Standard & Poor’s US Sovereign Debt Downgrade Initial Reflections

Interest-Rates / US Debt Apr 20, 2011 - 01:35 AM GMTBy: Asha_Bangalore

Standard & Poor's changed in its outlook on US sovereign debt to "negative" but reaffirmed the AAA rating of the nation's debt. Today's financial market response to this action includes equity prices viewing this in negative light. As of this writing the S&P 500 was down 1.1% at 1305. At the same time, the Treasury market posted a significant rally, with the 10-year Treasury note yield trading around 3.37% after closing at 3.43% on April 15. The dollar has gained ground vis-à-vis the euro and pound sterling. Gold prices moved ahead to nearly $1500 per ounce and oil prices have edged down.

Standard & Poor's changed in its outlook on US sovereign debt to "negative" but reaffirmed the AAA rating of the nation's debt. Today's financial market response to this action includes equity prices viewing this in negative light. As of this writing the S&P 500 was down 1.1% at 1305. At the same time, the Treasury market posted a significant rally, with the 10-year Treasury note yield trading around 3.37% after closing at 3.43% on April 15. The dollar has gained ground vis-à-vis the euro and pound sterling. Gold prices moved ahead to nearly $1500 per ounce and oil prices have edged down.

The market's response is not entirely consistent with a downgrading of sovereign debt because the decline in rating implies that the financial situation of the federal government is less secure and there are doubts creeping in about the federal government's ability to meet its debt obligations. If this was the case, the dollar should have declined and Treasury security yields should have risen.

Stepping beyond the immediate reaction in financial markets, let us start with the positive aspects of the story The downgrade to a negative outlook is a wake-up call to legislators to address the federal deficit problem in a methodical manner and drive it down from its current level (8.9% of GDP in 2010). Political gridlock and a serious tackling of fiscal imbalances as likely only in 2013, after the presidential elections, were cited as reasons for the change in outlook. If Congress rises to the occasion and contradicts the S&P assessment, the situation could change for the better. But, this is a big "if."

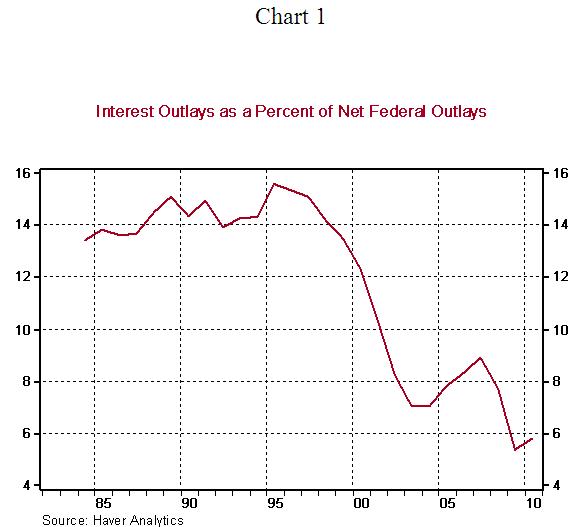

Standard & Poor's places the U.S along with fifteen others in the elite group of AAA rated sovereign debt issuers. Peers of the U.S in this group are Australia, Austria, Canada, Denmark, Finland, France, Germany, Lichtenstein, Luxembourg, Netherlands, Norway, Singapore, Sweden, Switzerland, and United Kingdom. The federal budget deficit of the US as a percentage of GDP is larger than its peers. Nevertheless, the debt service costs are not entirely burdensome at the present time. Interest costs of the federal government accounted for 5.7% of federal outlays and 1.4% of GDP in 2010 (see Chart 1). Interest costs were noticeably larger in the 1980s and 1990s (see Chart 1).

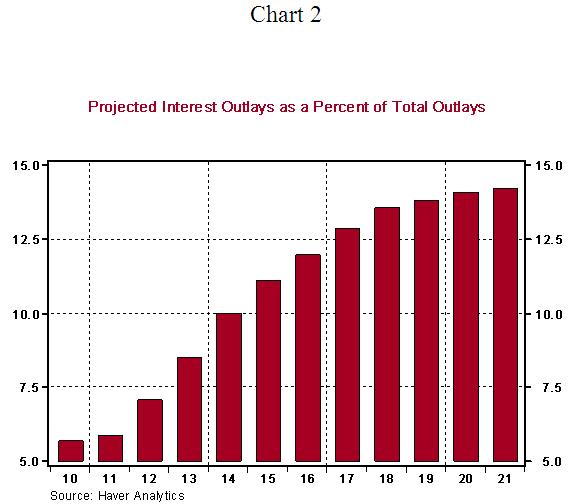

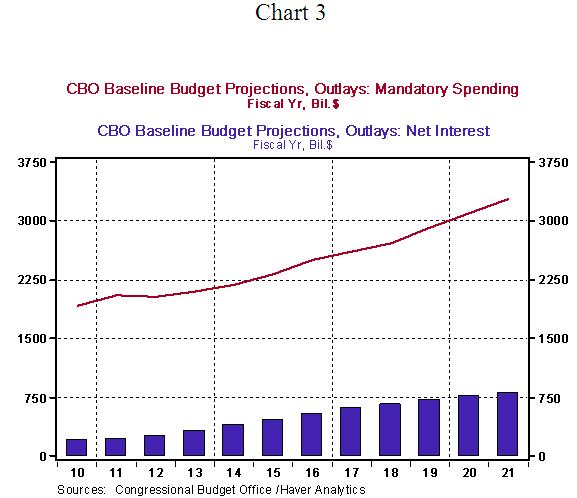

Projected growth of interest costs and other mandatory expense is at the root of the fiscal problem. By 2021, interest costs are projected to represent about 14% of federal outlays (Chart 2) and are estimated to be about $807 billion (see Chart 3).

The larger concern is mandatory outlays which are predicted to reach $3.3 trillion by 2021 (see Chart 3) from $1.9 trillion in 2010. The bottom line is that projected trend of federal government outlays needs to be addressed. The key question is if Congress will heed the warning bell and take steps of fiscal consolidation in the near term.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.