The SPX Stocks Index Dances Between Danger and Excitement

Stock-Markets / Stock Index Trading Mar 10, 2011 - 12:53 PM GMTBy: J_W_Jones

Many readers might remember that exactly two years ago the S&P 500 tagged the infamous 666 price level before putting on a monster 2 year rally that saw it surge over 100% to the February 2011 highs. Investors today are staring at a rising wall of risk while corporate credit spreads remain bullish, corporations have been able to expand margins and produce increasing profits, and Federal Reserve Chairman Ben Bernanke has declared that there are no inflationary concerns. Quite frankly I am going to leave Ben Bernanke alone simply because so many other people will do a better job of declaring him incompetent and the creator of massive bubbles in risk assets, but I digress.

Many readers might remember that exactly two years ago the S&P 500 tagged the infamous 666 price level before putting on a monster 2 year rally that saw it surge over 100% to the February 2011 highs. Investors today are staring at a rising wall of risk while corporate credit spreads remain bullish, corporations have been able to expand margins and produce increasing profits, and Federal Reserve Chairman Ben Bernanke has declared that there are no inflationary concerns. Quite frankly I am going to leave Ben Bernanke alone simply because so many other people will do a better job of declaring him incompetent and the creator of massive bubbles in risk assets, but I digress.

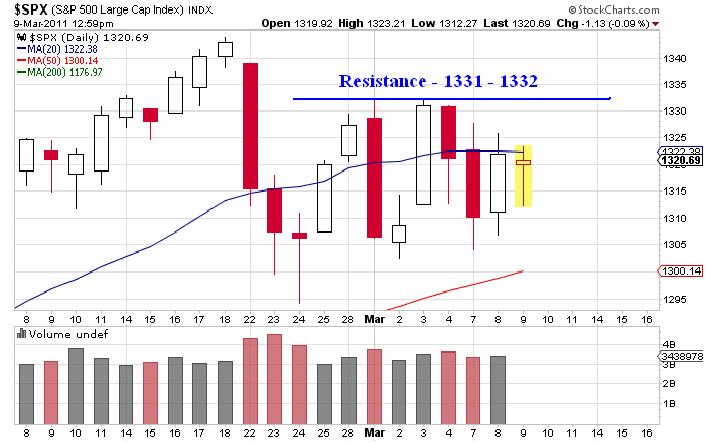

Right now investors have to weigh rising oil prices, geopolitical conflict in the Middle East, the threat of higher interest rates and inflation against the bullish backdrop discussed above. The price action in the broader market place is talking, but we have to listen with an open mind currently. There are two key price levels that are obvious when we look at a daily chart of SPX. First of all, the SPX 1331-1332 price level is acting as major resistance and holding the bulls in check. Should this level be breached to the upside on a daily close, we could see prices extend higher to test recent highs. The chart below illustrates the key upside level around 1331-1332.

However, it is important to note the bearish wedge forming on the SPX daily chart. If price can push below the recent lows around 1294, we should see an extension lower to the 1260-1280 area before support comes back into focus. If we were to test the 1260-1280 price level, it is hard to say where price action could go. We could see an extension higher which pushes to higher highs or we could rollover and test the 1250 price level below. I will wait until we get confirmation in either direction before making any major assessment, but for right now those are the key levels for traders to watch. The chart below illustrates the bearish wedge located on the SPX daily chart.

My bias remains to the downside due to what I am seeing in the Volatility Index (VIX) and what I refer to as the “usual suspects”. The usual suspects include small caps represented by IWM, transports represented by IYT, and the financials represented by XLF/KBX. I look at all of these metrics daily in order to facilitate my view of the marketplace and where I expect price action to be headed. Of course I take into consideration other analysis metrics such as market internals and chart formations, but the crux of my daily analysis is derived from the analysis of the VIX and the suspects.

Take for example the Volatility Index (VIX) daily chart and it is obviously trending higher and is well above key moving averages. I believe that in the future we will see the VIX test the 200 period moving average and potentially breakout. The test I am sure about, the breakout remains to be seen. The key levels on the VIX are shown below:

IWM has a similar trading pattern as the S&P 500 index but at current price levels it is well off of the recent highs. It is also building a bearish wedge and I will be watching it closely to see which way it breaks. If IWM breaks down ahead of the SPX it is likely that the SPX will follow suit. The transports (IYT) have gotten banged up the worst as the rise in oil price negatively impacts the entire sector. Transports are also trading well below recent highs and also have a bearish wedge formed on the daily chart.

The financials (XLF/BKX) exhibit a bearish wedge but they also have head and shoulders patterns forming on their daily charts. Should price break the neckline we could see heavy selling pressure set in on the financial complex. Most regular readers know that I put a lot of emphasis on the price action in the financials (XLF) and as such should they breakdown the broader indices will move in tandem. The daily chart of XLF is listed below:

Interestingly enough the U.S. Dollar Index futures appear to have formed a short/long term bottom on the daily chart. It is obviously unknown whether this is just a bounce to work off oversold conditions or the beginning of a longer term move higher. The primary point for traders to consider is that a rising dollar could place additional selling pressure on the S&P 500, crude oil, and precious metals.

By now I’m guessing most readers are starting to get the theme here. We have bearish wedges forming on key indices, however that does not mean that they will follow through to the downside. We could see a failure and a breakout higher just as easily as a bearish breakdown, thus the reason why the key levels are so important on the S&P 500. I am going to wait for a clear breakout/breakdown and will accept directional risk on the broad indices at that point. Until then, I am not going to get involved in the daily chop.

Get My Trade Ideas Here: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.