Why the ECB Expanded Its Balance Sheet By Over $1 trillion in Less Than Nine Months

Interest-Rates / Eurozone Debt Crisis Apr 05, 2012 - 10:32 AM GMTBy: Graham_Summers

Between July 2011 and today, the ECB has expanded its balance sheet by an incredible $1+ trillion: more than the Fed’s QE 2 and QE lite combined (and in just a nine month period).

Between July 2011 and today, the ECB has expanded its balance sheet by an incredible $1+ trillion: more than the Fed’s QE 2 and QE lite combined (and in just a nine month period).

This rapid and extreme expansion of the ECB’s balance sheet (again it was greater than QE lite and QE2 combined… in nine months) indicates the severity of the banking crisis in Europe. You don’t rush this much money out the door this fast unless you’re facing something very, very bad.

The two largest interventions were the ECB’s LTRO 1 and LTRO 2, which saw the ECB handing out $645 billion and $712 billion to 523 and 800 banks respectively.

As a result of this, the ECB’s balance sheet exploded to nearly $4 trillion in size, larger than the GDPs of Germany, France, or the UK.

So why did the ECB do this?

Simple… because everyone (even German banks) is lying about their true exposure to the PIIGS. And the European banking system is literally on the verge of systemic collapse.

Let’s consider the PIIGS’ exposure of German powerhouse Deutsche Bank (DB) widely considered to be one of the strongest banks in the EU.

According to the Bank of International Settlements German bank exposure to Greece is only $3.9 billion (though they state this is only on an immediate borrower basis).

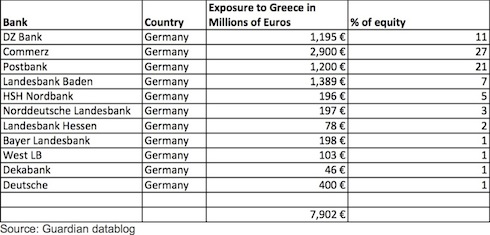

This is a bit odd as according to The Guardian German banks have nearly 8 billion Euros’ worth of exposure to Greek debt. And they only include 11 German banks in their analysis. However, of those 11 banks, THREE of them have Greek exposure equal to more than 10% of their total outstanding equity.

Let’s consider Commerzbank as an example. Let’s say Greece defaults and creditors get 20 cent on the dollar (this is likely wishful thinking). This means Commerzbank now faces 2.3 billion Euros’ worth of write-downs on its Greek holdings… which means it’s wiped out 21% of its entire equity… which pushes its leverage levels through the roof and most likely renders it totally insolvent (there is no way Greece is the only toxic junk this bank owns).

Mind you, I’m just doing back of the envelope analysis here. But based on this brief analysis right off the bat we know the following:

1) The Bank of International Settlements is either completely clueless about the risks posed to the financial system by PIIGS’ debt OR intentionally downplays those risks (neither is good).

2) The Guardian’s datablog (which obtains all of its data from publicly accessible records) somehow comes up with numbers that are dramatically different (and higher) from those published by the Bank of International Settlements.

Now let’s take our analysis a step further.

Deutsche Bank trades on US stock exchanges and so has to publish SEC filings on its balance sheet risk. Well, according to Deutsche Bank’s own filings, it had 1.6 billion Euros’ worth of credit exposure to Greece at the end of 2010. True, this is credit exposure not direct exposure to sovereign debt… but it’s still four times what the Guardian claims to the case.

More interesting that this, the term “Greece” is only mentioned twice in Deutsche Bank’s 2010 416-page annual report. Remember, this was the year in which the Greek Euro Crisis nearly took the system down: between January 2010 and June 2001, when the first Greek bailout was announced, the Euro lost 17% if its value. Worldwide, stock markets cratered despite central bank intervention. And it was only the Fed’s promise of QE lite and QE 2 that got the global equity rally rolling again.

So it’s a bit odd that Deutsche Bank’s 2010 416-page annual report would only mention the term “Greece” two times. Regardless, let’s fast forward to Deutsche Bank’s Third Quarter 2011 filing (its most recent) for some more recent data.

This time around, the term “Greece” shows up six times in the 100-page report. And this time around Deutsche Bank states it has 881 million Euros’ worth of exposure to Greek sovereign debt (TWO TIMES what The Guardian claimed).

By the way, Deutsche Bank has only 59 billion Euros’ worth of shareholder equity, so this position alone is worth roughly 1.5% of the banks’ equity. True, this is not a huge percentage, but if Greek creditors take a 70-80% haircut, Deutsche Bank would need to raise capital.

On a side note, I want to point out that we’re completely ignoring the fact that if Greece defaults so will Italy and Spain whose sovereign debt and financial institutions Deutsche Bank has 14.8 BILLION EUROS worth exposure to: an amount equal 23% of Deutsche Bank’s TOTAL EQUITY.

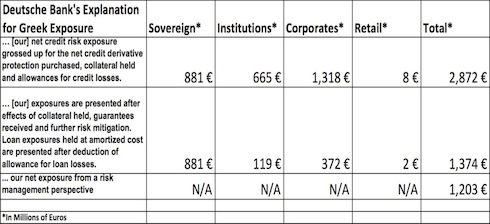

But let’s just focus on Deutsche Bank’s exposure to Greece for now. According to its Third Quarter 2011 filing, aside from the 881 million Euros’ worth of exposure to Greek sovereign debt, Deutsche Bank also has 665 million Euros’ worth of exposure to Greek financial institutions, and a whopping 1.3 BILLION Euros’ worth of exposure to Greek corporates (plus a negligible 8 million Euros’ worth of exposure to Greek retails) for a total of 2.8 BILLION Euros’ worth of exposure to Greek debt and businesses.

So… having taken our analysis one step further, we find that one single German bank, one of the alleged strongest I might add, has in fact, far, far more exposure to Greece and its economy than both the Bank of International Settlements and the mainstream financial press indicates.

Bear in mind, the numbers presented in Deutsche Bank’s are simply those that Deutsche Bank’s executives have told the company’s accountants are acceptable for public disclosure (we have no clue about the banks off-balance sheet risk).

It’s also worth noting that in 2010 Deutsche Bank claimed to have only 1.6 billion Euros’ worth of credit exposure to Greece, whereas by late 2011 the number has swelled to 2.8 billion Euros.

I have to ask… how exactly does a bank, which is supposedly managing its risk levels and adjusting its exposure accordingly, manage to increase its credit exposure to something as financially toxic as Greece by 75% in a nine month period?

This hardly strikes me as good risk management. But here’s how Deutsche Bank’s accountants try to explain that none of this (even the 2.8 billion Euros’ worth of exposure) is actually a big deal.

If the above chart sounds like it’s written in obfuscating language, let me translate it for you. According to Deutsche Bank’s accountants, once you include collateral held (likely garbage assets valued at mark to model fantasy land valuations), guarantees received (from GREEK institutions!?!?!), and “risk mitigation”, Deutsche Bank’s “actual” exposure to Greece drops from 2.8 billion Euros to only 1.2 billion Euros.

So… this is a bank whose credit exposure to Greece increased by 75% as the Greek Crisis worsened from 2010 to 2011… now claiming that thanks to their risk management, their “real” exposure to Greece is only 1.2 billion Euros.

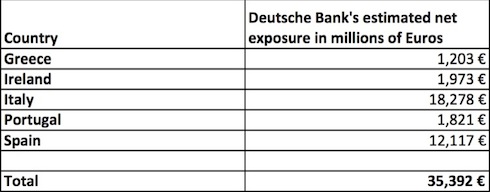

Ok, well if we’re going to play by those rules, let’s consider that when we include the rest of the PIIGS countries, Deutsche Bank’s “actual” exposure (as downplayed as it might be) is still 35 BILLION Euros, an amount equal to 60% of the banks’ total equity.

At these levels, and using the currently proposed Greek 50% haircuts as a model for future defaults in the EU, Deutsche Bank could very easily see 10-15 billion in write-downs from its PIIGS’ exposure. This would wipe out 16%-25% of the bank’s entire equity and render it borderline insolvent.

Thus, by our own analysis we find that even the German powerhouse of DB has PIIGS exposure that could easily wipe out a quarter of its equity, if not more.

By extension, if this is how exposed a German bank is to the PIIGS, how bad do think the rest of the EU banking system is?

BAD.

This is why the ECB has been freaking out and pumping so much money into the EU banking system. You don’t spend over $1 trillion in nine months unless something very very bad is coming down the pike. That something “BAD” is the collapse of Europe’s banking system: a $46 trillion sewer of toxic PIIGS debt that is leveraged at more than 26 to 1 (Lehman was leveraged at 30 to 1 when it went under).

If you’re not already taking steps to prepare for the coming collapse, you need to do so now.

Those investors looking for actionable investment ideas could also consider our Private Wealth Advisory newsletter: a bi-weekly detailed investment advisory service that distills the most important geopolitical, economic, and financial developments in the markets into concise investment strategies for individual investors.

To learn more about Private Wealth Advisory… and how it can help you navigate the markets successfully…Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2012 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.