Riders On The Gold and Silver Storm

Commodities / Gold & Silver Stocks Dec 23, 2011 - 04:53 AM GMTBy: Jeb_Handwerger

Those of us who are buyers and believers in the long term continuing secular rise in resource equities are going through a time of testing. The marketplace will present participants with years such as 2011.

Those of us who are buyers and believers in the long term continuing secular rise in resource equities are going through a time of testing. The marketplace will present participants with years such as 2011.

We reiterate our guiding principles at precisely these times that tests our basic mission statement. First and foremost is the avoidance of margin. Mining stocks are characteristically volatile and subject to turbulent corrections.

Being able to buy and hold in such maelstroms rewards the brave with eventually impressive profits. The commodity arena has never promised us a rose garden. In order to reap the rewards of speculation one must know the territory through which one is passing. This year we have crossed a lonesome valley of mining investments.

The challenges are immense. The rewards are even greater or else why do we endure the slings and arrows of outrageous fortunes if not to enjoy substantial profits.

To be right in the market, the consensus has to believe that you are wrong. Everything is down across the board in the junior mining (GDXJ) sector, yet we begin to detect what we forecasted a few months ago. Bernanke and the European Central Bank has arrows in their quivers, but in 2011 they have certainly chosen questionable ones.

The markets have voted to criticize their choices as being inadequate. Now we have seen the investors vote a resounding "No!" to both Obama, The Federal Reserve and The European Central Bank.

What is needed is debt reduction, entitlement reform and a coherent approach to taxation that does not punish the entrepreneur and the middle class in order to correct the market malaise. Until the leaders adopt rational policies instead of making empty speeches and blaming one another, such ambivalence will be regarded as just what it is, bromides and banalities. All the rest is commentary.

Plain talk and common sense are required here. Beware of making decisions based on panic and fear. There are monsters aplenty to frighten and confuse us off of our course. Precisely now we reiterate our basic motif.

1) Margin is to be avoided at all costs. We can not repeat this enough.

2) Mineral resources will continue to represent value and essentials for the survival of modern, industrial societies.

3) Mankind has not come this far in order to reenter the caves from which we came. Truly we are endowed by Our Creator with "certain inalienable rights".

4) Rare earths (REMX) will continue to be needed for its manifold uses. It should be represented among the winners in the next market rally. Downtrends feel like they will never end, but they do.

5) Gold (GLD) and Silver(SLV) will continue as standards of value as they have for the past millennia.

6) Nuclear energy (NLR) will stand as the central pillar of energy provision alongside solar and wind power.

7) The ascent of civilization continues to progress upwards.

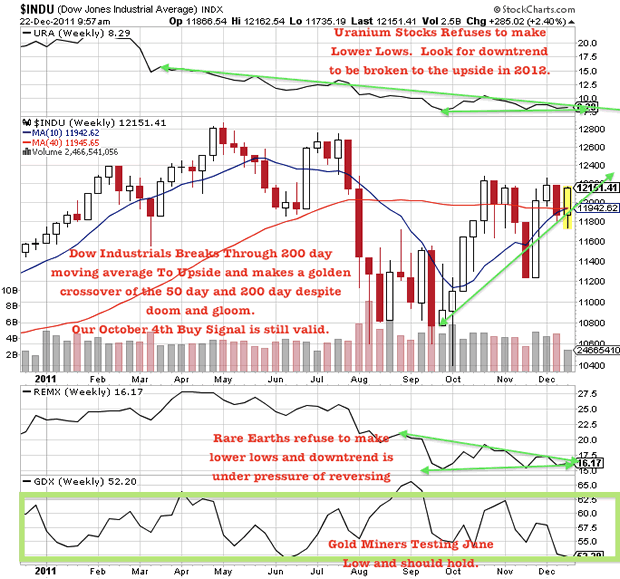

With the above provisos firmly in mind, how do we apply these halcyon concepts to the here and now? The battlefields of mining equities (GDX) are awash in a sea of red. Yet we detect some positive developments to be used as milestones. Gold (GLD), Silver(SLV) and mining equities (SIL) are finding support despite all the doom and gloom and year end tax loss selling. This may qualify as a valid divergence from which a turnaround may occur. Whether such a turnaround represents a new bull market in mining stocks or just a relief rally remains to be seen.

Rallies do occur even in the most negative of markets. In early October, the advance-decline ratio on the NYSE was almost 10 to 1. This may have marked a selling climax at our confirmed October 4th low in the Dow Industrials (DIA) and the S&P 500(SPY).

It remains to be seen how our chosen select sectors will act in this ongoing rise. It is hoped that the recent negative action of gold and silver represent forced selling by marginal players who frequently throw in their winning positions to offset their tax loss selling. It will not be too long before the European Central Banks recognize the store of value of gold that they will add to their coffers.

As for uranium miners (URA), we feel they are priced far below value. Nuclear plants continue to be built all over the world. In fact Russia stated that not only are they building new plants but that they are increasing the lifespan of their existing reactors by fifteen years. Moreover, the Japanese Premier Noda is actively pushing for the restarting of Japan's nuclear plants in order to avoid industrial collapse.

Technically, the uranium and rare earth charts look extremely oversold as they test 2011 lows. It gives dispirited holders reason to walk away, exactly at the wrong time in view of the positive aspects noticed above.

Our mission statement to encourage investments in long term wealth in the earth situations that are significantly undervalued. Short selling is a perilous pursuit. Bonds(TLT) and the U.S. dollar (UUP) are dangerous investments in light of record debt levels. Difficult as it may seem we continue to be riders on the storm.

At this time our sectors are down, margin calls abound and tax loss selling continue to skew most stocks and precious metals to the downside. Do not be dismayed, one does not go short now. Our wealth in the earth stocks are inexpensive, undervalued and oversold and once again reason will prevail and sanity will return to the marketplace as it always has.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.