Silver Lease Rates Rise Sharply – Bond Yields in Portugal Rise to Record

Commodities / Gold and Silver 2011 Feb 10, 2011 - 07:39 AM GMTBy: GoldCore

Gold is down 0.32% against the US dollar which is higher against all major currencies today. Gold is marginally higher in euros, Swiss francs, and Aussie and Kiwi dollars. Silver is down 1% in US dollars and lower in all currencies.

Gold is down 0.32% against the US dollar which is higher against all major currencies today. Gold is marginally higher in euros, Swiss francs, and Aussie and Kiwi dollars. Silver is down 1% in US dollars and lower in all currencies.

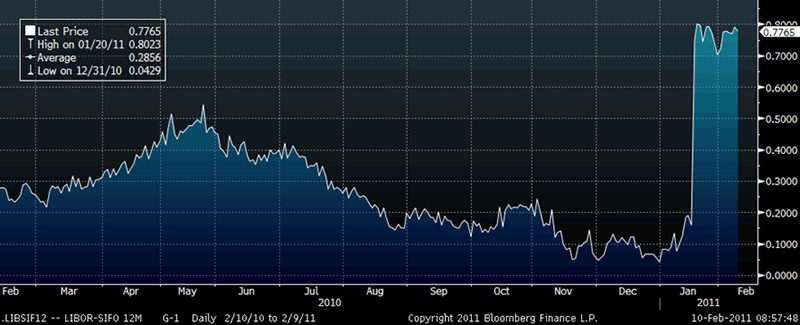

Silver Lease Rate – 1 Year (Daily)

Asian equities were lower (except for 2% gain in the CSI 300) after the slight falls seen on Wall Street yesterday . European indices have followed their counterparts with the Spanish IBEX 35 particularly weak and the Euro Stoxx 50 is down 1.1%.

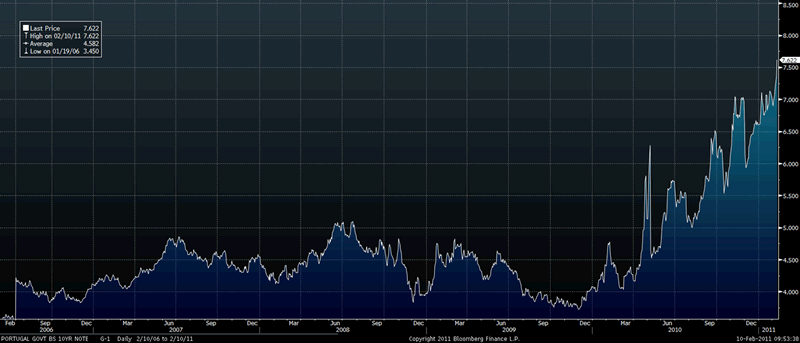

Portuguese 10 Year Government Bond – 5 Years (Daily)

German bunds (10 year) are down slightly from yesterday’s highest price this year and Portuguese bonds have come under pressure again with yields risen up to record highs of 7.62%. Ireland’s 10 year yield has also risen back above 9% after news of further massive losses in the banking sector and increasing talk of default in advance of the coming election.

Most commodities are lower today and NYMEX crude oil is down 0.77% to $86.02 and Brent down 0.23% to $101.55 a barrel. New York futures’ discount to London’s Brent widened to a record and is now some $15; very unusually, WTI crude is down 6.66% year to date while Brent is up 7.26%. The Saudi Arabian “peak oil” Wikileak revelations are still being digested by the market.

Gold and Silver Lease Rates Rise from Multi Year Lows

Gold, and particularly silver, lease rates (see chart) have been rising recently. The rate is found by subtracting the silver forward offered rate from the London Interbank Offered Rate (LIBOR). This likely signals increasing tightness and illiquidity in the bullion markets (as recently said by Sprott Asset Management, and UBS yesterday).

The rise in silver has been very sharp, having gone from 4.29 basis points (0.0429%) to 77.65 basis points (0.7765%) since the start of the year (31 December 2010).

While the rise is very sharp, it is important to put it in context, and silver lease rates remain well below the levels reached after the Lehman Brothers systemic crisis in late 2008 when silver lease rates surged to 2.5%.

At the same time, the very small silver bullion market is clearly under strain as seen in the continuing backwardation. This clearly shows that demand for physical is robust, evident from retail demand in the US where there were record US Mint silver eagle sales last month. There are delays (3 to 4 weeks) to get branded LBMA silver bars (100 oz) in volume.

Strong demand is also seen in the import figures in Asia – particularly from China and India. This Asian demand is both for silver for industrial purposes, but also retail demand from Asians buying silver to protect themselves from surging inflation.

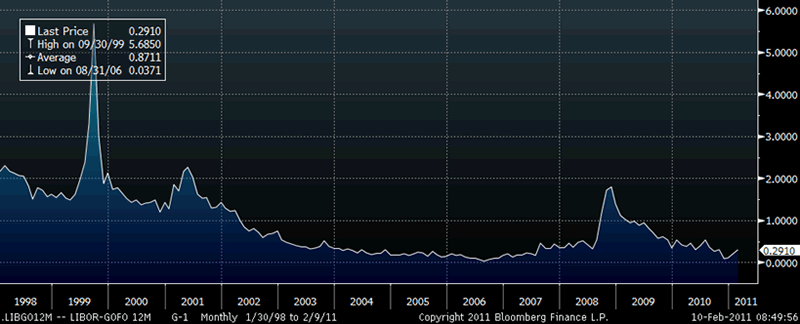

Gold Lease Rate - 12 Year (Monthly)

Gold lease rates have seen a more gradual rise so far in 2011. Similarly to silver, gold lease rates remain near historic lows, suggesting there are no major liquidity issues in the gold bullion market (London Good Delivery bars) market at this time.

The lease rates are important indicators and bear watching.

European Sovereign Debt Crisis Leading to Continued Safe Haven Demand

With the European sovereign debt crisis yet to be resolved and likely to deteriorate in the months ahead, safe haven demand for gold is likely to remain robust for the foreseeable future.

Key euro interbank lending rates jumped to 18 month highs yesterday afternoon. Excess money market liquidity is expected to drop to around 40 billion euros this week, down from 100 billion.

London interbank-offered rates for three-month euros rose to 1.049 percent: their highest since July 7, 2009.

The equivalent Euribor rate - traditionally the main gauge of unsecured interbank euro lending, which is fixed by a larger panel of European banks than Libor – rose to 1.089 percent, up from 1.079 percent.

The overnight EONIA rate jumped to 0.677 percent on Tuesday, up from a five-month low of 0.347 percent.

Dennis Gartman, the economist and the editor of the Gartman Letter, advised clients today to buy gold and sell yen. “We were especially impressed with gold’s strength relative to foreign currencies, rising far more smartly in terms of sterling or yen than in terms of the dollar,” Gartman said.

He is also bearish on the euro and questions whether it can survive the current crisis.

Gold

Gold is trading at $1,357.40/oz, €995.67/oz and £845.89/oz.

Silver

Silver is trading at $29.74/oz, €21.81/oz and £18.53/oz.

Platinum Group Metals

Platinum is trading at $1,826.00/oz, palladium at $815.50/oz and rhodium at $2,450/oz.

News

(Bloomberg) -- Gold-Borrowing Cost Near 5-Month High; Silver Rates Jump in 2011

The cost of borrowing gold in London is near the highest level in five months. Silver borrowing costs advanced this year.

The 12-month lease rate fell to 0.291 percent from 0.3033 percent yesterday, the highest level since Sept. 8, according to data compiled by Bloomberg. The rate has almost tripled this year, and is derived by subtracting the gold forward offered rate from the London Interbank Offered Rate.

“Scarcity of metal liquidity in leasing leads to high lease rates,” according to the London Bullion Market Association’s over-the-counter guide published on its website. “Heavy forward selling activity or a decrease in the supply of liquidity will push down forward swap rates and lead to upward pressure on lease rates.”

Gold for immediate delivery traded at $1,363.60 an ounce at 5:13 p.m. in London. The metal yesterday reached a two-week high of $1,368.18.

The 12-month lease rate for silver was at 0.7765 today. The rate reached 0.8023 on Jan. 20, the highest level since August 2009. That compares with 0.0429 on Dec. 31. Silver traded at $30.21 an ounce in London today and reached a 30-year high of $31.2375 on Jan. 3.

(Bloomberg) -- Gold Is ‘Ideal’ Form of Collateral, World Gold Council Says

Gold is an “ideal” asset to use as collateral for trading, said Natalie Dempster, director of government affairs at the London-based World Gold Council.

JPMorgan Chase & Co. on Feb. 7 said it will allow the metal to be used as collateral for trading, following similar moves by CME Group Inc. and Intercontinental Exchange Inc. Dempster commented yesterday in an e-mail.

“In many ways, gold is the ideal form of collateral as it does not bear counterparty risk.

‘‘The credit risks associated with many other assets that are widely regarded as highly liquid and have traditionally been used as collateral have sharply increased over the past year, most notably those of peripheral euro area government bonds.

‘‘Gold provides an excellent alternative.’’

(Bloomberg) -- Scotiabank Plans to Sell Gold to Consumers in Mexico, Dubai

Bank of Nova Scotia, which sells gold coins and bars to clients in Canada through an online store, plans to establish similar programs in countries such as Mexico and Dubai, Vice Chairman Barry Wainstein said.

“We’re looking at a number of different countries simultaneously,” Wainstein said in an interview. “In 2011, we may be up and running in one or two countries.”

Canada’s third-largest bank by assets has been expanding its ScotiaMocatta business, which trades and distributes metals such as gold and has roots that date back to 1671. The bank’s total revenue from precious-metals trading was C$245 million ($246 million) in the fiscal year that ended Oct. 31, a 53 percent increase from C$160 million two years earlier. ScotiaMocatta doesn’t disclose its financial results.

“We think we can roll out our retail product suite to a number of other countries,” said Wainstein, who is also the global head of foreign exchange and precious metals for the lender’s Scotia Capital investment-banking unit.

ScotiaMocatta opened its so-called eStore in September 2009, allowing Canadians to purchase physical gold valued at up to C$10,000 by ordering online. Clients outside of Canada, or those buying larger amounts, typically do so through wholesalers, Wainstein said.

About 60 percent of eStore users aren’t Scotiabank clients, said Wainstein, who declined to say how many customers have used the site.

The Toronto-based lender, which has operations in about 50 countries, may expand in Mexico because of ties to its Scotiabank Inverlat consumer bank.

‘Global League’

Dubai would be a good market for expansion because of demand for gold in the Middle Eastern country, Wainstein said.

“We’re not competing in the Canadian league; we’re competing in the global league,” Wainstein said.

The price of gold, which rose for 10 straight years, has declined about 4 percent this year as signs of a strengthening economic recovery curbed demand for the precious metal as a store of wealth. Gold fluctuated near a two-week high yesterday in New York and reached a record of $1,432.50 an ounce in December.

“I’m not clear where the price of gold is going,” Wainstein said. “In a market like gold, it could spike up in a couple of days.”

Scotiabank has made two acquisitions in the bullion industry since 1998, including the purchase of about $900 million in precious-metals loans from Bank of America Corp. in 2006.

Wainstein, whose bank owns gold vaults in Toronto and New York and leases space within the Bank of England’s vault in London, declined to say how much of the metal it stores.

Bank of Nova Scotia fell C$1.11, or 1.9 percent, to C$58.06 yesterday in Toronto Stock Exchange trading.

(Law360) Silver class-action suits against Morgan, HSBC consolidated in New York

A judicial panel on Tuesday consolidated class-action litigation alleging that JPMorgan Chase & Co. and HSBC Holdings PLC violated antitrust laws by manipulating the silver market and potentially reaped billions of dollars while keeping the price of silver artificially low.

The U.S. Judicial Panel on Multidistrict Litigation on Tuesday consolidated the seven class-action lawsuits pending against the two banks in the U.S. District Court for the Southern District of New York.

"A majority of the domestic defendants are located in that district, and thus many witnesses and discoverable documents are likely to be found there," the panel ruled. "In addition, a substantial majority of the constituent and potential tag-along actions are pending in that district (including the first-filed action)."

(Bloomberg) -- Gold Funds in India to Top Equity Funds, Reliance Capital Says

Investments in gold funds in India, the world’s largest consumer of bullion, will top mutual fund equity investments in the next three to four years, according to Reliance Capital Asset Management Ltd.

Reliance Capital yesterday launched a gold fund-of-fund which allows investments as small as 100 rupees ($2.19) a month. The money raised will be invested in bullion through its gold- backed exchange-traded fund, Sundeep Sikka, chief executive officer of Reliance Capital Asset Management, said in a phone interview yesterday.

Demand for gold as an investment in India surged 73 percent in the 12 months ended Sept. 30, according to the World Gold Council. Indian mutual funds had $1.65 trillion rupees of equity investments as of Jan. 31, data on the Association of Mutual Funds in India website shows.

“I am very bullish, this gold category will beat that in the next 3 to 4 years’ time,” said Sikka, referring to mutual funds investments in equities. “It’s a very simple thing - only 40 million investors are in the mutual fund industry, compared to 500 million people are investors of gold in India.”

The gold fund is the first of its kind in India, Sikka said. Investors don’t need to hold a so-called Demat account to invest in the fund, he said.

“We are not selling gold to mutual fund investors, we are getting gold investors to the mutual fund industry,” he said. “In the long term we see the dollar weakening. With the overall global environment, gold will be a good investment.”

(King World News) Robin Griffiths - China’s Gold Reserves to Rise From 2% to 10%

With gold and silver on the move today, King World News interviewed one of the top strategists in the world, Robin Griffiths of Cazenove Capital. Griffiths had this to say about clueless western journalist commentary on gold, “The kind of western journalists that continually write down gold, two things, they almost certainly don’t understand the Asian culture, and they were educated as strict Keynesians and he (Keynes) made the remark it was a barbarous relic. And when they are really desperate they say well, Mr. Buffett said you have to store it and of course you don’t get a dividend out of it. The thing they are choosing to forget is you’re only going to buy it with a piece of paper, and the piece of paper is being printed and thrown from a helicopter window, and they just choose to ignore that fact.”

Griffiths continues: “For as long as interest rates are super low, there’s no negative cost of holding gold. There is a seasonality to gold and very often it doesn’t start running until the end of February...Once we get into March, I think we can expect it to start motoring higher again.”

When asked about the strong demand coming out of Asia Griffiths stated, “I think we’re moving into a world where Chinese and Indian authorities are going to be more dominant than they were in the past, and in their culture of course gold is real money. On top of that, particularly China already has more than enough dollars, it’s finding that a problem. It doesn’t want to crack the dollar, but it doesn’t want to go long of any more because of its trading activities. Their national reserves are probably only just over 2% in gold at the moment and they could easily move up to 10%. I think this buying power will continue and I think gold’s secular trend will go a long way higher. So far it’s been a linear trend from $250 to $1,400, and technicians always know these things end up going exponential. I mean if we haven’t gone exponential by $1,400, the final high is going to be way higher than current levels.” Robin Griffiths is indicating that we should be looking for a staggering five-fold increase in Chinese reserves in gold. This is a monster undertaking and this confirms that Asian gold demand will be relentless well into the future. This means that China is looking to add roughly 5,000 tons of gold to their reserves, this is not good news for the gold bears.

(Bloomberg) -- Gold Priced in Rand Advances to Highest Since March 2009

Gold for immediate delivery rose as much as 0.8 percent to 9,916.423 rand an ounce, the highest compared with intraday prices since March 2009.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.