New Rhodium ETC

Commodities / Rhodium Jun 16, 2011 - 02:14 AM GMTBy: Ned_W_Schmidt

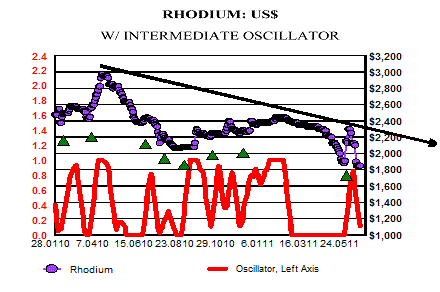

RHODIUM TRADING THOUGHTS is about timely and profitable trading of precious metals. We do not believe every turn in the market can be called. Our goal is that our recommendations should be profitable. Profits are the goals, not trades. Do not expect all recommendations to be profitable. No system can achieve that lofty goal. Our goal is simply to state whether conditions for a metal are favorable or not. Buy signals are issued when appropriate. These signals are generally speaking for day they are issued. If price remains below signal price, buying can be done. Do Not Buy signals are given when market is over bought, and buying is unwise. Blue triangles indicate an over bought condition. These would not be good times to buy, so they are labeled Do Not Buy. Software is not showing complete legend, for some reason.

RHODIUM TRADING THOUGHTS is about timely and profitable trading of precious metals. We do not believe every turn in the market can be called. Our goal is that our recommendations should be profitable. Profits are the goals, not trades. Do not expect all recommendations to be profitable. No system can achieve that lofty goal. Our goal is simply to state whether conditions for a metal are favorable or not. Buy signals are issued when appropriate. These signals are generally speaking for day they are issued. If price remains below signal price, buying can be done. Do Not Buy signals are given when market is over bought, and buying is unwise. Blue triangles indicate an over bought condition. These would not be good times to buy, so they are labeled Do Not Buy. Software is not showing complete legend, for some reason.

Since we last visited on Rhodium, the news has been favorable for the future value of the metal. Deutsche Bank announced the creation of an ETC, Europe's version of an ETF, for Rhodium. While that news is favorable, seems the market got a little ahead of the reality. The sharp upward move on the announcement has been reversed due to the general bearishness creeping into all markets.

Rhodium is not produced in sufficient quantity to suggest that an ETC was one of those investment products for which the world was clamoring. It is, however, to be part of a more important product in the European investment market. That "bigger" product is likely to benefit investors in Rhodium over time. Let us emphasize over time component of that statement.

Europe has an investment product referred to as UCITS, Undertaking for Collective Investment in Transferable Securities. UCITS are apparently aimed at retirement plans. It must contain at least 5 securities, or ETCs, to meet diversification requirements. Rhodium ETC made the 5th, with Gold, Silver, Platinum, and Palladium being the other four. With those comments we exhaust our knowledge of UCITS, and encourage anyone knowing more to drop us an email.

Deutsche Bank expects $200-400 million to flow into the UCITS over the next year, which implies $20- 60 million flowing into Rhodium ETC.(Financial Times, 2 June 2011) That compares favorably with the minimal investment demand for Rhodium at the present.

Point in all this is that the Rhodium ETC will be "dragged along" as Deutsche Bank markets the UCITS. While the current value of the ETC is small, ~$4 million, it is the incremental investment demand that will be created over time that attracts our attention. Part of our initial interest in Rhodium was the lack of investor interest. This vehicle helps to create that investor demand.

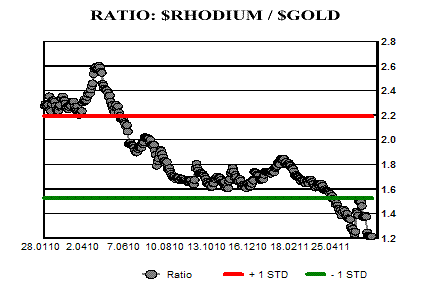

As the charts on the previous page indicate, Rh bounced on the announcement of the ETC. This week, for some reason, dealers slashed their bids, pushing Rh's price again into over sold territory. It is also, as second chart indicates, again selling at an extreme low relative to Gold.

OPINION:

Rhodium ETC begins the process of creating investor demand for Rhodium. This metal offers an opportunity to diversify a metals portfolio with what appears to be an under valued metal. Investors with high exposure to Silver should consider switching to Rhodium.

Fact sheet on db Rhodium ETC: http://www.etc.db.com/GBR/ENG/ETC/Productdetails/GB00B684MW17

Your Eternal Optimist;

RHODIUM TRADING THOUGHTS is published presently on an irregular basis, and is available only on selected web sites and at our web site: www.valueviewgoldreport.com

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.