There's Value Investing in Russia's Future

Stock-Markets / Russia Feb 14, 2012 - 02:22 AM GMTBy: Frank_Holmes

As Americans ponder the merits of Obama vs. Gingrich, Paul, Romney or Santorum, Russia will be electing its own president on March 4.

As Americans ponder the merits of Obama vs. Gingrich, Paul, Romney or Santorum, Russia will be electing its own president on March 4.

Perhaps we should say "re-electing" since it's almost certain former president and current prime minster Vladimir Putin will be elected. While protests and vocal opposition likely won't prevent Putin's presidential return, they have forced some interesting changes to the political climate and we've observed some positive changes in Russia's investment landscape.

The story begins last December when Putin's political party, United Russia, performed poorly in Russia's parliamentary elections. According to official election results, United Russia retained only 238 seats (down from 315 seats) in the 450-member State Duma, the lower house of the Federal Assembly of Russia.

While these results struck a blow to United Russia's parliamentary power, it was an uppercut to democracy in Russia as suspicions of fraud emerged following exit polls that predicted an even wider defeat. Another one-two punch combination for Russian democracy came when Putin said he had planned all along to swap seats with President Dmitry Medvedev in 2012.

This did not sit well with many young Russians who were raised with the hope of a democratic Russia, compelling them to take to the streets to voice their opposition.

In an effort to gain popularity among these protesters, Putin announced that he would introduce a one-time tax on oligarch companies that acquired state assets during the privatization of Russia in the 1990s following the fall of the Soviet Union. Privatization helped Russia shift toward a market economy, but it is widely believed that only a few well-connected people (business oligarchs) benefited and caused the wealth gap to increase substantially.

"An overwhelming majority of Russians think--with some justification--that the 'loans for shares' assets were sold at substantially below their market value ... In other words there is unlikely to be much domestic opposition to this proposal," says Morgan Stanley.

Putin's one-time windfall tax appears to be based on the U.K. approach, says Morgan Stanley. In 1997, the U.K. imposed a one-time payment on the owners of assets acquired during privatizations in the 1980s. The tax was 23 percent of the difference between the purchase price and the average net profit during the first four years following privatization, multiplied by the factor of 9.3. This resulted in an extra $8 billion for the British crown, according to Morgan Stanley.

The tax is a political risk in Russia, especially for the oligarch-owned businesses. However, our team has always preferred self-made businesses as the owners generally have their own skin in the game.

To understand the complex political situation in Russia, it helps to hear many sides of a story, so last week we sent Tim Steinle, co-portfolio manager of the Eastern European Fund (EUROX), to Moscow in advance of the historic presidential election. While in Russia, Tim had the opportunity to hear Alexey Navalny, a leader of Russia's opposition movement, give his side of the story.

Navalny coined the name "the party of crooks and thieves" that became popular for United Russia. According to a profile by The New Yorker, when United Russia threatened to file a suit against Navalny for slander, he posted a poll on his blog asking readers whether they thought United Russia was a party of crooks and thieves--Ninety-six percent of his readers agreed with him.

Trained as a lawyer, Navalny has positioned himself as a defender of minority shareholder rights against state-owned companies. He alleges a theft of $4 billion from pipeline operator Transneft that the government refuses to prosecute. In addition, Navalny points out that few management boards have independent directors, and even though by law just 2 percent of shareholder votes are sufficient to nominate a director, all nominations are done by the state. Even relatively investor friendly Sberbank has only one independent director out of 17.

Tim says there is a yearning for positive change among the reform-minded intelligentsia, the name given to Russia's intellectual social class. The intelligentsia also pushes for a fair playing field and registration for political parties and a free media.

Navalny compares gains by communists and socialists in the recent election to political dynamics in Eastern Europe in the 1990s, when the pendulum swung to liberals and back. In his view, this is a healthy development, as the economic platform of Communist and Just Russia parties are not that different from United Russia.

Navalny wages a battle of a thousand cuts to increase the stress on the regime he says is "on manual control." Historically speaking, reformers such as Kruschev, Gorbachev, Yeltsin, and Putin came from within the system. Navalny is clearly on the outside looking in.

Tim also sat in on a discussion with former finance minister Alexei Kudrin, who served as Russia's minister of finance from 2000 until September 2011. He was the longest-serving finance minister in post-Soviet Russia, credited with prudent fiscal management and a champion of the free market. He helped Russia weather the global financial crisis in 2008 by creating finance reserves which held a portion of the revenue from oil exports in a stabilization fund despite strong opposition from others who wanted to spend the money. Those savings were crucial to Russia's economy when the crisis hit and oil prices dropped.

Over the past 10 years, Russia's GDP grew at a robust pace of 7 percent annually and Russian companies greatly benefited from profits reinvested in their businesses. Russia's growth story now turns to value as Kudrin expects Russia to grow at a much slower pace, averaging around 4 percent.

We have seen this transformation in some Russian companies lately. Domestically, we have looked for growing, profitable and well-run companies that demonstrate significant growth in three key areas: revenue, earnings and return on equity.

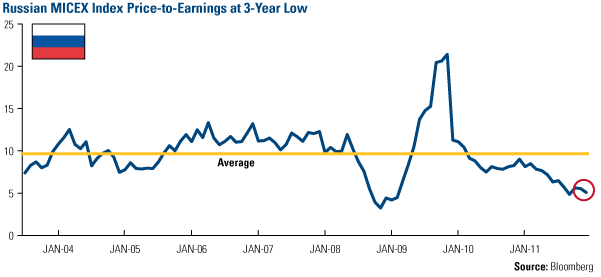

Russian companies have not usually met the criteria, but when we run this screen today, we see that many large-cap businesses are showing significant revenue growth, earnings per share growth and return on investment. Additionally, many of these companies can be purchased at the lowest valuations they have been at in three years. Whereas the price-to-earnings ratio for the Russian MICEX Index has averaged near 10 times since 2003, it is currently at 5 times.

Increasingly, Russian companies have begun paying dividends too, with some companies paying as much as a 10 percent annual dividend. As interest rates around the world will remain low or even negative for years to come, dividends offer investors the opportunity to earn income with the potential of appreciation.

Although political risks remain, we believe the country continues to be a hotbed of opportunity for emerging market investors. For the Eastern European Fund (EUROX), we'll continue to seek self-made businesses that pay dividends. These companies generally are run by owners who have invested their own capital and have a track record of growth.

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.