Thoughts on Currency Speculation, Dollar, Breaking Correlation Between the Euro and Gold

Currencies / Fiat Currency Jul 29, 2011 - 01:48 AM GMTBy: Aftab_Singh

A few weeks back, we mentioned that ’we would embrace [a short-term higher high in the dollar index] as an opportunity to take part on the long-side‘. The dollar index has come under some pressure over the past week, so just in case any of our readers were wondering if we’ve changed our minds completely, I thought I’d highlight why we’re sticking to our long dollar position for now (even though the immediate price action hasn’t corroborated this view yet). In the process of outlining our view, I’ll go over our philosophy on currency speculation and consider the breaking correlation between the dollar price of the Euro and the dollar price of gold.

A few weeks back, we mentioned that ’we would embrace [a short-term higher high in the dollar index] as an opportunity to take part on the long-side‘. The dollar index has come under some pressure over the past week, so just in case any of our readers were wondering if we’ve changed our minds completely, I thought I’d highlight why we’re sticking to our long dollar position for now (even though the immediate price action hasn’t corroborated this view yet). In the process of outlining our view, I’ll go over our philosophy on currency speculation and consider the breaking correlation between the dollar price of the Euro and the dollar price of gold.

Irredeemable Fiat Currencies:

Since we’re dealing with irredeemable fiat currency prices of other irredeemable fiat currencies, it will be well for us to spend a few moments considering irredeemable fiat currencies! Central banks have rather peculiar balance sheets due to their equally peculiar statuses as pseudo-governmental institutions. Dollars, Euros, Pounds etc. are not used for their virtues, but rather for their vices. What I mean by this is that they are sole legal tenders in their respective countries. This means that the guns of democratically elected governments ‘back’ them in the settlement of creditor/debtor contracts between private individuals. If, for example, two individuals went to court over a dispute over a creditor/debtor contract, the court would only have to force payment from one party to the other if the terms were made in the legal tender. Thus, we find that most contracts are stipulated in the irredeemable fiat currencies of the country and that these currencies circulate as money amongst the people.

‘So what?‘ — it may be asked. Well, insofar as the people accept this situation, central banks maintain this peculiar, almost untouchable status. Unlike their private counterparts, they are not subject to the profit and loss mechanism (they ‘promise’ nothing and they have the gun shielding them from competition). Be this as it may, it doesn’t stop the financial markets from recognizing the reality of central banks’ assets and liabilities. Each central bank owns a portfolio of assets and issues central bank notes & reserve balances against them. In this way, the entirety of a central bank’s liabilities (central bank notes & reserve balances) are — in some sense — ’good for’ or ‘backed up by’ the portfolio of assets held by that central banks (if that!).

How is that the market recognizes that this is the case? Well, both the assets of central banks (for example; gold, government bonds, federal agency debt securities, mortgage-backed securities, …) and the liabilities of central banks (for example, Federal Reserve notes & Federal Reserve balances) trade against each other in the global financial markets. Thus, the reality of this situation can be reflected in the exchange ratios between these things.

At first this may seem counterintuitive, opaque, peculiar and unnecessary, but I emphatically assure you that comprehending this concept requires nothing more than plain old common sense. After all, which is likely to be of greater value; an asset or a tentative, governmental irredeemable claim upon that asset? My hunch is that you would rather have the asset itself than the ‘tentative’ irredeemable claim upon that asset. In this way, people would not swap the asset for the claim upon the asset at par (that is, on a one-to-one basis). Rather, they would require some kind of incentive to induce them to exchange the asset for the irredeemable claim upon that asset: that is, a profit-motive would have to be obtained by each asset trading with more than one irredeemable claim upon such an asset.

With the hope that the above is intuitive enough (which it may very well not be! Feel free to email us if you have any questions!): The entire stock of Federal Reserve notes & reserve balances is an irredeemable claim upon the entire stock of the Fed’s assets (which consist of gold, government bonds, Mortgage-backed securities, Federal Agency Debt securities etc.). If there is to be a profit-motive in owning Federal Reserve notes (& reserve balances) then, the dollar prices of these various things should trade such that the entire stock of Federal Reserve notes & balances cannot buy the entirety of the assets at the Federal Reserve (at market prices).

We term the degree to which the liabilities fail to buy the assets the ‘discount to par‘ here at greshams-law.com.

The Dance Between the PhDs & the Market:

If the above is clear, then the following should flow intuitively. The greater the perceived profligacy of the PhDs at the helm of a given central banks, the greater the currency price of the underlying assets backing that currency. With the understanding outlined above, we can say that this ultimately translates to a ‘greater discount from par‘.

So, since the consistency and arrangement of central bank balance sheets are based on the actions of central bankers (which are dependent on academic perceptions of markets and economics), and since the market is engaged in discounting and anticipating the PhD’s, we arrive at a peculiar dance between the PhDs and the market. For people who are intent on risking little for potentially great gains, the phrase ‘currency speculator’ (as described by Doug Casey here), seems quite apt.

Needless to say, this dance is not easy to navigate. One must gain a clear insight into the intentions and intellecutal frameworks of central bankers in addition to the market’s ever-changing perception of those intentions and intellectual frameworks.

The PhDs Control the Composition:

Central bankers – of course – are at the helms of the world’s central banks. They decide upon the compositions and sizes of the portfolios of assets that ‘back up’ the central bank notes and reserve balances. Their great presumption – over the past hundred years or so – has been that ‘price stability’ is the be all and end all of ‘optimal’ money production (see this ECB propaganda cartoon if you don’t believe me!). However, they can only adjust this composition by buying assets with newly created central bank notes or reserve balances or selling assets for existing central bank notes or reserve balances. This is where the market comes in — it determines the price!

The Market Controls the Discount:

The global financial markets are populated by people who actually have to own and swap these damned things, so it should be clear that they may be a little more alert and astute than the PhDs might like. The more skeptical the market becomes of central bank notes & reserve balances, the higher the currency prices of central banking assets rise.

This discount is of primary importance for monetary policies, because it ultimately acts to prohibit grossly debauched monetary practices. The higher the ‘discount from par’, the greater the debasing effects of central bank balance sheet expansions. Conversely, the lower the ‘discount from par’, the lower the debasing effects of central bank balance sheet expansions. Thus, even the market’s anticipation of central bank balance sheet expansions can put those very balance sheet expansions into ‘overdrive’ and quickly force an abandonment of that policy (unless the central bankers are completely blind!).

The Interplay Between the PhD’s and the Market Complexified: The PhD’s make their decisions based on their perceptions of the world and the market. The Market reacts to the PhDs…

Ok, so we’ve established that the PhDs control (or at least attempt to control) the composition of the assets backing their currencies, and that the market ebbs and flows to discount and anticipate such debasement imparted by central bank balance sheet expansions and contractions. Here’s where it gets even more complex. The decisions of central bankers are based on their philosophical, economical and political convictions. Since the market is the primary source of information for central bankers, they act upon their particular views of the market. However, the market, consisting of people who are forced to hold the damn stuff, bid the discount up or down based on their perceptions of the central bankers.

In this way, we have a profoundly interwoven feedback loop. The central bankers adjust things for and because of the market. However, the market adjusts the discount based on its perception of central bankers. Moreover, and most importantly, the degree of the market’s discount affects the degree to which the actions of central banks debase their respective currencies.

Approaching this Field As an Independent Speculator: – Seeking Asymmetric Opportunities…

This – we believe – is the mechanism that underlines the tendency for currencies to embark on strong trends. When the market anticipates dilutive actions by central bankers, and are right, the actions of central bankers become ever-more dilutive. Conversely, when the market anticipates less dilutive actions by central bankers, and are right, the actions of central bankers become less dilutive.

So, as an independent speculator, how can one risk little for potentially great rewards? That is, how can one engage in exclusively asymmetric opportunities? We believe that such opportunities are available when the market discounts a scenario that is unlikely to come to pass (or that is based on a very particular set of circumstances). For example, when the market discounts overly debauched monetary policies that central banks do not follow up on, or when the market discounts little monetary debasement when central banks are sure to expand their balance sheets.

The Euro & The Dollar Over the Past Year or So…

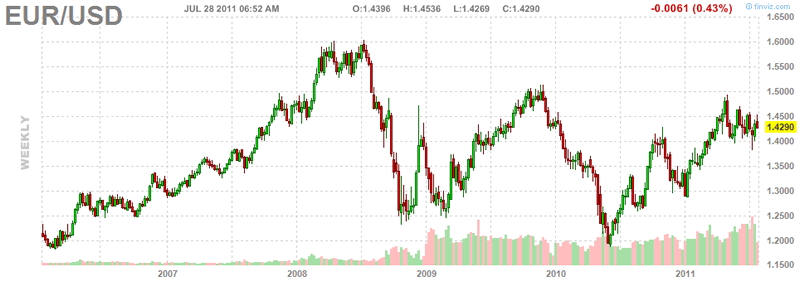

So, at last, we come to the practicalities of trading in July 2011. As can be from the chart below, from the end of 2009 to mid 2010, the Euro underwent a 20% haircut vis-à-vis the dollar. It came to be understood that ‘the Euro is like a gold standard’. That is, that the authorities in charge of the Euro are less capable of monetary debasement and hence the burden of issuing IOUs upon Euro notes is not eased by the monetary authorities. As rioting across the periphery of Europe grew worse, the market began to discount debasement of the Euro with increasing vigor. In short, it came to be believed that the entire European banking system might need a bailout. At the same time, the US was relatively ok and there was only a tentative option of ‘QE2′ on the cards. It was by no means a sure thing, and the US was deemed to be in better shape than Europe.

Source: FINVIZ.com

Alas, the market was discounting a level of monetary debasement that was unlikely to come to pass (given the relative conservatism of European central bankers). After all, the Euro is like a gold standard! What do you want to own during a bear market in a gold standard: why gold of course! Alongside this, Ben Bernanke did engage in the ‘QE2′ program, which surprised quite a lot of us (as we did not expect such balance sheet expansions in the face of that economic scenario). So, prior to the rally in the Euro, the market was discounting levels of monetary debasement that strongly contradicted the intellectual convictions of the ECB, and were only tentatively inline with the convictions of the Fed. Thus, when Europe muddled through and Ben Bernanke did engage in another round of quantitative easing, the currency markets had to do a 180 degrees turn. The degree to which the market was discounting monetary debasement in the Euro had to fall and the degree to which the market was discounting monetary debasement in the Dollar had to rise.

The Euro & The Dollar Currently…

However over a year has passed since the low in the Euro against the dollar, and the market has come to discount precisely the opposite scenario. Indeed, the past year seems to have been a suitably long period of time for market participants to wrap their heads around the notion that the Euro can be strong concomitant to problems in the European banking system. Indeed, they seem to have wrapped their heads around the notion that these two concepts are profoundly interconnected. Moreover, on the other side of the Atlantic, Ben Bernanke et al. have been revealed as serial money printers who are quite devoid of the capacity to engage in relatively tight monetary policy.

So, by early 2011, the world was discounting a future full of monetary debasement by the Federal Reserve, and it had even become embarrassing to be bearish on the dollar prices of anything! Moreover, the market had truly got used to a rising Euro and had thus begun to discount relatively small degrees of monetary debasement by the European Central Bank. Now, the big question for the currency speculator is; does this reflect the reality of the central bankers perceptions on what they ought to do? Or does the discounting of the market contradict the likely paths of American and European monetary policies over the weeks, months and years to come?

We here at greshams-law.com are inclined to think that there is an inconsistency between the degree to which Federal Reserve notes are trading at discounts to par, and the degree to which the Federal Reserve are intent on debasing its currency over the coming months. Moreover, we believe that the market is at best accurate about the ECB’s intentions and convictions (if not overstretched on the conservative side). We know that these central bankers don’t think ‘cleanly’ – so to speak. We know that they don’t accept the rudimentary truths that every child knows instincitvely — that people own themselves etc. We know that they tend to compartmentalize their thoughts and apply their vacuum-based models to the dynamism of reality. For one, this involves paying great attention to an index of consumer prices to the exclusion of most other things (bar the S&P 500 for the Federal Reserve) and consumer prices have been rising strongly of late! At least by their stated ideologies, then, they’ve got to be slightly worried about inflation and friendly to the tighter side of monetary policy.

It may be said that the Federal Reserve, for example, watches the S&P 500 like a hawk. Indeed, we’re inclined to agree, but we really doubt that they will do anything until the S&P 500 has made a decent top! So, although the market is probably right in discounting monetary debauchery in America, it may be that the timing is off. We do not think that the future holds a straight line to monetary debasement, and we’d guess that we’d have to see a slowing rate of CPI growth and/or an appreciation of dollars against US stocks. Thus, the market may have to reduce the ‘discount to par’ in the dollar. This, combined with a relatively stable (or perhaps under-discounted Euro), may give rise to a temporarily appreciating dollar over the coming weeks and months!

The Tale Told By the Breaking Correlation Between the Dollar Price of Gold & The Dollar Price of the Euro…

Indeed, this seems to be corroborated by the breaking correlation between the dollar price of gold and the dollar price of Euros. Remember, gold is on the balance sheets of the Federal Reserve and the European Central Bank. A rise in the price of gold, in combination with the bonds on the balance sheets of these central banks are conducive to pushing these currencies to greater discounts from par. So, the breaking correlation between gold and the Euro (priced in dollars) may be signalling that the Euro price of gold has greater upward pressure. This could be a signal that the market overdid the decline in the Euro’s discount from par and is now reversing. Likewise, it could be indicative that the ECB has taken on a lot of junk bonds. Either way, the market is having to retrace its steps. [Remember, this is happening when the dollar is stretched on the other side!].

Conclusions:

Despite the past few days in the markets, we continue to believe that the dollar could be strong against the Euro iver the coming weeks and months. However, eventually such a rise will likely bring about further monetary debasement by the Federal Reserve. Thus, despite the long-term secular pressures upon the dollar, we are positive about it for the moment.

Even if our ideas about the market’s view are incorrect, we must note that the extent of the discount on the dollar is dependent on a very specific path of US monetary policy. Indeed, we have reached a stage of ‘widespread bearishness on the dollar’ so any disruption could spark a reversal in fortunes for the US dollar. In short, even if the specifics above happen to be incorrect, the direction could well be correct for incidental reasons.

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.