FOMC Policy Statement - Status Quo is Also Noteworthy

Interest-Rates / US Interest Rates Jan 27, 2011 - 02:07 AM GMTBy: Asha_Bangalore

The federal funds rate was left unchanged at 0%-0.25% as expected; it has held at this level since December 2008. The Fed's plan to purchase $600 billion of Treasury securities has also been left in place along with the existing arrangement of reinvesting principal payments from its holdings of securities. The vote was unanimous although four members of the voting panel were replaced for 2011. Charles Plosser of the Federal Reserve Bank of Philadelphia, Richard Fisher of the Dallas Fed, Charles Evans of the Chicago Fed and Narayana Kocherlakota of the Minneapolis Fed are the replacements. Of these four voting members, Fisher and Plosser have been critics about the second round of quantitative easing that is currently underway. They have held the opinion that the current stance of monetary accommodation carries with it inflationary consequences that would be damaging to the economy. However, unlike President Hoenig of the Kansas Fed who shared this opinion and dissented at each meeting in 2010, these two members voted along with majority in today's meeting.

The FOMC's evaluation of the economic conditions did not show major departures from its assessment in December. The marginal modifications are consistent with the nature of incoming economic reports. The bird's eye view of the economy is unchanged from the December meeting, with the Fed noting again that the "economic recovery is continuing." The Fed now sees household spending to have "picked up late last year" compared with the December view that household spending was "increasing at a moderate pace." The Fed reiterated that "the unemployment rate is elevated and measures of underlying inflation are somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate." The Fed's depiction of the housing sector was not altered from the December statement which read as: "The housing sector continues to be depressed."

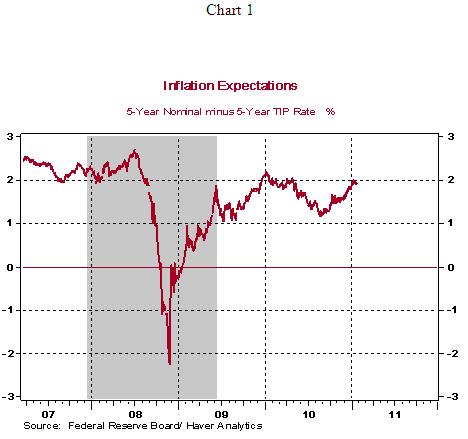

The Fed's opinion about inflation shows a small modification. The Fed continues to note that "measures of underlying inflation have been trending low" and that inflation expectations are stable despite higher commodity prices. The reference to commodity prices is new. In this context, it is important to bear in mind that pass through of higher commodity prices is not visible yet and a synchronization of growth across the world will be necessary for inflationary pressures to become troubling. The global economy is operating on two speeds - slow in the advanced economies and fast in the developing nations. For now, the dual speed world economy is giving the Fed room to focus on economic growth.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.