Gold and Silver Stocks Failure If Europe Should Fail

Commodities / Gold & Silver Stocks Oct 21, 2011 - 07:44 AM GMTBy: Clive_Maund

Action yesterday across markets was bearish and set alarm bells ringing - in particular the action in the PM sector, where the Head-and-Shoulders bottom pattern that we have observed in PM sector stock indices appears to be aborting. If it does abort it will probably mean that the broad market will go into the tank, and that is precisely what we we can expect to happen if Europe should fail.

Action yesterday across markets was bearish and set alarm bells ringing - in particular the action in the PM sector, where the Head-and-Shoulders bottom pattern that we have observed in PM sector stock indices appears to be aborting. If it does abort it will probably mean that the broad market will go into the tank, and that is precisely what we we can expect to happen if Europe should fail.

It has to be said that up until now we - and most of the rest of the world - have blithely assumed that, confronted with catastrophe, European leaders will overcome their differences and solve Europe's problems by printing up a few trillion euros to paper over the cracks, US style, and keep the show on the road for a year or two longer, but it is now becoming increasingly apparent that the scale of the problems is so gargantuan that there may be no credible or workable solution. The sad fact of the matter is that the bungling, discordant self-serving buffoons who run Europe may well have left it too late. If Europe should fail - and the markets look set to pass judgement on it next week, after a weekend of crucial meetings, then the consequences will be unthinkable, yet think about them we must.

if Europe should fail this is what we can expect to happen - European banks will crash and burn and take down major US banks, which are already walking wounded basket cases anyway. We are likely to see a lengthy unscheduled "bank holiday" - banks will slam their doors and if your money is still inside their vaults then you are out of luck. Major disruptions in supply and distribution of food and fuel in particular will trigger general panic, and riots and mob violence will spread rapidly - what we have seen on TV happening in Greece will suddenly happen on the streets of the US and many other countries. Stockmarkets will crash in a manner that will make 2008 seem like a "walk in the park". Virtually every asset class and investment will crater - especially commodities, stocks and Real Estate. The euro will be vaporized. The tidal wave of funds liberated by this mass panic are going to have to go somewhere and normally we would expect them to go into the US dollar and Treasuries, but with US banks failing even this cannot be relied upon. The one surefire investment category that will shine - provided that is that the markets or brokerage houses etc involved with these transactions don't themselves fail - is "misfortune securities", meaning bear ETFs and Puts.

The gravity of this crisis is such that we are not simply talking about protecting investments and making opportunistic gains out of the mayhem that will ensue, if Europe should fail, we are talking survival issues as well, as due to the interconnected nature of the global economy things could become very ugly, very fast across a broad front. If you want to learn what life is like when banks suddenly slam their doors, then you should read up on the Argentinian crisis of the early noughties. The middle class suddenly found themselves disconnected from their savings, and as many of them lost their jobs at about the same time, they became instantly destitute, and forced to swap their possessions for food. Crime soared and people who had been used to living relatively cushy lives suddenly found themselves living on the edge in a law-of-the jungle nightmare. If Europe should fail this is what may quickly become reality not just in Europe but in the acutely fragile and vulnerable US and many other other countries as well. Other undesirable consequences will be unemployment rising to incredible unprecedented levels, so that students leaving college will have almost ZERO chance of finding work. The travel industry, much of which is non-essential, will be devastated with airlines slashing flights and going bust and hotels suffering extremely low occupancy rates.

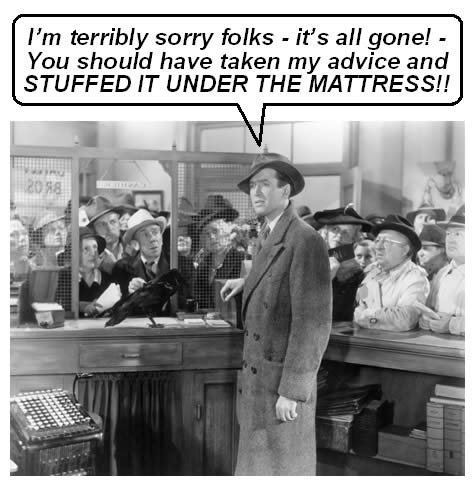

With things rapidly coming to a head in Europe, this catastrophic chain of events could be set in motion as early as next week. So stop and think about this for a moment - WHAT WILL YOU DO, AND WHAT SITUATION WILL YOU FIND YOURSELF IN, IF BANKS SLAM THEIR DOORS WITHIN THE NEXT COUPLE OF WEEKS? - are you starting to see what I am driving at? Good, then here is what you do. You go down to the bank either today (Thursday) or tomorrow - we have the luxury of another day - and draw out a stash of cash - sufficient to keep you and your family in food and essentials for at least a month and preferably more like 3 months. When you stroll into the bank it will feel surreal, everything will appear normal and people will be standing in short lines and chatting and smiling etc, and you may find yourself thinking "That Maund's lost it - he's completely off his rocker", but if the danger I have described should become reality then you are going to be mighty glad you visited the bank this week, instead of turning up in a couple of weeks to find the doors shut and a huge crowd of desperate people outside hurling rocks at the windows. If this danger does not become reality, and there is a miracle solution to Europe's problems and everything returns to "normal", then you have lost nothing and you can stroll down to the bank again and pay the funds back into your account in a few weeks time, once you are convinced it is safe to do so. No-one will think you are crazy because of course you don't have to tell anyone why you are drawing out the money.

What would be the effect on the Precious Metals sector, if Europe should fail? - sadly it will crater along with the rest of the market and we saw early evidence of that with the "shot across the bows" yesterday when the sector fell heavily on a broad market retreat. Now, we don't know for sure that Europe will fail, but the situation is very precarious and it looks like a 50:50 chance at this point that this dire scenario will prevail, or at least a 30:70 chance that it will. The danger is sufficiently great that we need to be aware of it ahead of time, so that we don't get caught out and go into blind panic along with the mob. What you do about this will depend on your own personal situation and investment orientation. There are various ways to handle it - you can pull in close stops on PM investments, which is recommended, hedge with bear ETFs and/or options, and the more aggressive and opportunistic amongst you can set yourselves up to make a fortune in options if the markets crater, accepting fully the risk of losing your stake if the crisis is averted or at least postponed significantly.

Let's hope Europe doesn't fail - but be ready if it does.

First posted on www.clivemaund.com at 7.30 am EDT on 20th October 11.

Footnote posted a day later on 21st - there isn't much that suprises me these days, but I have received some news from a subscriber, Bob, in the US, that has left me dumbfounded, and disappointed I must say as I was looking forward to being responsible for causing a run on the banks. Here is what he told me -

"Clive, in your post "If Europe Should Fail" you have recommended your subscribers "draw out a stash of cash". I have been attempting to do this with my local bank for over a week and this is what I have learned. The only "cash" the banks have at their facilities is the bare minimum for making change, cashing paychecks, etc. More than 99% of their so called cash "assets" is electronic money and not "cash" money. They are generally happy to transfer this electronic money elsewhere but if you want the real thing, "cash", the bank will, in most cases, either deny your request or put you off for, in some instances, more than a week. Many of my contacts across the US are reporting having the same problems I am having getting any significant amount of cash out of their local banks."

The meaning of this is clear - TAKE WHAT YOU CAN WHILE YOU CAN.

Specific information on a range of bear ETFs and options follows for subscribers...

By Clive MaundCliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

khen

23 Oct 11, 08:30 |

gold

Well, you've covered yourself so whatever happens you will be correct. A fifty fifty chance for a collapse or not. I can predict that myself. |