U.S. June Jobs Report, Weak Labor Market Casts Shadow on Economic Growth

Economics / Employment Jul 09, 2011 - 02:48 AM GMTBy: Asha_Bangalore

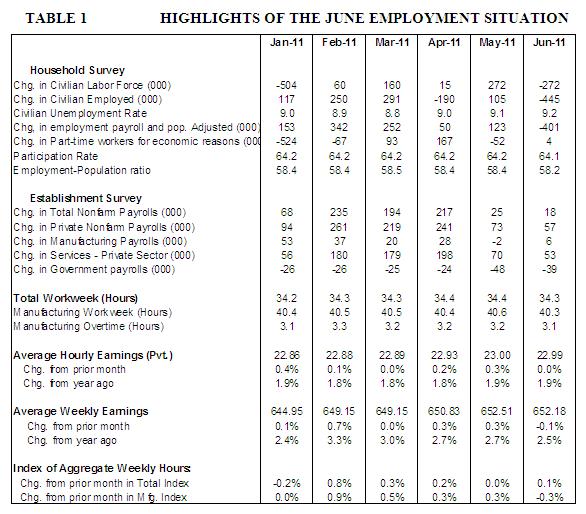

Civilian Unemployment Rate: 9.2% in June vs. 9.1% in May. Cycle high for recession is 10.1% in October 2009.

Civilian Unemployment Rate: 9.2% in June vs. 9.1% in May. Cycle high for recession is 10.1% in October 2009.

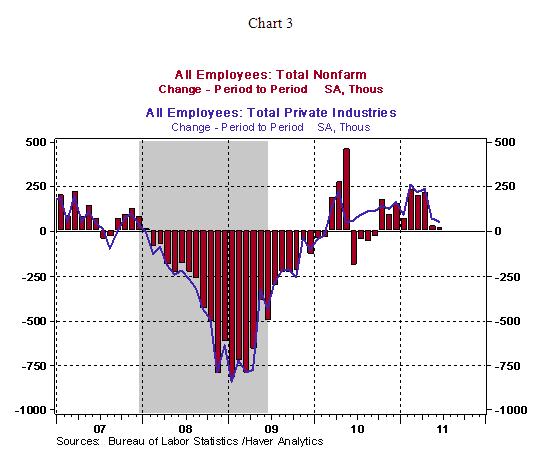

Payroll Employment: +18,000 in June vs. +25,000 in May. Private sector jobs increased 57,000 after a gain of 73,000 in May.

Private Sector Hourly Earnings: $22.99 in June vs. $23.00 in May; 1.9% yoy increase in June, matches increase posted in May.

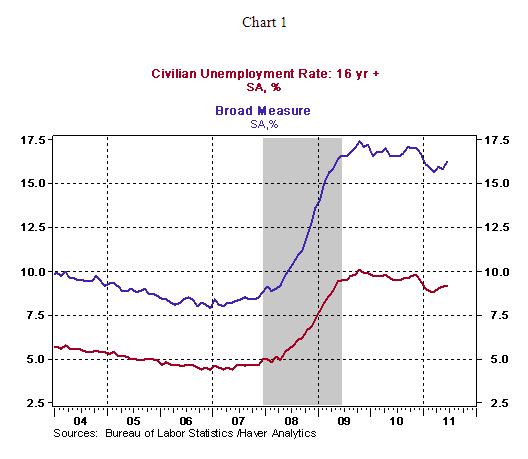

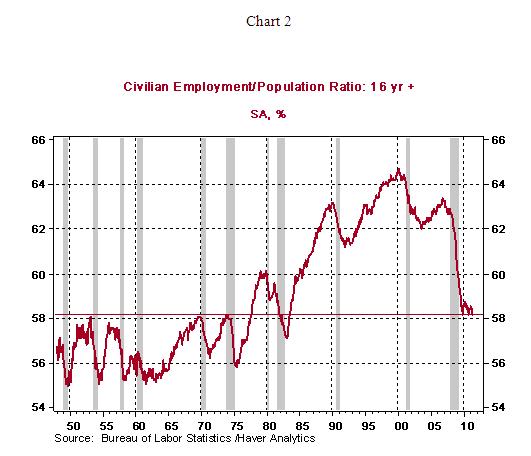

Household Survey - The unemployment rate rose to 9.2% in June from 9.1% in the prior month. Essentially, the jobless rate has increased noticeably from a low of 8.8% in March 2011. The broad measure of unemployment (inclusive of those who are working part-time because they cannot find full-time jobs and those who stopped looking for a job) moved up to 16.2% from 15.8% in May. The employment-population ratio edged down to 58.2% in June (see Chart 2) from 58.4% in May. Excluding similar readings seen in December 2009 and November 2010, the employment-population ratio last stood at this level in October 1983 (see Chart 2).

Establishment Survey - Nonfarm payrolls increased only 18,000 in June, after a downwardly revised gain of 25,000 in May. Revisions of estimates of employment in April and May resulted in a loss of 44,000 jobs. The back-to-back tepid increases in hiring imply that the labor market is in poor shape even after two years of economic growth. A few categories of employment posted small gains (factory, retail, professional and business services, and leisure and hospitality), while hiring fell across others sectors (construction, financial services, temporary help, and government).

The drop in hourly earnings ($22.99 vs. $23.00 in May) combined with the significantly mild improvement in hiring suggests a steady reading for personal income in June, at best. The 0.3% drop of the manufacturing man-hours index bodes poorly for factory production in June.

Highlights of changes in payrolls during June 2011:

Construction: -9,000 vs. -4,000 in May

Manufacturing: +6,000 vs. -2,000 in May

Private sector service employment: +53,000 vs. +70,000 in May

Retail employment: +5,200 vs. -4,000 in May

Professional and business services: +12,000 vs. +45,000 in May

Temporary help: -12,000 vs. -1,700 in May

Financial activities: -15,000 vs. +14,000 in May

Government: -39,000 vs. -48,000 in May

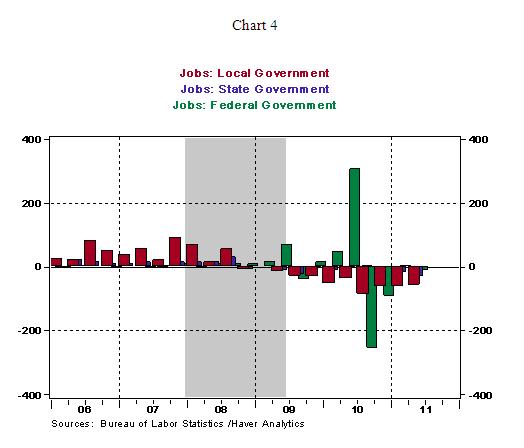

Loss of government jobs continues to persist, with layoffs at the state and local government accounting for most of decline (see Chart 4). In the first six months of the year, local government payrolls fell 116,000 and there was a reduction of 43,000 state government jobs, while federal government payrolls dropped 23,000.

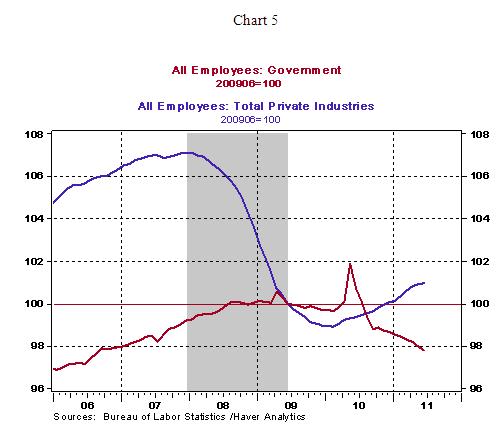

During the two years of economic recovery, private sector employment has advanced at a tepid pace but government hiring continues to decline (see Chart 5, the spike reflects the temporary jump in employment related to Census 2010). Chart 5 is an index chart where levels of employment are rebased and set equal to 100 when the recession ended in June 2009. Government payrolls have declined 2.2% from the level registered in June 2009 whereas private sector employment has risen nearly 1.0%. The weakness in government hiring is not a temporary source of pressure in the labor market. The challenging budgetary situation of state and local governments points to prolonged setbacks in job growth in this sector.

Conclusion - The June employment report underscores the sense of uncertainty surrounding current economic conditions. In addition to the weak June employment data, recent economic reports - soft June ISM surveys, drop in auto sales during June, elevated initial jobless claims, decline in home sales during May-- suggest that the U.S. economy appears to be going through more than a temporary "soft patch." Assuming that the supply chain problems emanating from Japan (that have caused a part of the setback in economic activity) have been sorted out, it is entirely conceivable that a rebound in auto production and related-jobs gains will occur in July and wipe out the clouds of doubt planted by weak economic data. Would this be a durable improvement? The short answer is "no." Growth in bank lending in the months ahead is necessary for the tentative economic momentum to be replaced by a solid turnaround in business activity. If bank lending languishes, economic activity will be lackluster in the second-half of 2011. The outcome of the sub-par performance is small gains in output and a stubbornly high unemployment rate. The Fed has completed the QE2 program as of June 30, 2011 and is not in a position to implement additional monetary policy programs to support the economy at the present time. More evidence of fragility in business conditions will be necessary to take action. Therefore, the Fed is in a watchful-waiting mode in the near term.

Asha Bangalore — Senior Vice President and Economisthttp://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.