BRIC Inflation, GDP, Stock Indexes, Monetary Policy Economic Analysis

Economics / Emerging Markets Apr 24, 2011 - 01:56 AM GMTBy: EconGrapher

This week the focus goes to the giants of the emerging markets, the "BRIC" economies (the economic/investment one, not the political club). In this edition we review inflation, GDP, monetary policy and the stock markets of Brazil, Russia, India, and China. Also thrown in is a quick review of the monetary policy decisions over the past week.

This week the focus goes to the giants of the emerging markets, the "BRIC" economies (the economic/investment one, not the political club). In this edition we review inflation, GDP, monetary policy and the stock markets of Brazil, Russia, India, and China. Also thrown in is a quick review of the monetary policy decisions over the past week.

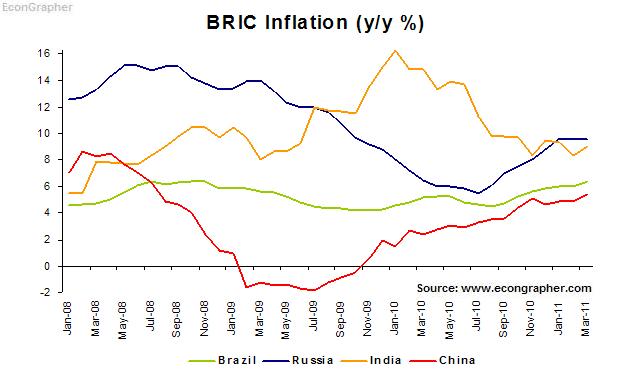

1. BRIC Inflation

First up is a look at inflation, the BRIC economies are basically the key representatives of emerging markets. And if there's been one key theme for emerging markets, it's inflation. Inflation has been surging in the emerging market world over the past year, driven by a strong run-up in agricultural commodities, thanks to supply shocks paired with the steady increase in demand due to rising wealth in places like the BRIC economies. As I've noted before, inflation will be the key issue in emerging markets this year - mostly because of the monetary policy response, and the subsequent impact on GDP, and stock market returns. It is likely that we'll start to see a tapering off of inflation through the second half of this year - but if not, then things could get 'interesting'.

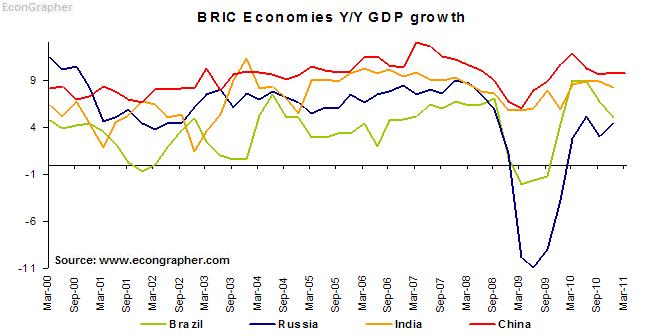

2. BRIC GDP

Over to GDP, the BRICs bounced back strongly from the great recession. China took a small hit, but charged back with large scale stimulus. India was more or less unscathed on its growth path. Brazil took a decent hit, but has subsequently returned to pre-crisis growth rates. Meanwhile Russia took a significant hit with the collapse of the commodity bubble and is still struggling to get back to pre-crisis levels as it takes on significant economic challenges. However, while the medium term outlook may be less than certain, the fundamentals still support the long term growth story. Also, while the pattern was similar to that of the developed markets' experience, on a relative basis emerging markets got off lightly.

3. BRIC Stock Indexes

Honing in on the stock markets of the BRIC economies, over the past 2 years Russian stocks have been the key performers (thanks in part to the rebound in commodity prices following the crash), while Indian stocks have been a distant second. Brazilian stocks have fallen slightly short of the S&P 500 and Chinese stocks remain weighed down due in part to the uncertainty around the monetary policy tightening cycle. The reigning intuition had been that since the BRIC economies are going to become the next big thing in terms of economic clout and contributors to global growth, then their stocks will also be the next big thing. But for a variety of reasons this may only be partially true. But interestingly, it also doesn't necessarily mean relative out-performance of US stocks since their are a lot of ADRs and large global companies that will reap rewards of said economic ascension, while benefiting from well developed capital markets and associated regulation and transparency.

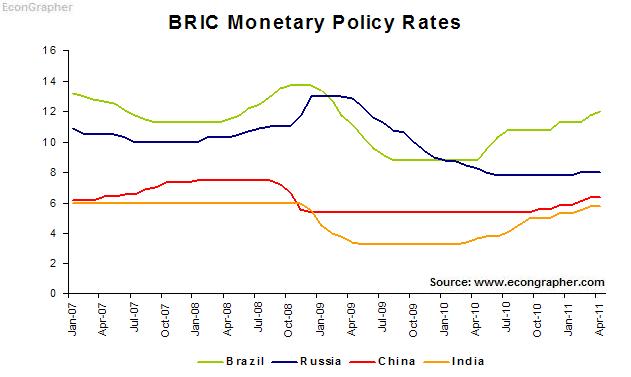

4. BRIC Monetary Policy

On monetary policy, this (vis a vis inflation) is one of the key factors in the course of emerging market investments this year. The chart below shows that basically all of the BRIC economies are well into the monetary policy tightening cycle, with Brazil increasing rates again in the past week. Clearly, rising policy rates will have a negative short term impact on stocks since on the valuation front higher interest rates reduce the discounted cash flows due to a higher discount rate, but they also have the impact of slowing economic activity - even stalling it over the medium term. This explains much of the caution that investors have collectively shown in relation to emerging markets in recent times. And this is also why people should be watching developments there closely for signs that the worm may turn.

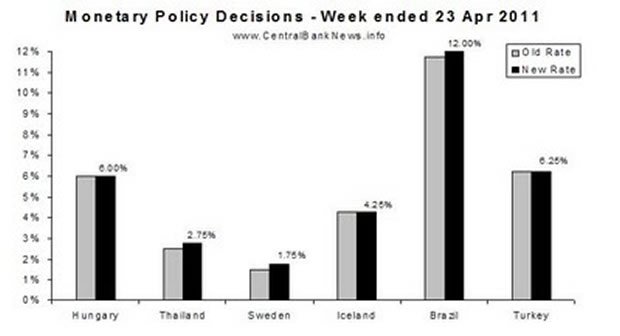

5. Monetary Policy

On the topic of monetary policy, the theme of global monetary policy tightening continued through the past week. The week saw interest rate increases from Thailand +25bps to 2.75%, Sweden +25bps to 1.75%, and Brazil +25bps to 12.00%. Of course there were also two reserve ratio hikes - showing that the inflation fight is not limited to the usual policy interest rate tools, with China hiking required reserves by 50bps and Turkey by 100bps. What was most interesting was the theme of a more global nature of policy tightening starting to come through. Sweden's move perhaps epitomized this, echoing the ECB's recent 25bp increase. So next week it will be particularly interesting to see what the US federal reserve has to say - indeed also Bernanke, in his post-meeting press conference.

Summary

So looking at the emerging giants that are the BRIC economies a couple of key themes stick out. First of all the long-term growth story remains intact, with no major damage to the fundamentals. However over the short-medium term the outlook is less than certain as the challenge of fighting rising inflation presents a tangible set of risks. The course of inflation, and thus monetary policy will perhaps be the key determinant of medium term investment returns. Interestingly, on the topic of monetary policy, the policy tightening cycle is well and alive, and is increasingly becoming a global theme. But there is some truth in the suggestion that emerging markets are a key driver behind this trend. So the main message - watch closely for a turn in the inflation worm.

Sources:

1. Trading Economics www.tradingeconomics.com

2. OECD Statistics stats.oecd.org

3. Yahoo Finance finance.yahoo.com

4. CentralBankNews.info www.centralbanknews.info

5. CentralBankNews.info www.centralbanknews.info

Article Source: http://www.econgrapher.com/top5graphs23apr11.html

By Econ Grapher

Bio: Econ Grapher is all about innovative and insightful analysis of economic and financial market data. The author has previously worked in investment management, capital markets, and corporate strategy.

Website: http://www.econgrapher.com

Blog: http://econgrapher.blogspot.com

© 2010 Copyright Econ Grapher - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.