Dodd Frank Act Finally Cleans up the COMEX Commodities

Commodities / Market Manipulation Oct 20, 2011 - 06:03 AM GMTBy: George_Maniere

One of the best parts of writing is that I get so many great ideas from my readers. The readers of this site are some of the smartest people I have ever spoken with. Even the people who have never traded bring a fresh and new prospective to the way I see the market.

One of the best parts of writing is that I get so many great ideas from my readers. The readers of this site are some of the smartest people I have ever spoken with. Even the people who have never traded bring a fresh and new prospective to the way I see the market.

Yesterday I was proved right and completely blown away by a post from a reader. I did some homework on other sites and the probabilities of his post being accurate are 80%. So let’s get to it because I think you are going to like his thesis.

The Commodity Futures Trading Commission (The Cartel) on Tuesday approved a much-debated, long-delayed rule designed to curb bets on oil, gold, sugar and in particular silver.

CFTC Chairman Gary Gensler said the limits will protect the markets. The 3-2 vote—cast along party lines—illustrates how divided regulators remain over the role of government in the markets. The debate leading up to the vote also shows how even some CFTC commissioners supporting the rule think it may not have the desired effect.

Opposed by Wall Street and in particular JP Morgan Bank the rule aimed at capping the positions firms can take in certain commodity contracts in order to curb sharp price increases. The rule gained traction in Congress during a silver price spike in 2011, which some attributed to excessive speculation by short-term traders. Along with a number of other rules, it was mandated by the Dodd-Frank financial-regulatory overhaul.

So finally position limits in silver will be enforced. Will there be delays? Of course and you can bet your bottom dollar that the Cartel will be out in force with their lawyers challenging the ruling. However, there is a very high probability that on a beautiful day in 2012, JPM, et al will finally be feed of its shackles and the price of silver will move dramatically higher.

Don’t think this will happen smoothly. Beginning today, all bets are off. As of last Tuesday’s Commitment of Traders survey, the commercial short position in silver was 58,000 contracts. At 58,000 contracts the speculation is that the short position is still between 15,000 and 20,000 contracts. Clearly, they have a lot of work to do to bring themselves into compliance.

As you are aware if the go blindly covering short positions they will drive the price of silver higher and higher and create steeper and steeper loses. They are going to want to continue to inspire more and more selling at lower prices in order to cover their shorts.

JP Morgan need to force silver lower in the days and weeks ahead otherwise they will be in the position of covering thousands of contracts at steep losses. The question is how do they get people to sell? The answer is simple. Let the CME do the dirty work.

Remember the CME only raises margins in response to volatility. If the Cartel can create enough volatility the CME will be forced to act.

So the answer is simple:

- Violently manipulate silver to create unprecedented volatility.

- Have the CME raise margin rates again in response to this volatility.

- Use dips I price to quickly cover short positions.

- If Cartel buying spikes price back up, this added volatility will force additional margin hikes.

Eventually two will have been accomplished:

- JP Morgan will have extricated themselves from the short position and brought themselves into compliance with the position limits today.

- To help avoid a subsequent run on the CME – owned COMEX, margins will have been increased so significantly during the process the COMEX will have made the leverage will have dropped 3 to 1. This will have made the COMEX a physical only exchange. Making the COMEX a physical only exchange will preserve the viability of the exchange and limit future liability of the CME Group.

Now here is what you have to do:

- Don’t get caught up in the wild volatility, emotion and disinformation of the next three to six months. When the silver you bought for $36.00is now $22.00 keep in mind that this is a plan that will pay off handsomely in the end. You must have faith and confidence that you are right and will prevail in the end.

- Set up a disciplined, regular physical purchase plan. You should make it a priority to buy some physical silver every week until the limits are finally enacted.

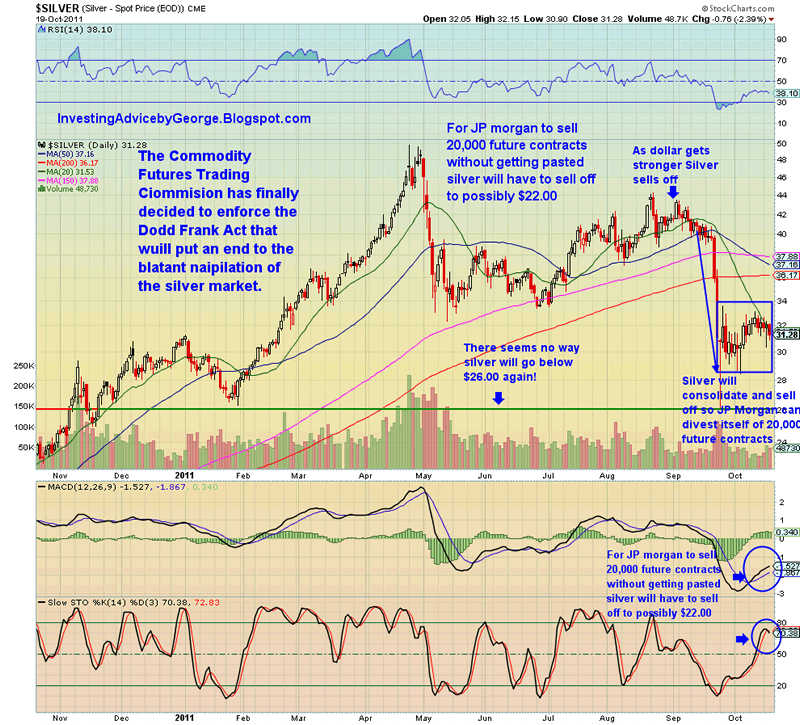

- Because silver will become a physical, spot priced market, you can rightfully expect significant price increases in 2012. Unencumbered by suppression, their will begin to be true price discovery. Does this mean that gold and silver will finally revert to 16or 12 to 1? Yes, it probably does. When will it happen? There are too many variables to hazard a guess but the day is coming. Please see the chart below.

In conclusion, steel yourself for the tremendous volatility that is coming and use every advantage to buy on dips. This may be the last chance for you to own silver at these prices. If holding physical silver is a logistical problem buy PSLV for silver and PHYS for gold.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.