Libya Crisis and Crude Oil Stock Portfolio Positions

Commodities / Oil Companies Feb 22, 2011 - 02:33 AM GMTBy: Richard_Shaw

Many of you may be watching the reports of the revolt in Libya on TV and listening to breathless commentators. Clearly, the situation in the Middle East is changing. But let's balance the TV excitement about oil and Libya with logic and data.

Many of you may be watching the reports of the revolt in Libya on TV and listening to breathless commentators. Clearly, the situation in the Middle East is changing. But let's balance the TV excitement about oil and Libya with logic and data.

First, whatever government results from the revolts in oil producing countries, they need to sell their oil to support their regimes as much as the rest of the world needs to buy their oil. Therefore, looking past short-term supply disruption concerns, oil wells will not be shut down long-term and oil will continue to flow.

Markets behave very much on psychology and perception in the short-term (overstating long-term expectations in either direction), but gravitate to fundamentals in the long-term. The fundamentals for owning oil are good.

In the very short-term, the Libya situation will probably raise the price of gold, and possibly US Treasuries as a safe haven move (although the inflationary expectations that are growing may counter the safety aspect of Treasuries) The safe haven money flow to Treasuries is more likely to be to the shorter than to longer Treasury maturities. Stock markets may shudder (they are down somewhat today -- the US markets are closed), but it is quite possible that the US stock market may have a better relative performance in a continuation of the recent money flow from emerging to developed markets, as nervousness increases -- no real conviction on that point.

Some market results today:

The GCC 200 index (Gulf region companies) was down 0.43%

The Shanghai (China) stock exchange was up 1.12%

The Bombay (India) stock exchange was up 1.25%

The Nikkei (Japan) stock exchange was up 0.14%

Hong Kong was down 0.47%

Brazil was down 1.18%

France was down 1.44%

Spain was down 2.33%

Italy (close ties with Libya) was down 3.54%

Except for Spain and Italy, these are within normal daily fluctuation parameters.

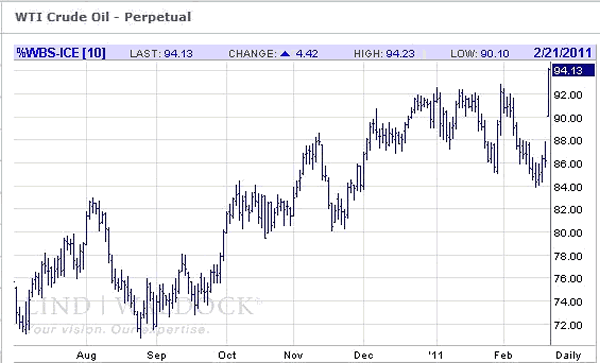

As for oil companies themselves, the 2% of world production that comes from Libya is causing oil prices to rise for the time being, and that has the effect of raising the value of the proven reserves of oil producing companies, and (if oil consumption does not fall) raising the revenues from oil that they sell. Oil on the futures markets is just over $94 today, up about 6.8% (see chart below)

In the net it may be that for companies with oil reserves elsewhere, the revenue and profits impact of the Libya situation could be positive, unless the cost of oil were to reduce the global demand.

In isolation, we see the Libya situation as not being necessarily a substantial fundamental stock market negative. If the revolt spreads to Saudi Arabia the short-term to intermediate-term oil markets impact could be severe. If the Chinese get momentum in their democracy revolt, the impact is unknowable at this time -- their government censored Egypt revolt information and are not censoring renewed democracy protest internet messages.

As for specific holdings in portfolios we manage; here are the statistics:

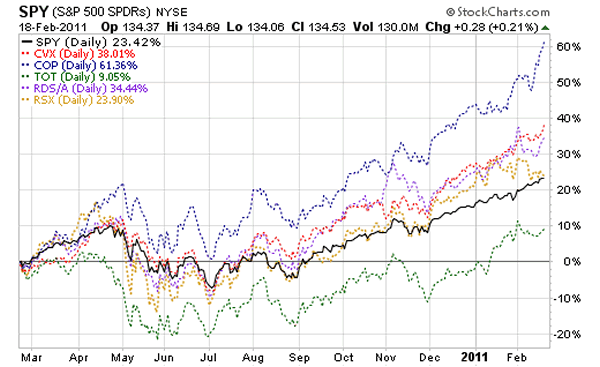

We hold positions in 4 oil producing companies at weights greater than 1/2% of assets; aggregating 10.87% of assets, with varying weights in different portfolios. The names, symbols and average allocation across all portfolios is as follows:

Conoco-Phillips (COP) 3.14%

Chevron (CVX) 2.94%

TOTAL (TOT) 2.44%

Royal Dutch (RDS-A) 2.35%

These allocations create a substantial overweight for oil in our combination of hard asset (oil) and income (dividends) seeking strategy. Other funds in our portfolios have oil companies within them. For example, SPY (representing the S&P 500) has 12.78% of its assets allocated to the energy sector.

Even though our portfolios are heavily biased toward energy, which we continue to believe that is appropriate during a period of economic recovery, emerging market middle class development, and rising inflation.

The exposure to Libya in our oil company holdings, expressed as a percentage of annual BOE (barrels of oil equivalent) for each company is:

COP 3.3%

CVX 0%

TOT 2.6%

RDS-A 0%

On average, if Libya were to nationalize all foreign oil assets, our positions would lose about 1.5% of production. We consider that risk to be acceptable at this time.

The S&P 500 energy sector has a 12.78% weight. The three top oil producers in the sector (Exxon, Chevron and Conoco-Philips) have a combined weight in the sector of 48.1%. Exxon has a 27.2% weight in the sector and has zero production in Libya. Chevron has a 12.7% weight in the sector and has zero production in Libya. Conoco has an 8.26% weight in the sector and has 3.3% of its production from Libya.

Oil importing emerging market countries such as China, India, Korea, and Turkey will probably suffer during a period of elevated oil prices. Oil exporting emerging market countries such as Brazil and Russia will probably prosper during a period of elevated oil prices. Russia is more of an energy play than Brazil.

Russia and Saudi Arabia are the world's two largest oil producers. We own the Russia fund (RSX) in some portfolios.

The Saudi stock market is down 0.55% today. The Russian stock market was up 1.12% today.

On the European markets (EuroNext) two of our oil positions were trading in meaningful volume:

TOTAL was down 1.27%

Royal Dutch was down 0.60%

US markets are closed today, but electronic trading does take place elsewhere. According to futures broker Lind Waldock, the S&P 500 is down from about 1340 on Friday to about 1330 today (down about 1%), while oil is up nearly 7%.

Bottom line, we are not alarmed by the Libya situation, but we are watching closely.

Disclaimer: This article is not personal investment advise to any specific person for any particular purpose. This article is presented subject to the full disclaimer found on our site available here.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2011 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.