressure on the economy, particularly if rates were to move significantly higher in a short period of time. While a bounce at some point is likely, being long treasuries for more than a trade puts an investor on the wrong side of the price action. Keep a close eye on treasuries because rising rates will matter at some point.

TBT Trade

With the 30 year treasury bond trading below its 50 period moving average, I thought I would outline a strategy which does incur significant risk, but offers an excellent income opportunity. While I would never advocate selling or buying options naked for beginners, selling equity backed puts naked is an excellent strategy to generate income. Additionally, this strategy should be used on an underlying that an options trader would not mind actually owning.

On Tuesday my newsletter at OptionsTradingSignals.com will be launching and this type of trade will likely never be discussed or recommended. However, it is critical for option traders to be aware of all of the trading strategies that options present. The example below is not a recommendation, but simply an example of how this type of trade works and how it can be utilized in a trader's portfolio. First of all, it is critical to realize that Regulation T dictates that option traders require 10-20% equity to sell a put option naked.

As an example, if TBT were trading at $35/share 100 shares would cost $3,500. To have appropriate equity, an options trader would need as much as $700 in cash to sell 1 put contract naked. However those requirements are different among the various options brokers as they typically have varying degrees of margin requirements which are based on the experience level of the trader and the trader's capital position.

As stated previously, this strategy should only be used on an underlying that an option trader would be willing to own directly. The reason being if an option trader gets assigned he can purchase the stock and potentially start a covered call campaign while he waits for prices to increase. With the 30 year treasury bond futures being well below their 50 period moving average, owning TBT at a lower price makes sense, particularly when the option trader collects a premium further reducing the cost of purchasing the common stock.

A general trading rule would be to sell naked puts about 5-6 weeks before expiration. A trader would want to look for a put option with a delta around 20. In most market conditions, this would give the trader a high degree of probability that the options will expire worthless producing income for the trader. If possible, using this strategy and incorporating support levels is also warranted. If a strike is near long term support, selling strikes at a lower price can result in some nice income producing opportunities and the potential of owning the stock at a much lower price.

If a trader is using this strategy and does not intend to be assigned the stock, stop orders are an absolute must. This strategy does expose itself to overnight risk, but when a put is sold unlike its cousin the naked call there is a max loss on each contract. The max loss would take place if the stock were to trade to zero and remain there. While this is highly unlikely, it is theoretically possible.

As stated above, this is a high risk strategy but option traders looking to own a specific underlying stock can use this trade construction to further reduce the cost of owning the stock or create additional income for their portfolio. In closing, if managed appropriately, this type of trade can produce some great returns while allowing an option trader the ability to own common stock at a lower price.

If you would like to continue learning about the hidden potential options trading can provide please join my FREE Newsletter: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.