Gold New Record High Barely Reported by Mainstream Media

Commodities / Gold and Silver 2011 Mar 02, 2011 - 11:30 AM GMTBy: GoldCore

Gold prices settled at a new record high yesterday, as unrest in North Africa and the Middle East pushed the safe haven currency to $1,435/oz. Silver surged to new 30-year record nominal highs at $34.74/oz. Prices surged in dollars and all major currencies and look set to reach record highs in other currencies.

Gold prices settled at a new record high yesterday, as unrest in North Africa and the Middle East pushed the safe haven currency to $1,435/oz. Silver surged to new 30-year record nominal highs at $34.74/oz. Prices surged in dollars and all major currencies and look set to reach record highs in other currencies.

Given the continuing strong fundamentals and the concerns of geopolitical instability spreading to Saudi Arabia and other autocratic oil producing nations, gold and silver look set to challenge $1,500/oz and $40/oz in the coming weeks.

Gold’s all time record nominal high yesterday was barely reported in most of the mainstream business and financial press today - slightly more online but there was little or no coverage in print.

This is an indication that gold and silver remain far from the “bubbles” that some have suggested. Speculative manias and bubbles are characterised by mass participation and widespread enthusiasm and “irrational exuberance” by all sectors of society including the media and particularly the retail investor and the “man in the street”.

As seen today, this is clearly not the case at the moment as there continues to be little or no reporting (let alone analysis) about gold and silver – even when they reach record nominal highs.

While the specialist financial press such as Bloomberg, Reuters. Dow Jones, the Wall Street Journal and the Financial Times did report the record highs; it was unreported in the mainstream press in most western countries.

In the UK and Ireland, none of the main papers (including the Times of London, The Guardian, the Daily Telegraph, The Irish Times, the Irish Independent, and the Irish Examiner) reported the record highs.

The Financial Times print edition reported the news with one sentence saying that “concerns were underlined by gold rising to a three-month high”. In fairness to the Financial Times, they do report on the gold market far more than most media outlets.

The media’s continuing non-coverage of gold and silver is a clear indication of the lack of animal spirits in the sector. It is proof, if any were needed, that the mainstream media and the man on the street remains far from bullish on gold and silver.

Indeed, recent years and recent months have seen many so called “experts” warning about the dangers of the gold “bubble”. They have been proven badly wrong and it would be interesting to read a story about how wrong they got it.

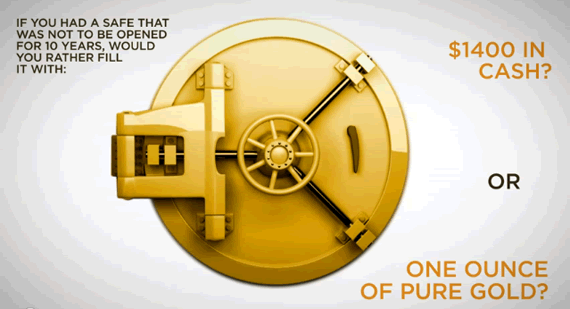

The majority of investors and savers in the western world do not know what gold bullion is and could not tell you the price of an ounce of gold or silver in dollars – let alone in pounds, euros or other local currencies.

The majority are unaware of the huge developments in the gold markets (only reported by specialist financial press) such as China’s emergence as one of the largest buyers of gold in the world (see news and our video below) and the fact that central banks and astute hedge funds are some of the largest buyers of gold in the world today.

A bubble only takes place when entire societies , including many - if not the majority - of journalists and media become convinced that you “cannot go wrong” with a certain speculation or investment and it is a risk free way of making returns.

This leads to gushing reportage and commentary about the “sure thing” that is a certain stock, bond, commodity or property market. It is characterised by widespread commentary and a belief not just in the financial press but in the mainstream media (day time radio and television etc) that one must speculate or “invest” by buying a certain security or asset class – whether that be tulip bulbs, Nasdaq, Apple or property in London.

Greed and buying motivated to make a profit or quick buck becomes widespread. This has not happened in the bullion markets as the majority of bullion buying has been safe haven buying for wealth preservation purposes rather than accumulation.

Concerns about a bubble in gold may be justified when it reaches its inflation adjusted high of $2,300/oz. Similarly with silver, concerns about a bubble may be justified when it reaches its inflation adjusted high of $130/oz.

Concerns about a bubble in gold will be justified when gold is covered in a regular manner in not just the specialist press but also in the mainstream. When vested interests selling gold regularly appear in mainstream media advising people to but all their money into gold because it is a sure thing, it will be time to become very cautious about the sector.

Near the top of the gold market (when the price is likely trading at thousands of dollars, euros and pounds per ounce) we are likely to see front pages in the business press (such as Fortune, Business Week etc) devoted to gold and snappy front page positive headlines about how “Gold is King”, “Why Gold is a Must” etc.

When that happens it will be time to be wary of the gold bubble and reduce allocations to gold and silver.

The lackluster, negligent media coverage of gold’s record highs yesterday suggests that we are a long way from there yet.

Gold

Gold is trading at $1,432.88/oz, €1,036.59/oz and £878.10/oz.

Silver

Silver is trading at $34.73/oz, €25.13/oz and £21.28/oz.

Platinum Group Metals

Platinum is trading at $1,836.25/oz, palladium at $818.00/oz and rhodium at $2,350/oz.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.