El-Erian: U.S. Very, Very Long Way from Debt Default Risk

Interest-Rates / Credit Crisis 2011 Aug 08, 2011 - 03:03 PM GMTBy: Bloomberg

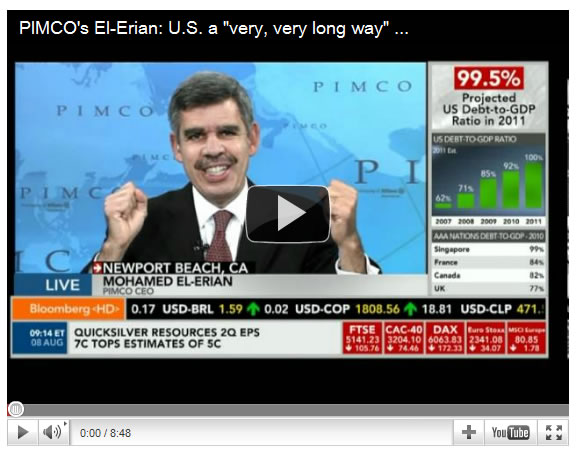

Mohamed El-Erian, co-CEO of PIMCO, spoke to Bloomberg Television’s Betty Liu and Erik Schatzker this morning regarding the S&P downgrade and its impact on the markets and economy.

Mohamed El-Erian, co-CEO of PIMCO, spoke to Bloomberg Television’s Betty Liu and Erik Schatzker this morning regarding the S&P downgrade and its impact on the markets and economy.

El-Erian said that the S&P downgrade is perhaps not yet the “Sputnik moment” and that the costs and risks of any new QE have gone up. Excerpts from the interview ca be found below, courtesy of Bloomberg Television

El-Erian on the S&P downgrade and whether it is a political statement: “We hope this is a wake-up call, that this is what politicians needed to realize that unless they get their act together, the standing of the U.S. will go down. Unfortunately, this weekend did not speak to that Sputnik moment. We had a very public and unfortunate clash between the S&P and Treasury. That does not help either side. We also have the blame game in Washington about who lost the AAA. They pointed to each other and no one wants to come together yet. Let’s keep our fingers crossed. Early indications are that this has not been the Sputnik moment we need for this economy.”

On what we need to get the economy growing: “People have to realize the S&P downgrade is not really about the ability of the U.S. to meet its payments. No one doubts the ability of the U.S. to meet its payments. It is about the ability of the policymakers to get their arms around the problems and put this country back on the path of growth, jobs and prosperity. Until they do that, we risk further downgrades. S&P has us on a negative outlook. Moody’s has us on the negative outlook.”

On whether he expects to see downgrades from Moody’s and other ratings agencies: “Only the agencies can reply to that. What worries me the most is that this is a further hit to business confidence and to household confidence. It comes at a fragile time for the economy. It is not a surprise that most analysts are revising down their growth estimates. There has been talk over the weekend about recession. This is not a good situation. We have to remember how fragile the economy is.”

On what he’s watching in the markets today: “Look at what the equity investors are doing. Are they going to stay in or say they cannot take the volatility and uncertainty? Look at how Europe’s response to what was a dramatic statement by the ECB and the indication that they are buying Italian and Spanish bonds. Keep an eye on the CD sovereign CDS’. S&P has opened up the prospects of further downgrades to sub-sovereigns in the U.S. It raises the question about other sovereigns.”

On whether we’ll see downgrades of other AAA countries and whether there is a new metric given S&P made a statement on the politics of the U.S.: “I do not think they are making a new statement. They have five factors they have had for a long time. One is the ability and the willingness to apply. Ability it speaks to whether the engineering can be sorted out. Willingness speaks to whether there is a political will. The market is looking at other countries. French debt to GDP is higher than the U.S. Yes, it is on a downward trend, but isn’t France in for all the support of the peripherals? That kind of talk is unsettling. That is why the French CDS is so much wider today.”

On what would happen if investors change their minds about the attractiveness of Treasuries: “There is credit risk and default risk. Credit risk is whether borrowing costs go up because the country’s deficit and debt is out of control. Default risk is whether a country actually defaults. The U.S. is a very long way from default risk. In addition, it has a printing press. Unlike Greece, Portugal, and Ireland, the U.S. has a printing press. It has many ways to avoid default. The best way is through growth and fiscal soundness. But there are other ways–they have collateral damage. The U.S. has many more degrees of freedom than Greece, for example.”

On his argument that there may be a migration to a system where the U.S. is no longer the center of the financial universe: “That argument is certainly what other countries feel and what the Chinese said over the weekend speaks to that. I was referring to the fact that the global system is built on the assumption of AAA at its core. That AAA supplies the reserve currency, the dollar, and the most liquid and deepest financial markets, the U.S. government bond market and that enables other countries to outsource their savings to us. As the AAA comes under pressure and becomes AA+, people will look at the margin for alternatives. You get a fragmentation of the global system. That is the path we are on if the U.S. does not promote growth and fiscal soundness.”

On what Ben Bernanke and the Fed should do to help restore confidence in the markets: “This puts the Fed in a very, very tough position. The first thing it has to do is revised down its outlook. It still has a cheerful outlook for growth bouncing back. It has been talking about transitory elements and not enough about structural elements. The Fed is going to have to have a reality check on its projections. The Fed is going to have to be very clear that when it comes to conventional policies and interest rates, it is not hiking any time soon. The Fed is going to have to decide between the benefits of unconventional policies–QE3–versus the costs and risks. The Fed is uncomfortable because over time, the costs and risks have gone up and the benefits have gone down. It is not as clear as it was with QE1 about whether the Fed should have another round. This is going to be a very difficult time. I suspect there will be heated discussions at the FMOC and Jackson Hole.”

Copyright © 2011 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.