The Fed Effect, Full Spectrum Dominance of Stock and Financial Markets

Stock-Markets / Financial Markets 2011 Jan 28, 2011 - 02:06 AM GMTBy: Joseph_Russo

Dual mandates of Maximum Employment and Price Stability are noble headline goals of the Federal Reserve.

Dual mandates of Maximum Employment and Price Stability are noble headline goals of the Federal Reserve.

Unfortunately, over a long period of time, the perceptibly infinite concentrations of power in concert with the short comings of human nature has inflated the Federal Reserve System into an all-powerful godlike entity to both fear, and worship.

We suspect such potent combination is in large part responsible for the 60-year track record in the ruinous mismanagement of the federal funds rate. A measure that clearly would have been best reserved for the free-market to manage.

We have a difficulty accepting that humankind as a whole could place so much power into the hands of a concentrated few. Then again, we also have difficulty accepting how people can become brainwashed by cult leaders, and behave in ways that are simply insane.

Perhaps Man Cannot Rule Himself

This must be the case, for if it were not, we would not have the need to rely upon the gods of a central bank to save us from ourselves.

Perhaps it is just the financial sphere that cannot rule itself, and the Fed is the all powerful entity to guarantee that the global industries it represents always maintain first place in line within the economic food chain.

When buckets of money flood Wall Street like a tsunami, driving equity values up over 90% in less that 2-years, the guy on main street looks up toward the fed-created blue sky, extends his hands out, and whispers to himself with endless hope, I think I felt a drop. Sorry dude, the trickledown theory dried up a long time ago.

Geez, wouldn't it be nice though, if you held tenure in an industry that had such a powerful lobby group or union to explicitly guarantee that no matter what - your industry would always survive, prevail, and maintain top-dog status in the economic food chain. Nice work if you can get it.

It's not hard to fathom that simply because it could, over time, human nature would shift dynamics to such extremes as to have the financial sphere totally usurp the fundamental underpinnings of the real economy.

All of the recent celebrity surrounding Dow 12K, hyping the sure success of the economic recovery, strong earnings etc, it's all a well known fabrication of the Federal Reserve System in concert with their cartel of primary dealers.

The Fed & Co. did their jobs in flooding the financial sphere with trillions in taxpayer liabilities to save the financial sphere, and now it's up to the media giants to convince the masses that everything is coming up roses. Good luck guys.

The quandary however, is for the gods to figure out a way to fire up the engines that drive their credit-based economic model.

If banks don't give money away like it's going out of style to people who spend it on stuff they don't need and can't afford, the industry and masses who worship and depend upon these gods of finance will eventually have no choice but to conclude that the Federal Reserve Systems economic paradigms have far outlived their practical utility, and are no longer viable.

Until that point of recognition once again reaches critical mass, BUY, BUY, BUY... as the Mad Money maniac regularly bellows.

Who's our Daddy

The Federal Reserve System is our daddy. Get used to it, because until it blows itself up, or causes a second revolution, they are the gods who give us our daily bread. It just costs more than it used to.

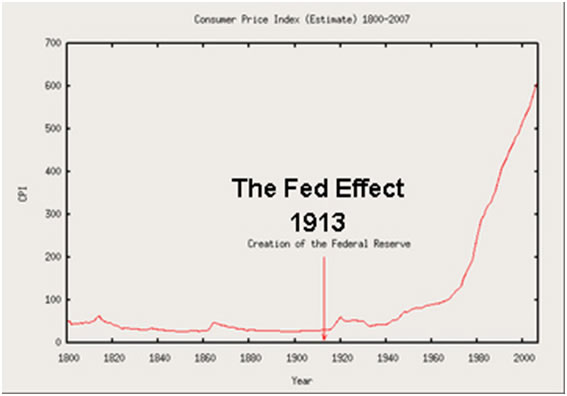

The chart below estimates the consumer price index from 1800-2007, and highlights a parabolic rise in the rate inflation of immediately following the inception of the Federal Reserve System. How's that for meeting their mandate of price stability? It appears as though they achieved exactly the opposite. Those gods, I tell ya, there something else.

A natural side effect/cause of such brilliance in maintaining stable prices is the devaluation and loss of purchasing power of the money created and loaned out by the Federal Reserve System.

Why does the United States even bother to borrow Federal Reserve System money it must then pay back with interest when it can constitutionally create its own currency?

Let's not even go there.

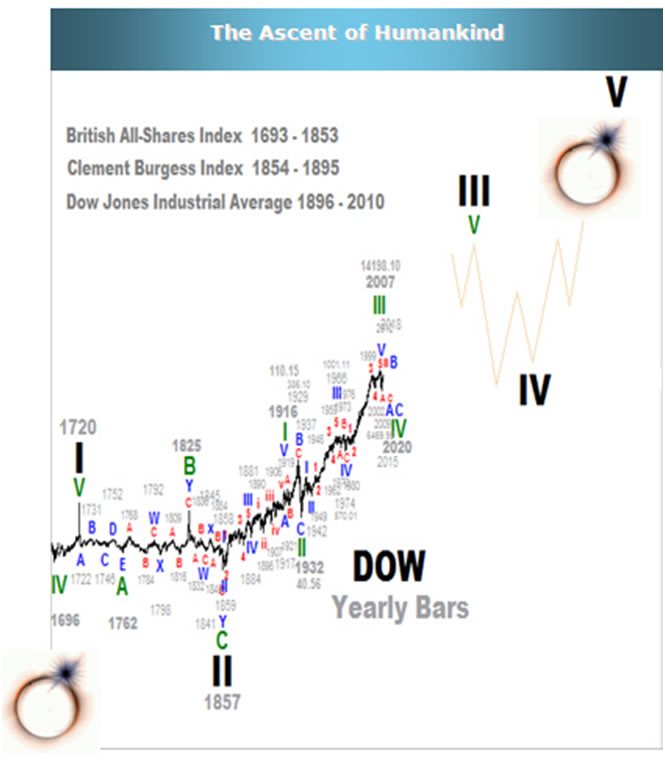

Instead, let's just take a quick look at some long-term secular trends created by the Federal Reserve System.

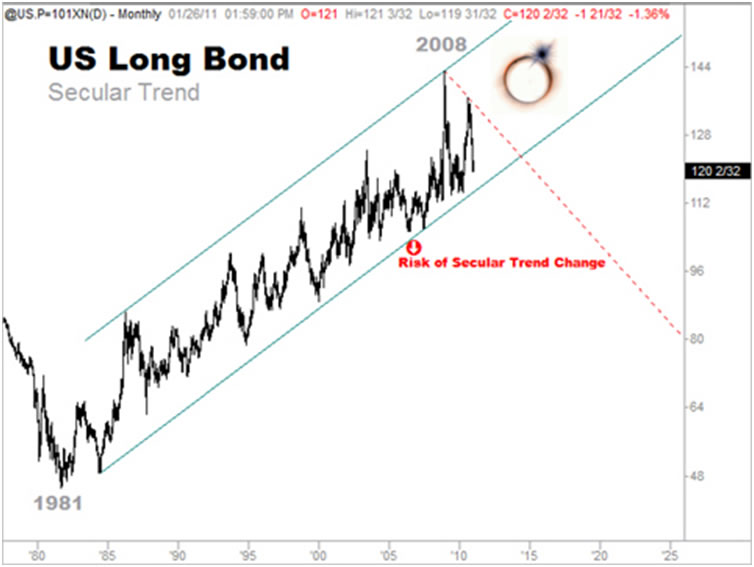

Below, we can see that the value of borrowed Federal Reserve dollars remains in long-term secular decline. If values cross the Rubicon beneath the risk of ruin trajectory dashed in red, all these borrowed paper dollars risk further-inflating our general costs of living.

Ah, elasticity - the beauty of the Federal Reserve note, which is just another element embedded within the full spectrum dominance they have in controlling every meaningful aspect of the financial sphere.

Don't Fight the Fed

Until reality and price action dictate otherwise, those engaged in the financial markets in any capacity would serve themselves well in heeding to that age-old adage. No matter how much it costs, these are the guys with the bread.

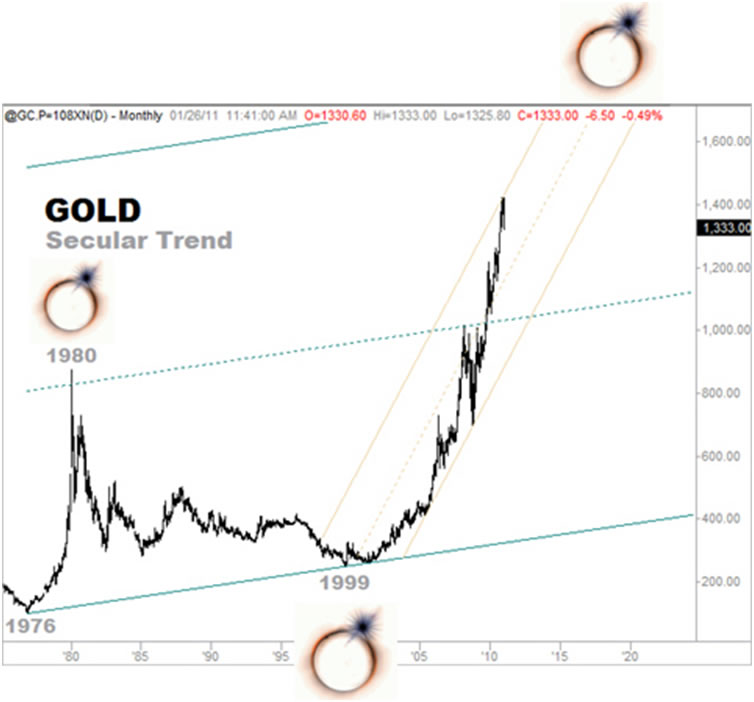

For the past 12-years, the absolute best way NOT to have fought the fed was to have invested heavily in Gold. What appears on this chart as a parabolic rise in the price of Gold is just another outgrowth of the Federal Reserve Systems exemplary management in their mandate of price stability.

Below, behold the behemoth of the entire financial sphere, the Bond market. It is here that the credit based economic model sustains itself. Unless interest rates remain close to zero from here to eternity, we suspect the Feds long standing model will be called into question in the not too distant future.

No matter what unfolds, rest assured that civilization shall continue to thrive.

Remain prudent, prepare for the worst, expect the best, and recognize that you are indeed the master of your own destiny.

Until next time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.