RIP Shadow Banking System, Long Live QEx

Interest-Rates / Quantitative Easing Mar 15, 2011 - 02:47 AM GMTBy: Gordon_T_Long

We have unwittingly become trapped in the snarled net of years of bad Public Policy. Like corporations that look no further than this quarter's results, our politicos never stop campaigning to start the tough task of ruling responsibly. A winning election simply represents 'rewards' and 'spoils' to all before quickly resuming the next campaign.

We have unwittingly become trapped in the snarled net of years of bad Public Policy. Like corporations that look no further than this quarter's results, our politicos never stop campaigning to start the tough task of ruling responsibly. A winning election simply represents 'rewards' and 'spoils' to all before quickly resuming the next campaign.

Image has become reality!

As a result the never ending political pandering has led to false expectations, undeliverable entitlements and false optimism in the electorate that rejects the immediate and obvious realities.

The result of a degenerated political leadership process is we are on the brink of a massive and sudden reduction in the US standard of living.

IN A BOX

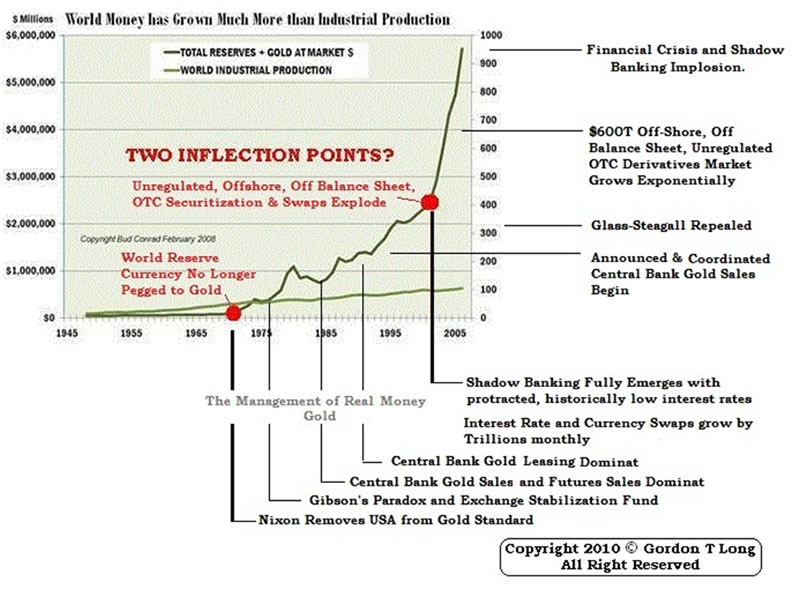

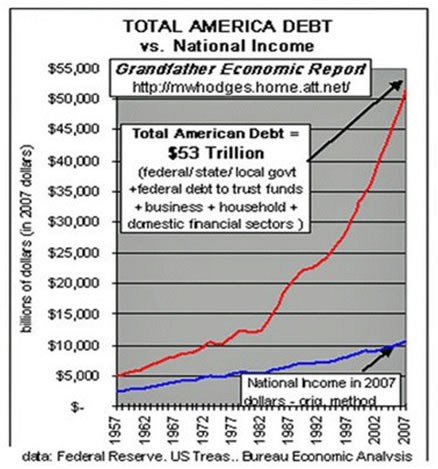

In 1971 President Richard Nixon rather than face the harsh realities of excessive US military spending, took the US dollar and the world Reserve Currency off the Gold Standard. It unleashed the greatest global debt pyramiding scheme the world has ever seen - or ever will see again.

To ensure all our readers truly appreciate what this decision meant and where we stand today, we need to revisit some basics.

First, in a the fractional reserve banking system which we currently operate under, money can only be borrowed into existence. Currency can be printed but the money supply only grows when debt is actually created. When the US Treasury issues bonds (debt) and it is taken on the Federal Reserve books as an asset, magically money is brought into existence via the issue of currency (or bank deposit) to the US Treasury. This is why the US dollar is a Federal Reserve note. It is an IOU to the Federal Reserve.

Secondly, Inflation is first and always a result of Monetary policy. If more money is put into the economy we will have more money chasing the same number of goods and it results in price inflation.

Thirdly, for an economy measured by GDP to grow, the money supply must grow faster than GDP or the economy will be starved of liquidity. If more money is created for economic growth and it consequentially produces inflation, then the money supply must maintain its growth at a faster pace than inflation. This is one of the reasons why when the inflation genie is released it is so hard to get 'back into the bottle' and to contain it. We learned this difficult lesson in the 1970's for those old enough to remember.

In theory therefore:

Money Supply Growth must be > Growth of the Economy

Since Money can only be loaned into existence and inflation is a Monetary phenomena

Money Supply must be larger > Inflation

Inflation must be larger > Real Growth (NOMINAL GROWTH MINUS INFLATION)

In a theoretical CLOSED economy there must always be a level of money growth which is slightly larger than inflation which is slightly larger than REAL economic growth.

Healthy Economy - Examples

4% GDP Growth with 5% Inflation means Money Growth is larger than 5% with a -1% Real Growth

6% GDP Growth with 7% Inflation means Money Growth is larger than 7% with a -1% Real Growth

9% GDP Growth with 10% Inflation means Money Growth is larger than 10% with a -1% Real Growth

Therefore you can see REAL Growth must always be zero or negative.

It Is Money CREATION that correlates with the growth of the NOMINAL value of the market

Unhealthy Economy - Examples

2% GDP Growth with 3% Inflation means Money Growth is larger than 3% with a -1% Real Growth

0% GDP Growth with 1% Inflation means Money Growth is larger than 1% with a -1% Real Growth

-2% GDP Growth with 0% Inflation means Money Growth is larger than 0% with a -2% Real Growth

Broken Economy - Examples

2% GDP Growth with 3% DEFLATION means Money Growth is larger than 1% with a +1% Real Growth

0% GDP Growth with 3% DEFLATION means Money Growth is larger than 3% with a +3% Real Growth

-2% GDP Growth with 3% DEFLATION means Money Growth is larger than +1% with a +1% Real Growth

-2% GDP Growth with 5% DEFLATION means Money Growth is larger than +3% with a +3% Real Growth

Therefore you can see Real Growth is always positive

Therefore when you have no growth and DEFLATION (due to deleveraging, malinvestment, default, bankruptcy) you still must have Money Growth. This forces the Fed to print it into existance or the government to take on the debt to grow the money supply or we have a liquidity trap.

To appreciate this fact you must remember that interest on outstanding debt STILL compounds every year.

The economy may stop growing but the carrying cost of outstanding debt doesn't.

The Federal Reserve in essence must make sure that DEFLATION is absorbed by adding money or the debt payments will shrink the economy

(Note: It is argued that it is actually the first derivative or rate of change of the increases/ decreases above, not the actual rate, that must be maintained. Even if this is true, the sign doesn't change which is the important point here.)

The major issue arises when even by increasing debt (somehow) it no longer generates growth.

This happens when we arrive at the consequential point of Debt Saturation relative to economic growth.

THIS IS THE PROBLEM WE NOW FACE, BUT KNOW ONE WANTS TO TELL YOU!

SITUATIONAL ANALYSIS

1- Debt growth now takes away from growth

2- Since the US is not a CLOSED economy and in fact is the world's reserve currency, money created by the Fed does not necessarily stay in the US.

In fact Quantitative Easing has presently ignited a massive global US dollar carry trade.

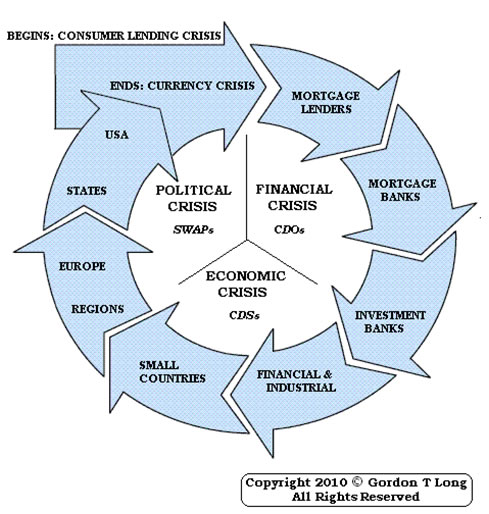

To put the above into perspective we need to understand that Money or more specifically Credit prior to 2008 had been growing not just through the banking system regulated by bank regulators but rather through what is referred to as the Shadow Banking System.

The Shadow Banking System as the prime pusher of toxic debt instruments collapsed in the 2008 financial crisis and so far it simply has not re-emerged in some sort of hybrid fashion. The Federal Reserve desperately needs this to happen and this has been another reason for the Fed's "Extend & Pretend" policy. Extend & Pretend was not only to give the economy time to rebound and push asset prices up (helping book collateral values), but also to allow asset appreciate to re-ignite a new and improved Shadow Banking System. It simply is not happening fast enough.

Here is the latest figures from the Federal Reserve's Flow of Funds report for Q4 2010. The report was startling since Q3 2010 was even worse than thought after final adjustments were made.

We had aQ4 2010 decline of $206.4 Billion in Shadow Banking liabilities with $440 Billion in combined Shadow and Conventional Banking System Liabilities.

This almost guarantees that the Federal Reserve must continue QEX.

THE SHADOW BANKING SYSTEM IS NOT RETURNING

THEY CAN'T STOP THE CRUMPLING BAD DEBT

It will take too much printed money by the Fed, created so fast, that the collateral fallout damage would be economically fatal.

Even the TRADITIONAL Banking System is shrinking on a M3 basis (it is no longer reported)

CONCLUSION

The collapse of the Shadow Banking is not resulting in the degree of asset deflation you might expect because the assets deflating are what has been referred to as toxic debt. The underlying basis for these instruments is real estate which is correspondingly being stopped from collapsing by the halting of Mark-to Market and other Fed sanctioned accounting gimmickry. Meanwhile the offsetting Money creation by the Fed is flowing into equities and bonds. This is creating the asset inflation that the Fed wants and needs.

A major problem for the Fed is not just being able to generate the amount required to offset the Shadow Banking System erosion, but also the rate at which the it can realistically make this happen. The Fed needs to buy more time.

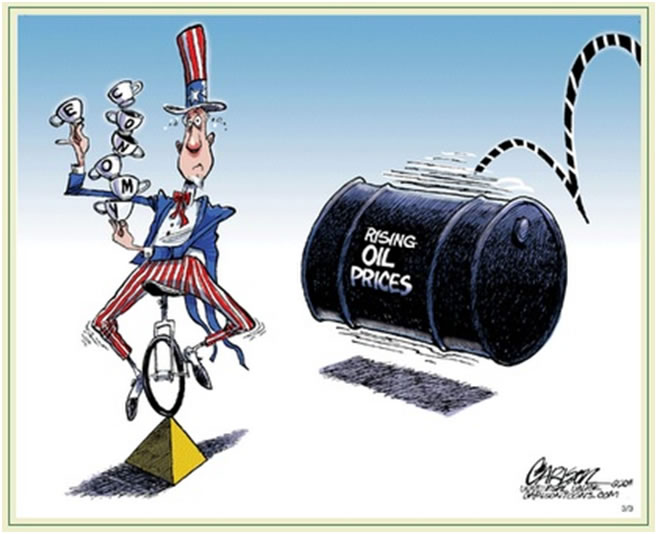

Unfortunately there are other major problems that are boxing them in.

DEBT SATURATION

Global growth has been pushed to the level of a desperate high octane race as a result of one bad public policy after another.

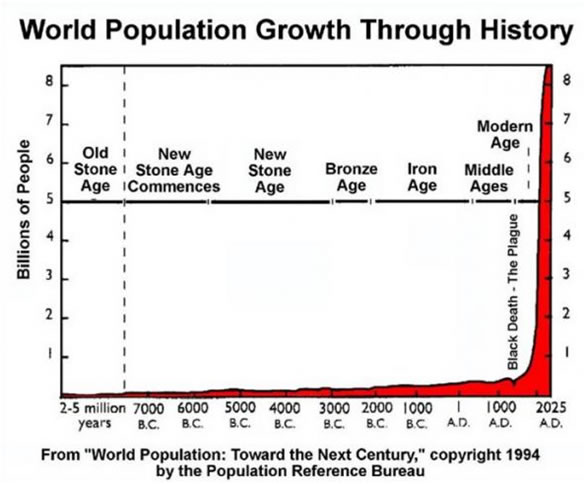

Exponential money growth has resulted in excess global capacity, underutilized production capabilities and unprecedented levels of mal-investment.

Everything that even hints at a slowdown or problem has continuously been met with rapid additional money supply expansion. The result is a global economy that can no longer absorb new debt at the same or faster rate and is burdened with existing debt payments that are simply not fundable without ever shrinking interest rates or easy roll-over banking covenants.

At nearly zero interest rates and slowing growth we have a potent cocktail for an economic disaster.

JOB CREATION & REAL ECONOMIC GROWTH

We additionally have a global crisis of job growth to match population employment needs.

Schumpeter's creative destruction is operating at full throttle with the internet and Information Technologies continuously obsolescing untold jobs worldwide.

Manufacturing through major process changes, supply chain integration and robotic automation has reinvented itself over the last 15 years. Gone are the days of thousands of factories employing thousands of people. Today it is hundreds of factories employing hundreds of people with thousands wanting to work there.

Yes China was the recipient of many of the 46,000 factories that left America but they employ much fewer people than they did when they were in the US. China has 30 million people a year leaving the rural farmland looking for factory work. India, Malaysia, Indonesia, etc face similar problems. There are not enough new factories needed to fill this requirement. This is deflationary in nature until the base commodity increases of manufacturing outstrip labor and capital cost savings.

New technology companies like Bio-Tech employ one tenth to one hundredth the employees that were employed during the computer communications technology era of the 80's and 90's. Higher education is required in these new industries and there is a much higher number of Master and PhD workers. However, the growing numbers of thousands of students with advanced degrees can't all be jammed into these too few corporations.

Unemployment is elevated and growing everywhere with more and more higher educated youth unable to find appropriate work. Sovereign nations globally face the daunting challenge of achieving employment levels that will stop social unrest. Some as we are witnessing in North Africa and the Middle East with 15- 30% unemployment are failing to do so.

RESOURCE SCARCITY

To say we have a looming global resource scarcity issue seems obvious, however I seldom ever read that we do? We see prices in all commodities continuously rising, food of all types rising, energy of all crack levels rising; yet no one talks about the realities of a systemic long term problem.

Shortages are always regarded as a temporary disruption or associated with some special situation. Folks, I hate to break the news but we are on the verge of major global resource shortages and scarcity. When Americans understand it is not their inalienable right to have gas at $3 per gallon while everyone else pays $9 they will quickly get the message. That day is fast approaching.

We will soon be in an era of worrying about how we pay for what we NEED versus how we can afford what we WANT.

DON'T SAY NO ONE WARNED YOU!

This article was taken from 2011 Thesis Report: "Beggar-Thy-Neighbor" FREE

Sign Up for the next release in the Currency War series: Commentary

Gordon T Long gtlong@comcast.net Web: Tipping Points Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2011 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.