Stock Market Calls for Incremental Approach

Stock-Markets / Stock Markets 2011 Feb 23, 2011 - 08:12 AM GMTBy: Chris_Ciovacco

As of 7:50 a.m. ET, the markets are stable, which is a good sign for now. The situation with Col. Moammar Gadhafi needs to be monitored closely. This morning’s Wall Street Journal (WSJ) provides a good visual of the unrest:

On the ground in the eastern chunk of this oil-rich desert nation, the signs of rebellion are plain to see in the armories of a military base near Baida: Weapons crates lie busted open and empty. Rifles are missing from their racks. Left behind are helmets and gas masks and cleaning kits—things that can’t shoot.

Based on the combination of (a) problems in Middle East, (b) weak housing data, and (c) an unfavorable risk-reward environment, we did some selective selling yesterday. We took some profits off the table and reduced exposure to copper (JJC) and agriculture (DBA). We still own both positions, just not as much. Selling a small amount allows us to step away from risk incrementally, which has a few benefits:

- If Tuesday’s slide extends into today, and possibly morphs into something bigger, we have broken “mental inertia” with the sell button. Hypothetically, if we see big declines today, our mental set is “we sold some yesterday and we can sell more today if needed”.

- If yesterday turns into a one-day pullback, mentally, we are fine with that since we only sold a small portion of our portfolio yesterday. We would be happy to make money if the market can hold.

- One of our biggest enemies in trading and managing money is indecision, or the inability to take action when the situation calls for it. If you sold nothing yesterday, and the S&P 500 is down 30 points again today, you may shift into “it is too late to sell mode”, which can be a dangerous place to be.

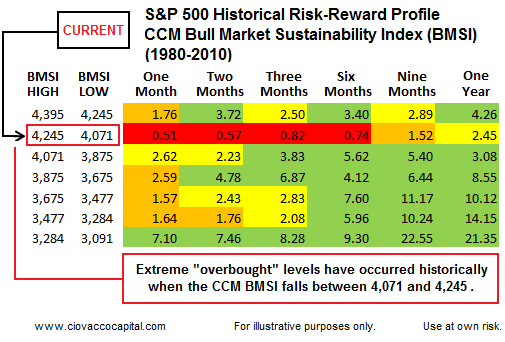

The CCM Bull Market Sustainability Index (BMSI) hit 4,195 last Thursday. As the table shows below, markets with similar profiles have been difficult to make money in (not impossible). For this condition to be cleared, the markets need a pullback (Tuesday) or a period of sideways consolidation.

From a strategy perspective, we will continue with the incremental approach. If the markets can move higher, we are happy to stay with our longs in gold (GLD), silver (SLV), and energy (XLE) to name a few. If a pullback does become a correction, we mentioned some possible buy candidates in Bears May Be Taken To The Woodshed During Next Correction, including VTI (broad U.S.), XLI (industrials), and XLE (energy). The article (Woodshed) also shows a possible range of major support for stock prices, which may come in handy sometime in the next few weeks.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.