Gold a Bubble? Forbes Predicts New Gold Standard Within 5 Years

Commodities / Gold and Silver 2011 May 12, 2011 - 07:28 AM GMTBy: GoldCore

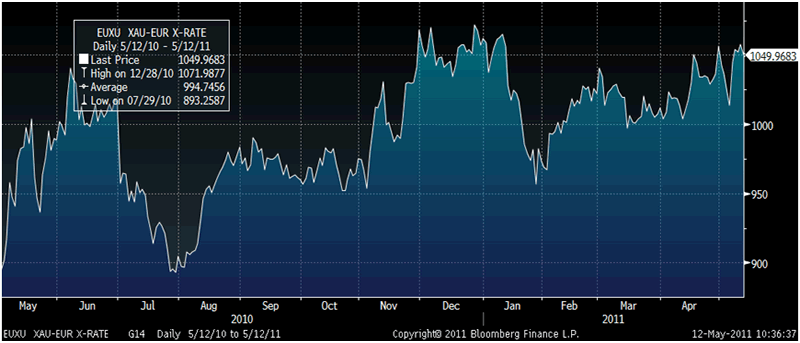

Gold and silver's recovery in recent days proved to be temporary and further falls were seen yesterday (sharply in silver) prior to a tentative recovery overnight and then more falls again this morning. The euro has stabilised after recent sharp falls and euro gold at €1,050/oz remains comfortably above €1,000/oz after a period of correction and consolidation. Euro gold looks like it is set to break above record highs of €1,072/oz (12/28/10) and target €1,100/oz as the European debt crisis deepens.

Gold and silver's recovery in recent days proved to be temporary and further falls were seen yesterday (sharply in silver) prior to a tentative recovery overnight and then more falls again this morning. The euro has stabilised after recent sharp falls and euro gold at €1,050/oz remains comfortably above €1,000/oz after a period of correction and consolidation. Euro gold looks like it is set to break above record highs of €1,072/oz (12/28/10) and target €1,100/oz as the European debt crisis deepens.

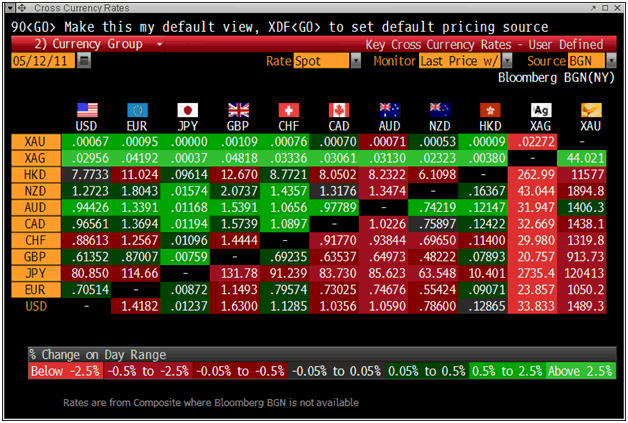

Cross Currency Rates at 1030 (London AM Fix)

The massive disconnect between the COMEX spot and futures prices and the physical market continues with leveraged, powerful players on Wall Street (primarily hedge funds and Wall Street banks) able to effect short term sell offs in the paper market despite the very strong supply and demand fundamentals in the physical bullion market.

Euro Gold - 1 Year (Daily)

Simplistic assertions continue gold and silver are asset bubbles, and that silver's bubble has burst, continue.

Those who have been wrongly calling gold and silver bubbles in recent years fail to realise that gold and silver are no ordinary assets, indeed many contend that they are not assets at all, rather they are money. The precious metals were demonetised in the second half of the 20th century as unbacked paper currencies (fiat money) became accepted globally.

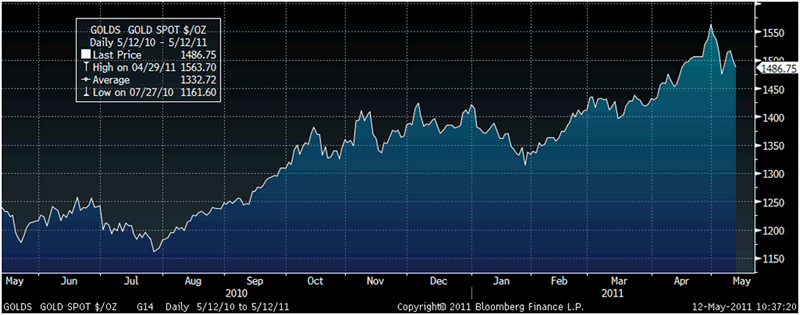

USD Gold - 1 Year (Daily)

Those continuing to call gold a bubble do not understand monetary economics and the growing trend towards the gradual remonetisation of gold. This is due to the unstable nature of the global financial system and markets and growing concerns about all fiat currencies including the international reserve currency, the US dollar and major reserve currencies such as the British pound, the Japanese yen and the euro.

Ultra loose monetary policies and global currency debasement renders simplistic and naive the confident assertions of gold and silver being bubbles.

Indeed, with growing calls for a return to the gold standard, the latest from billionaire media magnate Steve Forbes (see news), gold looks set to at least rise to its 1980 adjusted high of $2,400/oz.

Forbes said in an interview, that people know that something is wrong with the dollar.

What seems astonishing today could become conventional wisdom in a short period of time, Forbes said. He concluded that "you cannot trash your money without repercussions".

He thus echoes long term gold standard advocate Representative Ron Paul and the recent advocation of a return to some form of gold standard by World Bank President Robert Zoellick.

A return to a gold standard would likely see gold revalued to thousands of dollars per ounce.

Gold

Gold is trading at $1,486.04/oz, €1,049.83/oz and £912.24oz.

Silver

Silver is trading at $33.01/oz, €23.32/oz and £20.25/oz.

Platinum Group Metals

Platinum is trading at $1,753oz, palladium at $698/oz and rhodium at $2,075/oz.

News

(Bloomberg) -- HSBC Cuts Three-Year, Six-Month View on Gold Asset Allocation

Gold should account for 10 percent of a portfolio on a three-year view, down from 15 percent previously, Fredrik Nerbrand, global head of asset allocation at HSBC Bank Plc, said in a report dated yesterday.

Gold should account for 10 percent on a six-month view, down from 13 percent, it said. "We think the diversification benefits have diminished," he wrote in the report.

(Bloomberg) -- Central Banks, IMF Sell 53.2 Tons of Gold in Current Accord

European central banks and the International Monetary Fund sold 53.2 metric tons of gold so far in the current central bank gold agreement which began September, the World Gold Council said.

Euro zone banks sold about 1 ton of the metal in the period and the IMF sold the rest, the council said today in a report on its website.

(Bloomberg) -- Shanghai Gold Exchange May Widen Silver Trading Band Tomorrow

The Shanghai Gold Exchange will widen the trading band for silver contracts to 13 percent if the metal falls by the daily limit at the close today, the bourse said in a statement posted on its website.

The exchange will also raise the margin requirement to 19 percent if it closes limit down today, according to the statement.

(Human Events) -- Forbes Predicts U.S. Gold Standard Within 5 Years

A return to the gold standard by the United States within the next five years now seems likely, because that move would help the nation solve a variety of economic, fiscal, and monetary ills, Steve Forbes predicted during an exclusive interview this week with Human Events.

"What seems astonishing today could become conventional wisdom in a short period of time," Forbes said.

Such a move would help to stabilize the value of the dollar, restore confidence among foreign investors in U.S. government bonds, and discourage reckless federal spending, the media mogul and former presidential candidate said. The United States used gold as the basis for valuing the U.S. dollar successfully for roughly 180 years before President Richard Nixon embarked upon an experiment to end the practice in the 1970s that has contributed to a number of woes that the country is suffering from now, Forbes added.

If the gold standard had been in place in recent years, the value of the U.S. dollar would not have weakened as it has and excessive federal spending would have been curbed, Forbes told HUMAN EVENTS. The constantly changing value of the U.S. dollar leads to marketplace uncertainty and consequently spurs speculation in commodity investing as a hedge against inflation.

The only probable 2012 U.S. presidential candidate who has championed a return to the gold standard so far is Rep. Ron Paul (R.-Tex.). But the idea "makes too much sense" not to gain popularity as the U.S. economy struggles to create jobs, recover from a housing bubble induced by the Federal Reserve's easy-money policies, stop rising gasoline prices, and restore fiscal responsibility to U.S. government's budget, Forbes insisted.

With a stable currency, it is "much harder" for governments to borrow excessively, Forbes said. Without lax Federal Reserve System monetary policies that led to the printing of too much money, the housing bubble would not have been nearly as severe, he added.

"When it comes to exchange rates and monetary policy, people often don't grasp" what is at stake for the economy, Forbes said. By restoring the gold standard, the United States would shift away from "less responsible policies" and toward a stronger dollar and a stronger America, he said. "If the dollar was as good as gold, other countries would want to buy it."

An encouraging sign for Forbes is that key lawmakers besides Rep. Paul are recognizing that the Fed is straying well beyond its intended role of promoting stable prices and full employment with its monetary policies.

Forbes cited Rep. Paul Ryan (R.-Wis.), who, he believes, understands monetary policy better than most lawmakers and has shown a willingness to ask tough but necessary questions. For example, when Federal Reserve Chairman Ben Bernanke appeared before the House Budget Committee in February, Ryan, who chairs the panel, asked Bernanke bluntly how many jobs the Fed's quantitative-easing program had helped to create.

Politicians need to "get over" the notion that the Fed can guide the economy with monetary policy. The Fed is like a "bull in a China shop," Forbes said. "It can't help but knock things down."

"People know that something is wrong with the dollar," Forbes concluded. "You cannot trash your money without repercussions."

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.