Freddie Mac Facing Insolvency and Gold's Immediate Outlook

Companies / Subprime Mortgage Risks Nov 28, 2007 - 04:37 AM GMTBy: John_Lee

This is a follow up to my last article: ‘ Subprime Mortgages Lead to Subprime Currency' (available here ) in which I wrote:

“The curious mind asks, who holds those $trillions worth of mortgages? Thanks to the genius of the American banking and marketing machine, just about every sizable institution underneath the sun with a fixed income portfolio. From Europeans to Asians, from Banks to Brokerages, from Hedge Funds to Pension Funds, Institution to Retail, Trusts to Endowments.

Most of those aforementioned outfits are in a state of shock and have been reluctant to mark their $trillion+ subprime portfolio to market. Every other day there is new revelation of substantial subprime loss. First it was New Century in March, then American Mortgage and Countrywide in September, then it got worse as Wells Fargo, Bank of America, Credit Suisse First Boston, Citibank (albeit with a new CEO now) came out of woodworks. Last Friday it was Wachovia (US 4th largest), and on Tuesday it was Etrade. Not one major bank dealing with mortgages was immune. If there is such thing as systematic risk, we are sure looking at one, and therefore expect a lot more skeletons to come out of the closet in the months to come.”

In two short weeks, HSBC, Citibank, Goldman Sachs, Swiss Re, and Japanese outfits have revealed tens of billions of losses stemming from US mortgages.

I also said:

“At this juncture, the Fed has no choice but to redeem any and all mortgages at near face value directly, through GSE, or offshore vehicles. The more the Fed redeems, the more dollars they print. When you print $1 trillion (10%) a year, people can reasonably swallow the extra money supply, but when you print a $1trillion in a hurry and in a conspicuous way, you are directly challenging money managers' intelligence and you will see a squeeze in gold. It's that simple”.

CNNF kindly explains how GSE's work and their impending failure.

“Fannie Mae guarantees mortgages, which have been packaged and sold to investors as bonds. If a homeowner falls significantly behind on his payments, Fannie Mae has to buy back the loan from the bondholder. If the mortgage has an outstanding amount of, say, $100,000 and unpaid interest of $5,000, Fannie Mae would have to pay $105,000 -- its full value -- to make the bondholders whole. However, the $105,000 loan may actually be worth less on the market. It is Fannie Mae's job to estimate the market value, or fair market value, of the loan and to record that price on its books. So if the fair market value is $80,000, Fannie Mae takes a loss of $25,000 (the difference between $105,000 and $80,000). That loss is considered an SOP 03-3 loss -- so named after the applicable accounting rule.

Until recently, Fannie Mae included SOP 03-3 losses as part of its credit-loss ratio. But here's the trick: Fannie insists that, based on past trends, it can recover a large part of that $25,000 loss by, for example, helping the borrower renew payments. So it simply decided to stop including SOP 03-3 losses in calculating its credit-loss ratio.

Fannie Mae's decision to exclude SOP 03-3 losses coincide with their shocking rise: In the third-quarter ended Sept. 30, 2007, the company's SOP 03-3 losses came to $670 million, up from $37 million in the same period a year ago. It's not clear why SOP 03-3 losses are skyrocketing, but it suggests that Fannie Mae is having credit problems and is having to buy a lot more bad loans back from bondholders”

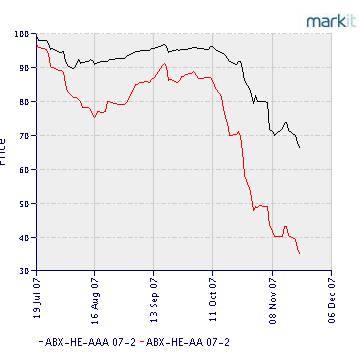

The reason for the dramatic SOP 03-3 rise is very clear according to the ABX index below.

The index shows collectively, that mortgages GSE's (Fannie and Freddie) guarantee are selling at .70 cents on the dollar. Freddie's $120 billion and Fannie's $42 billion of exposure to GSE-qualified mortgages means a write-down of over $30 billion and $10 billion respectively. Given that both outfits have about $1 billion in excess capital, they are now technically insolvent, especially when the ABX index is showing no signs of reversing. Freddie has hired Goldman Sachs and Lehman Brothers as advisors to help it raise capital in the very near term, but our take is that no sane institution will lend money to Freddie. If left to their own devises by the government, Fannie and Freddie are doomed.

In our last article I also said:

“No sane foreign institution is going to finance American home owners, and why should they when they can finance the Brazilians, Canadians, Thais, Russians, Chinese, Indians, with an appreciating currency? The dollar reserve status is now shattered. Mind you, it's not that we are against the dollar in particular, we just don't think any fiat currency deserves to be the world's reserve currency.

To those who say gold is due for a pro-longed correction at $800, they are missing the big picture. To us gold's run has just gotten started, the Emperor is now naked for all to see”.

Not only are mortgage-backed securities distressed, but auto-loan backed securities and credit-backed securities are now beginning to experience pressure. The world had a love affair with the Dollar, and happily ate up any Dollar-denominated package that threw a 5% interest at them. This $30 trillion+ affair has ended and the aftermath is not pretty. To understand why the Fed has to print and bail out all those banks and funds, we highly recommend that you watch this British comic strip (available here )

From the banker:

"One thing I learned is if you are going to ***** up something, better ***** up big so government has to bail you out, and if the government does not give me my money back, I will tell them, it's not my money, its your pension fund money”

Technically gold has just successfully tested the 50 day-moving-average support. Our 2007 target of $850 for gold may be too conservative, as once the $850 level is overcome, gold could rapidly challenge the $1,000 level. Welcome to inflation and welcome to gold.

John Lee, CFA

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.