ECB Liquidity Loans Still Not Enough to Stop Stock Market Topping

Stock-Markets / Stock Markets 2011 Dec 23, 2011 - 05:02 AM GMTBy: UnpuncturedCycle

Giuseppe L. Borrelli writes: Yesterday we learned that the European Central Bank offered to loan 523 banks a total of 489 billion euros ($641 billion) in funding. The idea is part of a drive to increase liquidity and curtail the threat of sovereign default by some euro-zone members. Unfortunately the short-term liquidity needs for European banks exceed one trillion euros. What's more the ECB is loaning out money to EU banks for three years thereby increasing the overall debt of these troubled banks while allowing them to postpone the problem of how to pay down that debt. In return the ECB is receiving bad sovereign debt as security at face value and it is leaving itself with little cash on hand.

Giuseppe L. Borrelli writes: Yesterday we learned that the European Central Bank offered to loan 523 banks a total of 489 billion euros ($641 billion) in funding. The idea is part of a drive to increase liquidity and curtail the threat of sovereign default by some euro-zone members. Unfortunately the short-term liquidity needs for European banks exceed one trillion euros. What's more the ECB is loaning out money to EU banks for three years thereby increasing the overall debt of these troubled banks while allowing them to postpone the problem of how to pay down that debt. In return the ECB is receiving bad sovereign debt as security at face value and it is leaving itself with little cash on hand.

I realize the ECB under Mario Draghi is better off than it was under his predecessor, Jean-Claude Trichet, but it is still too little and too late. That's why the kneejerk reaction saw Italian, Spanish and Portuguese bond yields fall on the news and then turn back up a couple of hours later. I would have thought that any quantitative easing in Europe would have been closer to a trillion Euros but that was just wishful thinking on my part, and of course there is no political will for that type of action. Of course we have the "rumor" of more QE to come in February, but the market seems to take a dim view with respect to promises regarding some future action.

Regardless of what you may think about Dominique Strauss-Kahn, the former IMF managing director, he seems to have more of a handle on the real issues. He delivered a speech in Beijing yesterday chastising the leadership of Europe for its "state of denial" about the severity of the credit crisis. It seems that an angry Strauss-Kahn is speaking his mind now that he has no official capacity and can lash out at European leaders. He was adamant that the European crisis was a three-pronged problem: a debt crisis, a growth crisis, and a leadership crisis. The crisis in Europe is further aggravated by the fact that the European leaders seem that time is not of the essence where Strauss-Kahn believes time is not a friend of the EU. It is of the utmost importance that the crisis be dealt with now and not later. Now that he is out of the IMF and not running for President in France, it seems he feels liberated enough to finally speak the truth.

Back in the good old USA it appears that once again the Democrats and Republicans have agreed to disagree. It looks like the agreement to extend the payroll tax cuts for another two months is dead in the water and now everybody in Washington goes home to lick their wounds for a the holidays. The blame game is now completely out in the open as both sides blame each other and the coming elections promise to be the dirtiest in years.

On the economic front we saw that for the week ending December 17, the advance figure for seasonally adjusted initial claims was 364,000, a decrease of 4,000 from the previous week's revised figure of 368,000. The 4-week moving average was 380,250, a decrease of 8,000 from the previous week's revised average of 388,250. The advance number for seasonally adjusted insured employment during the week ending December 10, was 3,546,000, a decrease of 79,000 from the preceding week's revised level of 3,625,000. The 4-week moving average was 3,631,750, a decrease of 40,000 from the preceding week's revised average of 3,671,750.

In a separate report we saw that third-quarter GDP growth was revised down to 1.8%. Third-quarter growth was originally estimated two months ago at a 2.5% annualized rate, but was revised down to 2.0% growth in last month's estimate. The revisions come from more complete data than were available at the time of the first and second estimates. Economists surveyed by MarketWatch had been expecting no revision in the third estimate. See comprehensive economic calendar. Growth has averaged a paltry 1.2% rate so far this year -- much slower a pace than is usually the case in an economic recovery. Growth rates of 3% or more are more common.

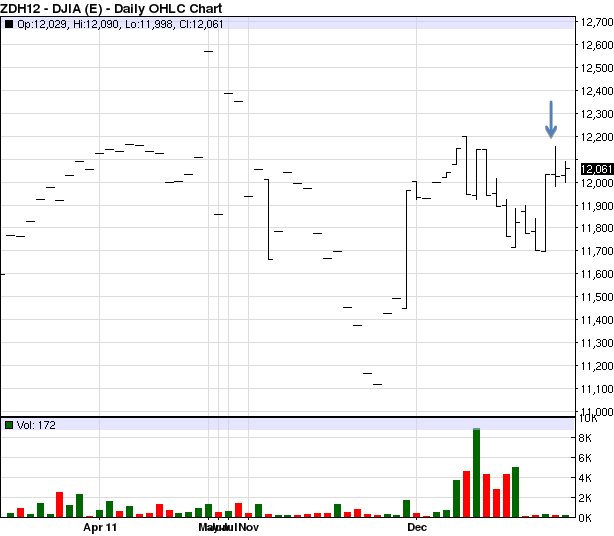

With respect to the stock market I have noted a subtle change over the last couple of weeks and it manifests itself in the inability to hold rallies. In nine out of the last eleven sessions the Dow has held a triple digit gain in either the futures session during the night, or just after the New York open only to sell off later in the day, more often than not ending the session in negative territory. Yesterday was one

more example as the March Dow futures contract shot up more than 120 points, trading as high as 12,156, on the great news that the ECB would print US $641 billion. Nine month ago that would have driven the Dow higher for days if not weeks! As it turned out yesterday the March Dow futures contract ended the day unchanged as it gave up its gains. I will even go so far as to say that they had to support the market to keep it from ending much lower.

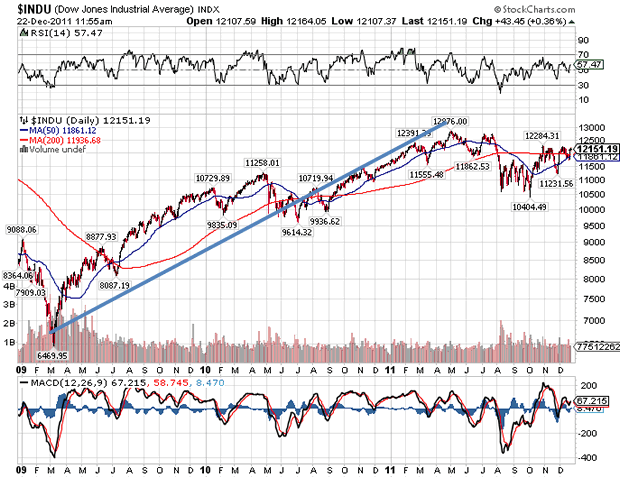

In the preceding chart I have highlighted a bear market rally that topped on April 30th at 12,876 and well below the October 2008 high of 14,169. After the April 30th lower high we see a modest 9% decline followed by a run up to a second lower high in late July. This in turn was followed by a sharper break that made new lows for the year and now I maintain that we are in a final period of distribution.¹ Once this period of distribution ends, the market will begin the long trek down to a test of the 2009 low, and then even lower.

I don't know how much longer this period of distribution will last, but I do know that we are much closer to the end than we are to the beginning. The market is saying as much! Right now we are in the midst of a fifth, and I believe final test of good resistance at 12,215. Once that ends then we should see a test of support at 11,550, 10710 and then on down to 9,640 before any type of rally is seen. I should add that we'll also see psychological support at 11,000 and 10,000. Since no one is afraid right now, the decline will begin gradually and no one will pay attention. Of course the media will play it down as a buying opportunity, but nothing could be further from the truth. I continue to urge investors to be out of all stocks and for those of you willing to take advantage of an opportunity, you should be short the Dow. In any event it's one train you don't want to be on.

Distribution is where the stock moves from a strong hand to a weak hand.

Giuseppe L. Borrelli

www.unpuncturedcycle.com

theunpuncturedcycle@gmail.com

Copyright © 2011 Giuseppe L. Borrelli

- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.