Gold and Silver Forecast to Break Higher

Commodities / Forecasts & Technical Analysis Feb 05, 2007 - 12:30 PM GMTBy: Dominick

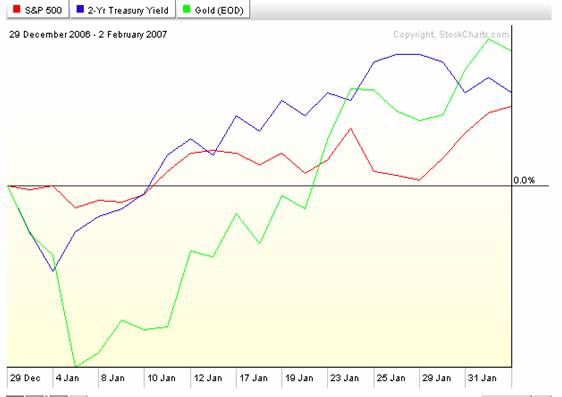

Regular readers know last week's update was about the forces moving the precious metals markets and what we could expect to see based on how those forces were likely to interact. We particularly discussed the correlation between stocks and gold, that the stronger economy had been producing a perception of greater demand with more acute inflation expectations, both of which were bullish for the metals. We'd noted previously that this relationship could also be seen with bond yields, which also tend to move upward as stocks and metals appreciate in value. This first chart shows all three asset classes since January 3rd.

Regular readers know last week's update was about the forces moving the precious metals markets and what we could expect to see based on how those forces were likely to interact. We particularly discussed the correlation between stocks and gold, that the stronger economy had been producing a perception of greater demand with more acute inflation expectations, both of which were bullish for the metals. We'd noted previously that this relationship could also be seen with bond yields, which also tend to move upward as stocks and metals appreciate in value. This first chart shows all three asset classes since January 3rd.

Despite the obvious, publicly stated hawkishness of the FOMC membership, we went into this week knowing the markets had only recently priced out expectations of a rate cut, and that rate hikes were not yet seriously being entertained, at least by most traders. It was therefore reasonable to conclude that positive economic data would continue to rally the markets rather than cause rate hike panic attacks as they did during uncertain periods last year, back when goldilocks was still just a fairy tale. With the looming Fed statement virtually guaranteed to unleash sizeable waves into the markets, traders were forced to stay cautious until midweek. Still, using our understanding of the situation, we were able to make the following post on the TTC forum Wednesday morning, prior to the opening bell:

this morning the dollar is stronger against most major currencies, on the cusp of an expected 3% GDP number and weak overseas markets, and gold is giving back its overnight gains. stock index futures are also down and the expectation would be for metals to largely track stocks, as good news for the economy should lift both asset classes… on the whole… economic data and earnings will probably be on the positive side today with gold likely to stay within a fairly tight range at least until the 2:15 announcement.

The rally after the Fed statement confirmed our bullish leaning, and the link between metals and equities was also upheld. We did note in the forum, however, that the GDP figure, which came in on the high end of the expected range, would potentially throw this situation out of balance since a strong GDP tends to rally the dollar. But as of Wednesday, the Fed's continuing expectation of only “moderate” growth had sent the dollar into decline, with the euro-dollar climbing back above 1.30 fairly convincingly and gold penetrating the $660 range.

Now, the Fed has done its best since October to ignore the rise in metals and focus narrowly on wages and employment for their sense of price inflation. But, as we'd indicated over the past several weeks, despite what the Fed might say, gold appears on traders' radar once it breaks the $650 level and hints at $700, and they either work themselves into a heated rally or ice it down in a dramatic selloff of shorts and profit-taking. A chart posted to the TTC forums on Thursday contemplated just that possibility.

.jpg)

As you can see, a relative strength reading of 70 has been the death knell for every gold rally since July. But, RSI doesn't point to a foregone conclusion, of course, since if you'd sold in March '06 when the RSI bumped 70, you'd have lost out on the greatest metals rally in decades. Clearly, the trick at these important points is in knowing what the economic and fundamental context will allow. As you already know, here's how this week played out:

.jpg)

So far, gold has found support at roughly the late December highs, but, these recent vibrations around $650 have put us at an important inflection point. Over the past several weeks we've referred to multi-year trendlines in the precious metals as essentially place holders for the long term bull market trend and as potential safety nets should a worst-case scenario occur. As we work toward our outlook, this next chart shows how recent action in silver fits into that framework.

.jpg)

The trendlines have been very effective at charting trend support levels, but they've obviously done an excellent job of capturing the highs as well. In fact, the middle and top lines in the chart correspond to highs in 2004 and 2005. So yes, it's definitely bullish that silver has moved into the upper channel, and we can therefore draw a clear target near $15. However, after a somewhat nasty close this week, silver's in the middle of the road and, like gold, lying at a crucial pivot. And also just as in gold, it'll take an understanding of the economic and fundamental context to make an informed decision. What the chart below clearly tells us, though, is that if silver doesn't at least take out the December highs, around $14.05 ($14.39 in the futures), the likelihood is that we'll see a return to the lower channel and probably even the bottom trendline. Oh say, can you C?

.jpg)

As we predicted on Wednesday, by the end of the week, stocks (S&P 500) and the dollar were trading higher, but their small rally left bond yields and the metals behind. But one day is not a trend, so it important to understand the several factors at play here. First, you've probably heard by now that the U.S. government expects to buy back about $130 billion in Treasuries beginning this April. While it's convenient to simply chalk this up to prudent spending and higher tax receipts, it's clear the move will put discernible downward pressure on bond yields over coming months and that the change simply couldn't happen at a better time.

Yields have risen recently as the drag on the economy from the housing and auto sectors has decreased. Of course these two sectors are the most acutely sensitive to interest rates and, as they prime themselves for their busiest seasons, could be devastated by higher rates. But, if banks can use the Treasury market to offer lower interest on loans without the Fed having to cut its target rate, then buyers could spring into action and work off the excess supply in housing and breath new life into the ailing domestic auto industry. These two are clearly the weakest links of the goldilocks economy. As you can see from the next chart, copper, which is levered to housing construction, is at new lows from it's all-time high. Clearly some interest rate help for home builders is in order, but with supply still high, it probably won't be enough to save copper from retracing even more of its parabolic ascent.

.jpg)

Regular readers remember that we were way ahead of the curve when we announced on December 17 that the Fed would not be lowering interest rates as most of the market at that time believed. As markets have swung towards our point of view, we increasingly emphasized the effect of the Fed's open market activities as they continue to hold the target rate steady. Housing and autos remain the most obvious reasons why the Fed can't hike rates. Sagacious bond traders who understand that economic context actually priced in faint odds of a rate cut during last week's session. While the chances of an actual change to the target rate are debatable, it does appear that bond yields are set to come down over the next few months and this could put significant pressure on metals.

To the upside, however, stocks have to stay strong for buyers to feel rich enough to start buying real estate again. In other words, stock assets need to pick up some of the slack that housing prices have let out. Therefore, beware of short squeezes! We've noted that metals and stocks have been moving together in the past. A good short-covering rally will test to see if that relationship has truly been broken.

It's also questionable how much damage could potentially be done to metals if Fed officials remain very visible in their concerns about inflation. Though it appears contained nominally, Bernanke's advocacy to Congress of the chain inflation method of measurement proves the Fed is always in search of new ways to understate the effects of its constant expansion of the money supply. Even the relatively high 4.2% year over year rise in wages during December is probably much less than the actual price inflation being experienced by the average consumer. Since real inflation will always work in favor of precious metals, if the Fed heads stay hawkish and keep their schedules full of speeches and public appearances, any declines in metals will likely remain orderly and appear incrementally over time. Upside targets are clearly marked for both metals and, obviously, any exogenous events, such as war or terror, indicate a buyer's market.

In the end, there's just too much going on to put it all in a single weekly update. But, you can keep up with the evolving market forces described here by joining us in the TTC forums, where monthly membership costs less than 1/10 oz gold or a 10 oz bar of silver -- one of the best values on the web!

Joe Oroborean

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.