Crisis High 2011 and the Next Market Credit Crash

Stock-Markets / Cycles Analysis Sep 23, 2011 - 02:21 AM GMTBy: Clif_Droke

The year 2011 is in many ways a Year of Destiny. The year-to-date has seen revolutions in the mid East, natural disasters in the U.S. and globally, a debt crisis in Europe and the potential of another economic recession in the U.S. On the financial front the year 2011 has also brought on the beginnings of a new bear market which should carry us into the fateful year 2014 when the dominant long-term 120-year cycle bottoms.

The year 2011 is in many ways a Year of Destiny. The year-to-date has seen revolutions in the mid East, natural disasters in the U.S. and globally, a debt crisis in Europe and the potential of another economic recession in the U.S. On the financial front the year 2011 has also brought on the beginnings of a new bear market which should carry us into the fateful year 2014 when the dominant long-term 120-year cycle bottoms.

The month of September has witnessed the remnants of the 6-year cycle peak, the last of the long-term cycles of any significance within the Kress 120-year Mega Cycle. The price high of the 6-year cycle was in May of this year while the final peak in time is occurring right now. What happens after the 6-year cycle's time peak is in (no later than the first week of October) is still open to conjecture. But if the events of the past few months are any indication, the worst fears of the pundits will be realized going forward: economic recession, financial chaos in Europe and the potential that the crisis will spread globally and bring about a return of the Credit Crisis.

On September 1, Samuel Kress released his latest Special Edition entitled, "Crisis High Revisited" [SineScope, 15 Phoenix Ave., Morristown, NJ 07960]. Mr. Kress is credited with the discovery of the cycle series which bears his name. He must also be credited with predicting that 2011 would be the final year of the cyclical bull market recovery which began in March 2009 and he offers some penetrating (if frightening) insights into the coming years heading into the 2014 long-term cycle bottom.

Special Edition XI begins with an explanation of how the Kress cycles are constituted. As mathematics is the most precise of all languages, the Kress cycles are based on a basic mathematical sequence which, in Kress' words, "identifies the natural order of universal events." He is referring of course to the famous Fibonacci sequence. This sequence forms the basis of each component cycle. For instance, the Fibonacci numbers 2 and 3 are combined (2x3) to form the 6-year cycle, which is the starting point of the cycle series. The number 6 is then multiplied by the Fibonacci number 5 to produce the 30-year cycle. The Fibonacci numbers 8 and 5 are multiplied to produce the 40-year cycle, and the powerful 40-year cycle multiplied by the Fibonacci number 3 results in the 120-year cycle. These are just some of the numerical examples Kress provides in his latest report, and the importance of some of these components cycles will be discussed here.

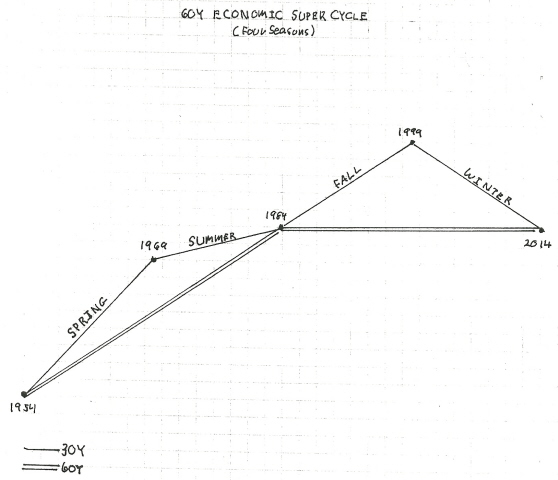

"The 120-year cycle is the longest of [the] cycles, and is the composite of all lower cycles and is referred to as the Grand Super Cycle, or more appropriately, the Mega Cycle," writes Kress. This cycle includes two 60-year, three 40-year and four 30-year cycles. As Kress points out, "The nature of the 40-year is that it creates a severe decline for several years until it forms its bottom, as occurred in 1934 and 1974." Kress adds that once the lower cycles run their course, as they will do in 2011, the bear market's decline has "historic implications."

In his latest Special Edition, Mr. Kress also discusses the significance of the 60-year cycle. The Kress 60-year cycle reflects the average duration of the underlying economic super cycles known as the Kondratieff Wave, or K Wave. Mr. Kress refers to the 60-year cycle as the Super Cycle. He points out that the second 60-year cycle within the current 120-year cycle began in 1954 after completion of the post-World War II adjustments. The 60-year cycle also includes two 30-year Mini Super Cycles. Writes Kress, "All the component cycles of the 60-year are classified into three functions - bias, direction and amplitude - and can be employed for continuing reference."

Mr. Kress also explains that the interrelationship between the 30-year secondary bias cycle and the 12-year primary direction cycle depicts the longer-term position of the stock market. He writes, "The fifth and final 12-year [component] of the 60-year [cycle] peaked in later 2008 at the time of the 'credit crisis.' Common sense dictates that this has continuing systemic damage." He points out that 12 years after the first three 30-year cycles peaked (in 1921, 1951 and 1981, respectively) the market was higher. But 12 years into 2011 after the final peak of the 30-year cycle in 1999, the market is significantly lower. This is another reason to expect that the bear market which began in 2011 will have historic implications and will likely witness a resurgence of the credit crisis.

Mr. Kress believes that for a more practical contemporary evaluation, the 6-year secondary direction cycle is more effective. He writes, "The 6-year peaked in early May at the height of our 'debt crisis,' a continuing indication of the systemic problems. Historically, the peak of the second 6-year is higher than the peak of the 12-year. However, May's 6-year [price] peak is significantly below the 12-year cycle's peak." He adds that the declining Mega Cycle of 120 years is clearly taking its toll.

In his latest Special Edition, Mr. Kress also addresses the question as to what the stock market's configuration will likely be for the next three years. He concludes that starting with 2012, "Each successive year's decline should be greater than the previous year's decline while realizing that interim rallies and declines can temporarily distort the yearly picture."

The ultimate concern is of course how low can the market decline by the 120-year cycle bottom in late 2014? Kress responds that "the cycles imply that the potential for the worst of anything to occur exists." Much of this admittedly gloomy scenario depends on the severity with which the economy disintegrates. "Assuming a worst case scenario," Kress writes, "the market could revisit the fourth 30-year cycle which began in 1984 at S&P around 150 with a Dow equivalent around 1,500. If the S&P violates the March 2009 low of S&P 666, the potential for the worst increases."

Cycles

Over the years I've been asked by many readers what I consider to be the best books on stock market cycles that I can recommend. While there are many excellent works out there on the subject of technical and fundamental analysis, chart reading, etc., precious few have addressed the subject of market cycles. Of the relatively few booksh on cycles that are available, most don't even merit mentioning. I've read only one book in the genre that I can recommend - The K Wave by David Knox Barker - but even that one doesn't deal directly with stock market cycles but instead with the economic long wave. I'm pleased to announce, however, that after nearly 10 years of research and one year of writing, I've completed a book on the subject that I believe will meet the critical demands of most cycle students. It's entitled, The Stock Market Cycles, and is available for sale at: http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.