Is it a Sea Change if Rating Agencies Stick a Lower Rating for U.S. Sovereign Debt?

Interest-Rates / US Debt Aug 04, 2011 - 06:37 AM GMTBy: Asha_Bangalore

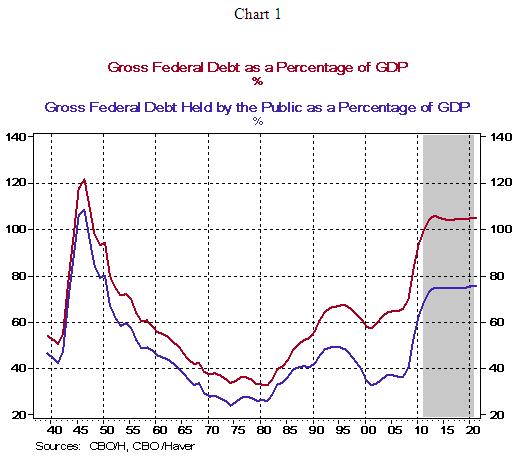

The debt ceiling has been raised through 2012 and political drama related to the debt ceiling is unlikely to be repeated soon. Fitch and Moody’s indicated that the coveted AAA status of U.S. debt remains in place with a possibility of downgrades tied to the nature of fiscal consolidation Congress may deliver. As of this writing, S&P has not made public its opinion, but the new law does not meet its requirement of a $4 trillion reduction of the projected deficits indicated last month. Federal government debt (gross) of the United States stood at 93% of GDP in 2010 (see Chart 1). The Congressional Budget Office’s (CBO) projections show this number at 105% by 2021.

The debt ceiling has been raised through 2012 and political drama related to the debt ceiling is unlikely to be repeated soon. Fitch and Moody’s indicated that the coveted AAA status of U.S. debt remains in place with a possibility of downgrades tied to the nature of fiscal consolidation Congress may deliver. As of this writing, S&P has not made public its opinion, but the new law does not meet its requirement of a $4 trillion reduction of the projected deficits indicated last month. Federal government debt (gross) of the United States stood at 93% of GDP in 2010 (see Chart 1). The Congressional Budget Office’s (CBO) projections show this number at 105% by 2021.

There is growing expectation that rating agencies will lower the U.S. sovereign debt rating by one notch in the near term. Is this a sea change that will have far reaching consequences? In our opinion, it will be a symbolic gesture and a non-event for the following reasons.

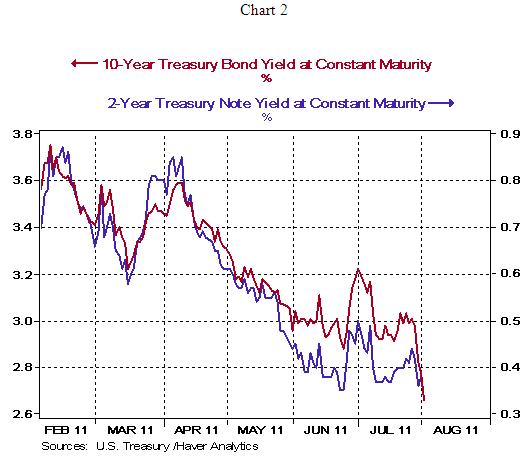

First, amid all the chatter about an imminent reduction of the ratings of Treasury securities, bond yields have declined (see Chart 2) contrary to expectations. Yields moved up in the very short-end to reflect uncertainty about the debt ceiling legislation. These yields have moved back down after the compromise was reached.

Second, there is no question about the ability of the United States to service its debt obligations. A large part of the process of rating sovereign debt includes assessing the ability of the nation’s ability to meet its debt obligations. Net interest payments made up close to 6% of net federal outlays in 2010 and are less than 2.0% of GDP. The CBO estimates that net interest payments would be about 14% of net outlays by 2021 and nearly 4.0% of GDP. The lesson here is that interest payments have to be monitored and managed but the country has the ability to meet its obligations.

Third, the depth and size of the Treasury market has no suitable substitute, as yet. Marketable Treasury securities, according to Fitch, amount to $9.3 trillion, while the combined market of French, German, and British government securities total $5.3 trillion (Reuter’s estimate is $7.1 trillion). The important message is that U.S government securities exceed the size of all other major markets. Investment guidelines of asset management are unlikely to face meaningful changes as a result of downgrading U.S. sovereign debt by one notch.

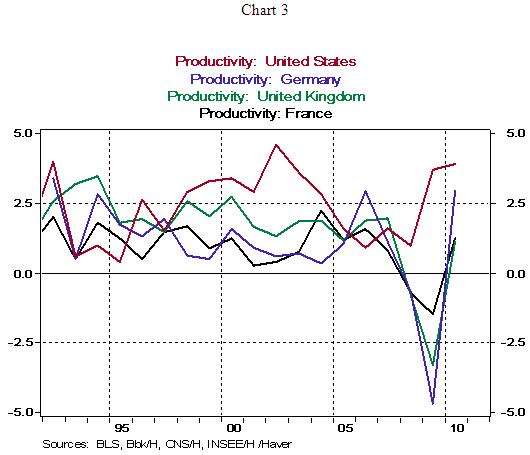

Fourth, the U.S. is a competitive and innovative economy, with openness to capital flows and relatively flexible labor markets compared with its peers who share the AAA rating. Despite the weakness of recent economic numbers in the United States, the medium-term prospects of the nation are stronger than its peers.

Fifth, the privileged status of the dollar, as a major reserve currency of the world, allows a distinct advantage. U.S. liabilities are denominated in dollars, implying that non-US holders of Treasuries bear the exchange rate risk. The unique status of the dollar enhances the ability of the U.S. to pay its creditors.

In sum, the fiscal risk profile of the United States does not point to a radical change in its ability to meet its debt obligations in the quarters ahead. That said, fiscal pressures arising from entitlement programs are legitimate and should be addressed as early as possible.

Are there lessons from the past downgrades of sovereign debt in other industrialized nations? Japan comes to mind immediately, with public debt as a percentage of GDP around 200%. Ieisha Montgomery, Country Risk Analyst at Northern Trust, points out that Japan experienced its first downgrade in November 1998 and it was followed by additional downgrades. In January 2011, S&P cut Japan’s sovereign credit rating to AA-. She also adds that Japan is relatively insulated from rating downgrades because over 95% of debt is held locally. Australia is also her area of expertise. She notes that economic and fiscal concerns brought about the downgrades of sovereign debt starting in 1986 and it was raised back to Aaa only in October 2002. James Pressler, Country Risk Analyst at Northern Trust, shared information about Canada and Sweden; both countries reclaimed the AAA status after losing it due to economic crises.

In the case of Sweden, a collapse of the banking system in 1991 led to the first downgrade, followed by additional reductions by 1995. The upgrading process was spread over four years, with the AAA status restored in 2002. In the case of Canada, a ratcheting up of public debt to 100% of GDP and a severe recession led to the downgrades. An improvement of economic conditions resulting in a reduction of public debt and disappearance of budget deficit led to Canada reclaiming AAA rating in May 2002. Spain suffered a downgrading of sovereign debt in 2009 by S&P and Moody’s and Fitch followed in 2010. The Spanish economy is likely to face a long period of adjustment before the economy turns around. In each of these cases, bond yields did not post significant increases as a result of downgrades. It appears that market reaction to actions of rating agencies is muted, while economic recovery and fiscal consolidation are the keys to reclaiming the highest rating.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.