U.S. Interest Rates Federal Open Market Committee Meeting Preview

Interest-Rates / US Interest Rates Jan 22, 2011 - 04:17 AM GMTBy: Asha_Bangalore

The Federal Open Market Committee (FOMC) meeting on January 25-26 is most likely to close without any change in Fed policy. The FOMC will reaffirm its plan to complete the $600 billion purchase of Treasury securities. The policy statement should contain modifications that would reflect the nature of latest economic reports. The strength in recent retail sales data, the sluggish labor market, and ongoing challenges of the housing market will feature in the policy statement.

The Federal Open Market Committee (FOMC) meeting on January 25-26 is most likely to close without any change in Fed policy. The FOMC will reaffirm its plan to complete the $600 billion purchase of Treasury securities. The policy statement should contain modifications that would reflect the nature of latest economic reports. The strength in recent retail sales data, the sluggish labor market, and ongoing challenges of the housing market will feature in the policy statement.

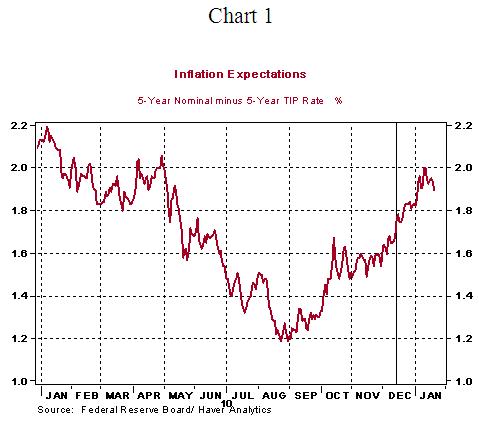

The Fed's latest view on inflation will be noteworthy given the recent hike in energy and food prices and the 25 basis points increase in inflation expectations (see Chart 1) since the December 14 FOMC meeting.

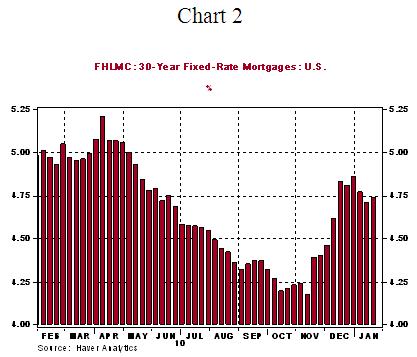

Mortgage rates have also moved up roughly 60bps from a low of 4.17% during November 2010 (see Chart 2).

The FOMC noted its concern about the unemployment rate at the December meeting. The December employment report, published in January 2011, shows an elevated level of unemployment in the nation (9.4%). There is a strong likelihood of the Fed retaining the view presented in the December 2010 policy statement.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Currently, the unemployment rate is elevated, and measures of underlying inflation are somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Although the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, progress toward its objectives has been disappointingly slow.

Going forward, an important consideration is the policy bias of new voting members of the FOMC. At present, there is one vacancy in the Board of Governors of the Fed. In 2010, President Hoenig of the Kansas City Fed dissented in each meeting and would have preferred a less accommodative stance; he is not a voting member in 2011. Philadelphia Fed President Plosser and Dallas Fed President Fisher are new voting members in addition to Chicago Fed President Evans and Minneapolis Fed President Kocherlakota. The FOMC will be weighing on important decisions in 2011 as the economy enters the expansion path of the business cycle. The timing and magnitude of a monetary policy change will probably be the highlight of 2011. Presidents Plosser and Fisher have presented a differing view from the majority of the FOMC in 2010. President Plosser has consistently taken a hawkish stand and has stressed the price stability mandate of the Fed. As recently as January 17, Plosser noted:

"If economic growth in the United States continues to gain traction and the prospects begin to look ever better, it might be time for us to begin thinking about how do we begin to gradually take our foot off the accelerator,"

"I do know that there is a danger that we wait too long, and the consequences of that might be disruptive and dangerous," he added.

President Fisher of the Dallas Fed, another new voting member who strongly favors the inflation mandate, commented as follows on January 12:

"Barring some unexpected shock to the economy or the financial system, I think we have reached our limit,"

"I would be very wary of further expanding our balance sheet."

President Evans of Chicago track record suggests that he is likely to vote with Chairman Bernanke. President Kocherlakota is a new head of the Minneapolis Fed and starts his first voting term on the FOMC. As of January 11, 2011, he indicated he is "comfortable" with the Fed's current policy stance.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.