Gold GLD ETF Incredible Chart

Commodities / Gold and Silver 2012 Jan 03, 2012 - 01:28 AM GMTBy: David_Grandey

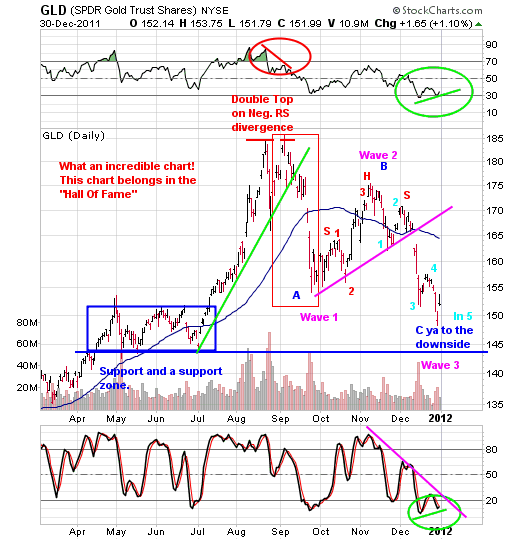

They say a picture is worth a thousand words, one needs look no further than the chart below for that.

They say a picture is worth a thousand words, one needs look no further than the chart below for that.

It’s a great example in the event that the market tops out and how to protect oneself and more importantly how to profit from that should it occur.

We’ve been highlighting a lot of patterns that are of the “Change In Trend “ variety (in this case up to down) and of the “Short Sell Set Up Variety. Overall we call them the “What to Watch For” when looking to short sell and the “What to Watch Out For” if one is long or looking to go long.

The other day we showed you an example of what a Head And Shoulders Top looks like and what a First Thrust Down Short Sell Set Up Pattern looks like in the chart of SLW.

Today we are going to show you one chart that has everything one could ever look for in a chart. There are so many patterns embedded in it that we focus on at All About Trends on a daily basis its not funny. To say the least this chart needs to be (and will be) included in our hall of fame for educational purposes to refer back to time to time. One would do themselves well to print it off for you’re own hall of fame.

Double Top

There are a lot of patterns in this chart so let’s first off take it from the top as in Double Top with Negative RS divergence (green circle). From the July lows (everything above the green line) this issue took off like a rocket! Hot highly emotional on a red bull sugar high money loves this type of stuff. They love chasing buses which when all said and done as you can see is hazardous to ones financial health. There came a time when the issue was putting in what we call an early warning alert change in trend pattern that you all call a double top. Our mantra at All About Trends with these is:

“Nice uptrend, above the 50 day, puts in a double top and breaks to the downside.”

Notice that once it broke to the downside it stopped back at a prior support level of 150 to 155?

First Thrust Down

That initial break down is what we call the First Thrust Down (Red Box). After an issue stages a First Thrust Down more often than not (because this is an art more than a science) the issue will tend to get some sort of snapback rally. Everything above the pink line is the snapback rally. Upon a break of the snapback rally (Pink Line)? At all About Trends its called “Bombs Away”

Remember our mantra with these is: First Thrust Down, Snapback Rally and Bombs Away.

In addition to the First Thrust down it can also be considered Wave 1 to the downside for those familiar with Elliott Wave.

Three Waves Up

Now lets take a closer look at that snapback rally. Within that snapback rally there is a lot of structure. First off see those little red 123 numbers? That is a classic Elliott Wave three waves up pattern. Therefore the big picture wave count at the completion of the three waves up makes this a Wave 2. So we have the first thrust down being wave one, the snapback rally being wave 2 and yep wave 3 took place on the break of the pink line to the downside for “Bombs Away”.

Head And Shoulders

Also within that snapback rally you can clearly see a Head and Shoulders top also marked in red. Folks, this is how the market talks to us and our subscribers at All About Trends, all via chart pattern recognition and the components of patterns.

Five Waves Down Of Wave Three

Lastly in that chart you can see some sky blue numbering. That bombs away is comprised of 5 waves down. Here too classic Elliott Wave and true to form for a wave 3. Typically according to Elliott Wave Theory after 3 waves down comes the 4th wave (If big picture this issue topped- bear count) the 4th wave can be sideways or a traditional three waves up just like wave 2 was.

The bull count big picture is that if this was just a 3 waves down traditional correction then its upward and onward from here starting soon.

On a side note. What happens to our big picture indexes at the end of this move off the October lows upon a break to the downside? You’re looking at it!

Notice where we are now?

5 waves down and near a prior support zone. So at this point what do you do if you own it? Well first off the bulk of the damage is surely done here. After all over the last two months its gone from 175 to the 150 zone and is sporting POSITIVE RS DIVERGENCE! (little green line in the RSI indicator at the top of the chart and the green circle) Remember its always darkest just before the dawn.

What is Positive RS Divergence? Simple. Its when an issue hits a low and the RSI hits a low right along with it, then the issue bounces along with the RSI too. After the bounce the issue rolls over and breaks into a lower low than the recent prior low BUT the RSI DOES NOT. That is Positive RSI divergence.

The flip side to that (Negative RSI divergence) can also be found in the chart at the Double top. See it? The issue hits a peak, pulls back, retests it’s highs yet the RSI DOES NOT CONFIRM the highs. All found in the red circle.

Folks, consider this whole article a lesson in short selling and advanced technical analysis. The beauty is that you didn’t have to cough up $3000.00 for some university infomercial that you attend that is going to show you all of this with the hard sell sales pitch at the end.

It ultimately is your call as to what you do but at least we’ve given you a heads up of “What To Watch For” with regards to taking short sells and of course the flip side which is “What To Watch Out For“ if long. Going forward if you start to see patterns like those mentioned above you now have all the tools in you’re arsenal to allow you to take action all in what we at All About Trends call the quest to “Be All That You Can Be”!

After all you only get one shot at life so make sure its a best seller and not a “B” Movie, we’ll give you the tools all you have to do is “Make A Decision” which is the starting point of ALL accumulation of riches be it financial or otherwise.

To learn more and receive our free report — “How To Outperform 90% Of Wall Street With Just $500 A Week,” like us on Facebook or sign up for our free newsletter.

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2011 Copyright David Grandey- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.