Coal Generators Power Struggle: Consumers To Foot The Electric Bills?

Commodities / Energy Resources Jun 23, 2011 - 06:54 AM GMTBy: Dian_L_Chu

Utility giant American Electric Power (AEP) sent shock wave last week by suggesting consumers could see their electricity bills jump an estimated 40-60% in the next few years. AEP is one of the country's largest investor-owned utilities, serving parts of 11 states with more than 5 million customers.

Utility giant American Electric Power (AEP) sent shock wave last week by suggesting consumers could see their electricity bills jump an estimated 40-60% in the next few years. AEP is one of the country's largest investor-owned utilities, serving parts of 11 states with more than 5 million customers.

As part of the company’s plan to comply with EPA's new regulations, AEP said it would cost $6-8 billion in capital investments over the next decade to retire and retrofit its coal fired power plants to meet regulations that start taking effect in 2014. And that’s when the utility rate increases are expected to begin to appear.

As noted in my other article, a study by the Brattle Group concludes that new EPA new emission regulations could push up to 50,000 MW to 67,000 MW, or 20% installed coal plant capacity into early retirement, and additional $100-180 billion investment may be needed to upgrade existing coal plants to comply with the EPA's potential mandates.

Chicago Tribune also reported that generators have announced they plan to retire another 21,000 megawatts in the near future, and some industry consultant studies estimate 60,000 megawatts of power will be taken offline by 2017.

So it seems the estimated impact of EPA’s new Air Toxics Standards for Utilities would be an early retirement of around 20% of coal plant capacity in the next five years or so. Those soon-to-be-retired coal plants are most likely older and smaller coal plants not far from being totally decommissioned in the first place.

Steven F. Hayward, a resident scholar at the American Enterprise Institute, also commented that

“…the average age of the [U.S.] coal fleet is 42 years….it is more likely to be the smaller plants that will be shut down for the simple reason that the fixed capital costs of additional pollution abatement will be too high, while the costs will not be excessively high for the larger plants.”As for the numbers from AEP, Hayward writes,

“…although new gas-fired power has become very cost competitive on average, the replacement cost of small coal units with small gas units (or renewables such as wind and solar that require gas-backup) is likely to be higher than average in many cases. Hence, the kind of numbers we’re seeing out of Illinois.”Admittedly, whenever there’s new legislation affecting the industry landscape, negative impact on the cost structure is inevitable and could eventually be passed through to consumers. However, the ability to pass on the incremental cost as well as the dollar amount are still subject to market supply and demand fundamentals.

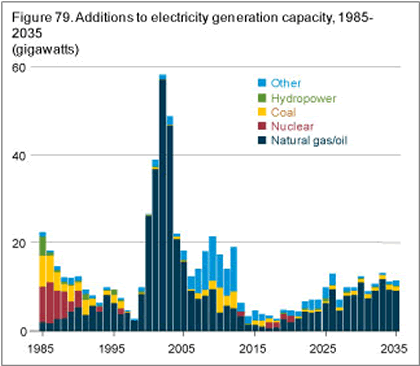

Since power plants in the U.S. are used at only about half their potential full output, the estimated coal capacity retirement, which are expected to be compensated by an increase in gas power generation, most likely will not cause significant supply demand imbalance.

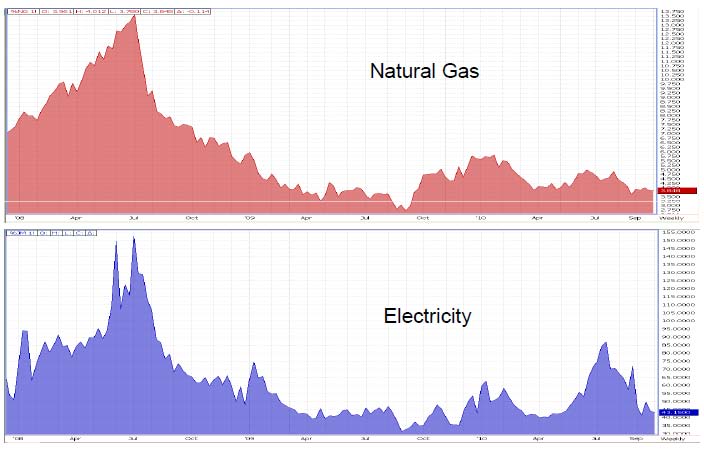

Furthermore, electricity costs historically has been highly correlated to natural gas (See Graph Below). Even in the state of Texas which ranked number one based on total amount of coal-generated electricity in 2005, the correlation was as high as 90% from Feb. 2007 to Feb. 2008. The correlation could increase even further now that natural gas is taking the power gen market share from coal with the help of new environmental regulations and cheap Henry Hub price.

|

| Chart Source: Hess Corp. presentation, 2011 |

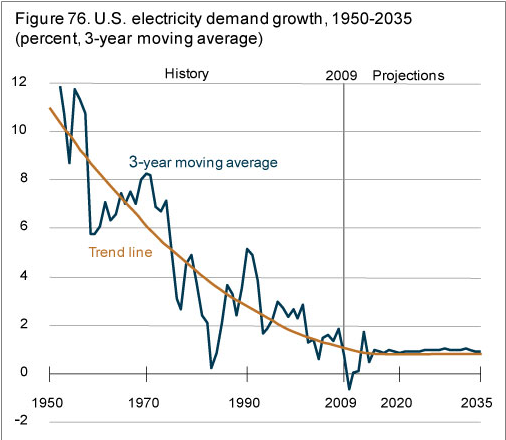

And here is the electricity supply and demand projection by the Energy Dept. in its Annual Energy Outlook 2011 released in April 2011:

“In the Reference case, electricity demand growth rebounds but remains relatively slow, as growing demand for electricity services is offset by efficiency gains from new appliance standards and investments in energy-efficient equipment.”

|

| Chart Source: EIA |

“More recently, the economic recession in 2008 and 2009 caused a significant drop in electricity demand. As a result, the lower demand projected for the near term in the AEO2011 Reference case again results in excess generating capacity.”

|

| Chart Source: EIA |

According to Source Watch, AEP is the top producers of coal-fired electricity in the U.S. in 2005. So it is easy to understand why American Electric Power is busy clashing with the EPA, after its peer Exelon Corp., (EXC) took the high road.

Exelon is expected to benefit from this new air legislative change due to its large fleet of nuclear power plants that have low emissions and are cheap to run. Below is Exelon’s statement in March 2011 regarding proposed EPA rules as reported by MarketWatch:

"Based on our detailed review of the Air Toxics Rule and our preliminary analysis of the Section 316(b) rule, rumors of a 'train wreck' caused by new EPA regulations are simply false…. That is not to say that there is not room for additional dialogue, but these discussions need to be guided by sound science, not rhetoric….. EPA has done a good job listening to the industry and moving the ball forward."

It looks like the battle line is drawn in the power gen sector, and coal got thrown under the bus. Regarding what the final damage to consumers' wallet will be, I guess only time will tell.

Disclosure - No Positions

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.