Defaulting on the Fed's Bonds

Interest-Rates / US Debt Jul 11, 2011 - 02:06 PM GMTBy: Robert_Murphy

Ron Paul recently made (another) splash among economic pundits with his suggestion that the Treasury simply cancel the $1.6 trillion in its debt held by the Federal Reserve. Many of Paul's longstanding critics seized on the proposal as reckless and said it was further evidence that Paul doesn't understand financial markets. However, Paul received unexpected praise from the progressive economist Dean Baker.

Ron Paul recently made (another) splash among economic pundits with his suggestion that the Treasury simply cancel the $1.6 trillion in its debt held by the Federal Reserve. Many of Paul's longstanding critics seized on the proposal as reckless and said it was further evidence that Paul doesn't understand financial markets. However, Paul received unexpected praise from the progressive economist Dean Baker.

In the present article I'll explain the basics of Dr. Paul's proposal. It's hard to say what its ultimate impact would be if enacted, because the analysis depends on our assumptions. Even so, we can sketch some of the main considerations to at least build a framework for evaluating his suggestion.

In the present article I'll explain the basics of Dr. Paul's proposal. It's hard to say what its ultimate impact would be if enacted, because the analysis depends on our assumptions. Even so, we can sketch some of the main considerations to at least build a framework for evaluating his suggestion.

Ron Paul's Modest Proposal

At the 10:00 mark in this interview with radio host Jan Mickelson, Paul says that one quick solution to the stalled debt-ceiling negotiations is for the Treasury to simply cancel the roughly $1.6 trillion in its securities currently on the balance sheet of the Federal Reserve. That would immediately reduce the outstanding federal debt by the same amount, thus freeing up room for Treasury Secretary Geithner to continue meeting the government's financial obligations even without a Congress-approved increase in the statutory debt ceiling.

Paul argues that this debt cancellation is acceptable because the Fed just printed up the money out of thin air to buy the bonds in the first place. In other words, it's not as if the Treasury would be reneging on its debts held by hardworking, frugal investors.

Furthermore, Paul briefly mentions that the move would neuter the Fed's power going forward. After all, the textbook "open-market operations" through which modern central banks conduct monetary policy are the buying and selling of government debt. If the Federal Reserve could no longer trust that the Treasury would honor its debt once the Fed had acquired it, then the entire enterprise of US central banking might be jeopardized. For Ron Paul, of course, that is a virtue of his proposal.

The Critics

As usual, most of the pundits thought Ron Paul's idea was absurd. Greg Mankiw thought it was a "crazy" idea that amounted to an accounting gimmick that effectively raises the debt ceiling by $1.6 trillion without the trouble of voting on it, while Karl Denninger thought it was an endorsement of the "raw printing of money," and "functionally identical to FDR's … gold devaluation."

The first thing to note is that Mankiw and Denninger can't both be right: Ron Paul's idea can't simultaneously be an accounting gimmick and a wildly inflationary policy that wrecks the dollar. Even so, let me explain their (different) points of view.

Mankiw treats the Federal Reserve as an appendage of the federal government. (Purists will rightfully object to his classification, because in reality the Fed is a quasi-private entity with private shareholders.) Therefore, if the Treasury owes the Fed money, that's basically saying the government owes itself $1.6 trillion, which is equivalent to saying that the government owes itself nothing.

However, the practical effect of such a cancellation — according to Mankiw — is that the Treasury would free up $1.6 trillion of room under the current statutory limit on the total outstanding debt that the Treasury can owe. In other words, if we count the $1.6 trillion in Treasury debt currently on the Fed's balance sheet, then Geithner is already out of room and he can't borrow any more. But if we suddenly declare that the $1.6 trillion is no longer valid debt, then Geithner can go into the markets and borrow another $1.6 trillion from new lenders. The move would be equivalent, therefore, to Congress raising the current debt ceiling from $14.3 trillion to $15.9 trillion.

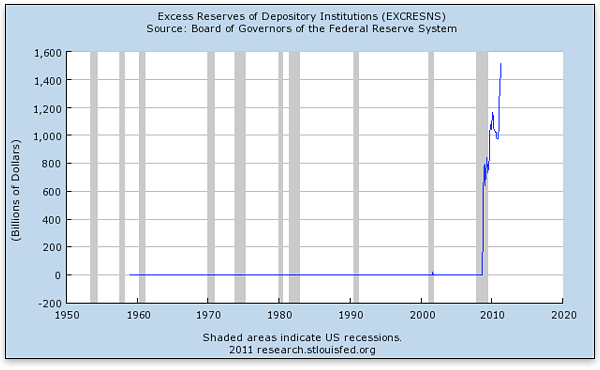

On the other hand, Denninger claims that the move would be a lot worse than an accounting trick — it would be a severe devaluation of the dollar. Although he doesn't spell out exactly why this should be so, I think Denninger has in mind something like the following: When the Fed initially acquired its massive holdings of Treasury debt, it created new reserves. Currently, the banks aren't granting new loans based on these reserves, in the manner described by economics textbooks. That's why "excess reserves" have gone through the roof since the financial crisis started in the fall of 2008:

What Denninger (and other critics warning about Paul's "hyperinflationary" proposal) presumably have in mind is that investors continue to have faith in the US dollar because they believe that Ben Bernanke will suck those excess reserves out of the financial system when he needs to. In other words, once consumer prices start rising at an alarming rate, Bernanke would need to tighten up on monetary policy.

The standard, textbook way for Bernanke to unwind his extraordinary interventions would be to literally reverse them. That is, he would sell the Fed's massive holdings of Treasury debt back into the hands of the public, and in so doing the excess reserves would shrink back down toward their normal level (near zero). Commercial banks would then be unable (because of reserve requirements) to create trillions of dollars in new loans, and the dollar would be spared.

Now we see the potential problem in Ron Paul's idea. If the Fed no longer has $1.6 trillion in Treasury securities, then it won't be able to convince people in the private sector to write checks to the Federal Reserve in exchange for its assets. Therefore, the Fed won't be able to drain excess bank reserves out of the system.

Possible Defenses of Ron Paul

I haven't heard Dr. Paul specifically address these types of criticisms, but here's how he might do so:

In response to Mankiw, Paul could argue that yes, his suggestion is a trick to avoid the acrimonious debt-ceiling battle, and that's exactly the point. If somebody thinks that we are currently on a trajectory of Republicans winning massive spending cuts, then Paul's suggestion would give the deficit spenders an easy way out.

However, Ron Paul has publicly said that he thinks the Republican leadership will cave and will raise the debt ceiling. Furthermore, despite their tough rhetoric, the Republicans won't actually put a dent in the mushrooming federal debt. Even from the narrow point of view of minimizing the growth of the debt, then, it's not clear that Ron Paul's proposal is worse than what would otherwise happen.

Beyond that, Ron Paul's real goal here is to weaken the Fed. I believe he is offering his suggestion as a way for legislators to get out of their current budget impasse, when they wouldn't dream of zapping the Fed in such a way in other circumstances. As usual, the ultimate object here is probably educating the public rather than achieving a particular victory. Paul himself says in the interview linked above that the Treasury won't actually do what he is suggesting. But it obviously helps his long-term agenda of weakening (or even abolishing) the Fed to openly discuss something as "radical" as cancelling its Treasury holdings.

In response to Denninger and others who worry that the proposal would weaken the dollar, again I would argue that we need to specify the alternative. I personally think those reserves are in the banking system to stay, just as I never believed that US troops would be injected "temporarily" into Afghanistan and Iraq to deal with the terrorist emergency. Even if we take Bernanke at his word, I have pointed out elsewhere that in the event of a new crisis — where interest rates spike and the reserves start leaking out of the system — then the Fed's assets would take a huge write-down anyway. In other words, what is currently $1.6 trillion in Treasury debt might fall to a fraction of that in the event of a dollar crisis.

In light of the above considerations, I could defend Ron Paul's overall views like this: "Sure, it's possible that there will be a drop in the dollar's purchasing power within the next few years. My proposal doesn't avoid that, but guess what? That drop is inevitable. The real inflation occurred when Bernanke created more than a trillion dollars in money out of thin air. Once he handed it over to the big bankers, and in the process financed much of the government's massive deficits, that move was a fait accompli. At least by canceling those securities, we make it harder for the Fed to do something like this in the future, by throwing into question its open-market operations."

Finally, I want to point out that having the dollar backed up by gold is qualitatively different from having it "backed up" by IOUs issued by the federal government. For one thing, Federal Reserve notes (and banks' electronic deposits with the Fed) are legal tender, and we truly have a fiat currency. If you turn in a $20 bill to the Treasury or the Fed, they will give you two $10s or four $5s, but they don't owe you anything besides the US dollar itself.

Furthermore, reflect for a moment on the absurdity of claiming that Treasury debt "backs up" the dollar reserves in the financial system. Suppose someone is holding a $100 bill, but he's not sure if he trusts it as an asset. Would it reassure him to know that somewhere in the vaults of the Federal Reserve there is a piece of paper issued by the US Treasury promising to pay a $100 bill in the future?

In short, if someone thinks the US dollar is a worthless asset, then that person will also think US Treasury debt is a worthless asset, because it's nothing but a promise to pay US dollars down the road. This has nothing at all to do with the classical gold standard, in which the bearer of US currency could exchange it for a completely different asset, namely gold.

An Unlikely Ally

Although his motivations are decidedly different, Dean Baker defended Ron Paul's proposal. In order to deal with the problem of excess reserves and their potential to cause high price inflation down the road, Baker suggested that the Fed simply raise reserve requirements.

In other words, rather than eliminating the excess reserves by having the Fed sell assets, Baker is proposing that the Fed simply mandate that banks keep a larger amount of cash in the vault (or electronic reserves on deposit with the Fed) in order to "back up" the checking-account balances of the banks' customers. In this way, the banks won't be able to pile a massive amount of new loans on top of the existing reserves.

This may or may not be a good solution in the grand scheme of things, but I do want to point out that it's equivalent to stealing that money from the banks. Consider the following analogy: Suppose the government passed a new law requiring all bank customers to keep a checking account balance of at least $1,000. No matter the emergency, people wouldn't be allowed to let their checking accounts fall below $1,000 at any time, under threat of a ten-year prison term and huge fine.

Such an outrageous policy would be akin to stealing $1,000 from every bank customer in America. For example, someone who had a bank balance of $1,300 on the eve of the announcement would effectively only have $300 "in the bank" after the announcement. The $1,000 balance would be useless to the person, except if he thought the government might someday reverse the policy.

A similar analysis holds for our current banking situation. The bankers sitting on over $1 trillion in excess reserves are doing so consciously. They have considered the various uses to which they could put those reserves, and they have decided they would rather keep them parked at the Fed, where they are safe, even though they earn a paltry return. To suddenly raise reserve requirements would be tantamount to seizing that money. Depending on one's view of the bankers and how they got the reserves in the first place, perhaps such a seizure is justified, but let's not treat the move as a technical adjustment in policy parameters.

Conclusion

Ron Paul's proposal to cancel the Treasury debt held by the Federal Reserve is an intriguing idea. Whether it is a clever solution to a bad situation or an awful idea that will wreck the dollar depends on how we project the baseline path of the economy.

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2011 Copyright Robert Murphy - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.