ECB Doesn’t Rule Out “PIIGS” Gold as Collateral for Gold Backed Eurobonds

Commodities / Gold and Silver 2011 Sep 02, 2011 - 08:22 AM GMTBy: GoldCore

Gold and the Swiss franc are higher today as risk aversion has returned with global stock markets falling on concerns the US employment figure later today will disappoint and confirm that the US economy continues to weaken.

Gold and the Swiss franc are higher today as risk aversion has returned with global stock markets falling on concerns the US employment figure later today will disappoint and confirm that the US economy continues to weaken.

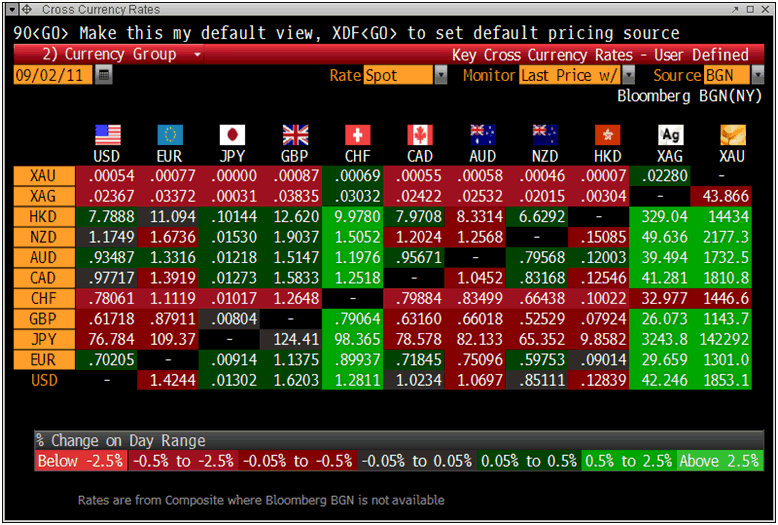

Gold is trading at USD 1,853.50, EUR 1,300.10, GBP 1,143.30, CHF 1,446.50 and JPY 142,320 per ounce.

Cross Currency Table

Gold’s London AM fix this morning was USD 1,854.00, EUR 1,301.23, GBP 1,143.81 per ounce. The gold fix was higher than yesterday’s in all currencies - USD 1,815.50, EUR 1,270.73, and GBP 1,118.95 per ounce.

Today, the President of the ECB, Jean- Claude Trichet did not rule out a gold backed euro bond in an interview with ‘Il Sole 24 Ore’ published on the ECB’s website.

The comments were a response to former Italian Prime Minister Romano Prodi who proposed - in Italian national daily business newspaper ‘Il Sole 24 Ore’ last week - the creation of a euro bond backed by member states’ gold reserves.

Prodi was President of the European Commission from 1999 to 2004.

Trichet was asked about “the creation of a fund guaranteed by the gold reserves of countries that would issue bonds to buy back national debt and make new investments.”

Trichet did not answer the question directly but said “at this stage, we have the EFSF bonds, which are bonds with a European signature. The main message of the ECB Governing Council to governments is to implement rapidly, fully, comprehensively the decisions taken by the European heads of state and government on 21 July.”

Reuters reported today in an article entitled ‘Gold sales would not solve Europe’s debt troubles’ that “Europe’s most indebted nations are under heavy pressure from their richer neighbours to sort out their finances, but they are unlikely to mimic the impoverished gentlefolk of old by selling off the family silver — or in their case, gold – to do so.”

Reuters recount how senior German lawmakers and politicians have advocated so called ‘PIIGS’ nations sell their gold to fund “bailouts”.

Reuters says that the “demands ignore the fact that this gold is not the property of the PIIGS' governments to sell.”

"Foreign exchange reserves are held and managed by central banks, not by governments," said Natalie Dempster, director of government affairs at the World Gold Council. "Forex reserves are set aside for specific purposes - defence of currency, payment of external debt obligations and payment of imports."

"In the past you could have had incidences where governments might try to overstimulate their economies by running exceptionally loose monetary policy before an election," she said. "That is a reason why it is critical, in an advanced economy, that central banks are independent”, said Dempster.

With regard to Prodi’s proposal to create a euro bond backed by member states' gold reserves, Reuters said such proposals remain little explored according to analysts.

GFMS' Klapwijk said that "it has slightly surprised me that some of them haven't looked harder at some creative uses of gold in terms of gold-backed bonds, which might be a useful way of trying to lower the cost of borrowing."

"But again, they come up against the fact that the scale of the borrowing required is so large that there are probably other ways of trying to deal with the problem rather than using gold. That would probably be a drop in the bucket."

Separately the Central Bank of Ireland has said that it will not disclose whether the gold reserves of Ireland (a paltry 6 tonnes) have been swapped or loaned out or had any other receivable status recorded against them (see Commentary below).

A senior administrative officer for financial control at the Central Bank of Ireland responded to an inquiry regarding the custody and ownership of Ireland’s gold reserves: “The bank is not, however, in a position to provide further information, nor to outline its investment strategy in relation to the gold holdings.”

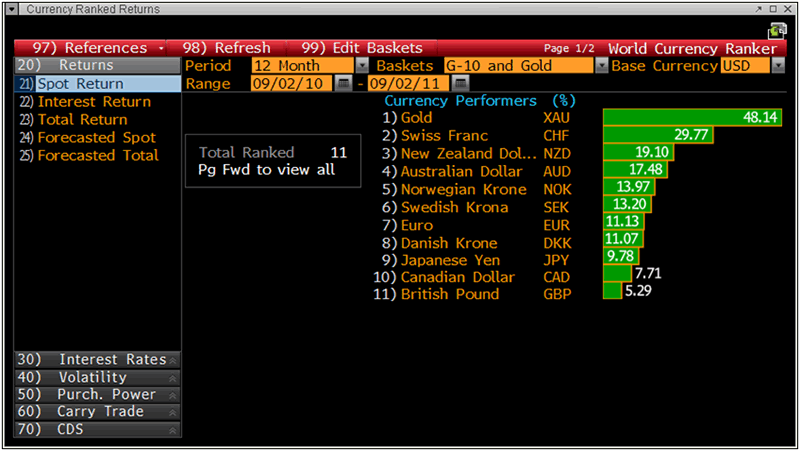

G10 Currencies and Gold – 1 Year Performance

Gold’s lack of counter party and debasement risk and its safe haven status is resulting in it being slowly remonetised in the global financial and monetary system.

Gold’s status as a finite monetary reserve makes it ideal collateral today especially with the risk of contagion in the Eurozone and wider global financial system.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $42.45/oz, €29.78/oz and £26.19/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,862.50/oz, palladium at $790/oz and rhodium at $1,800/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.