Central Banks Favour Gold as IMF Warns of “Collapse of Euro” and “Full Blown Financial Markets Panic”

Commodities / Gold and Silver 2012 Apr 18, 2012 - 06:38 AM GMTBy: GoldCore

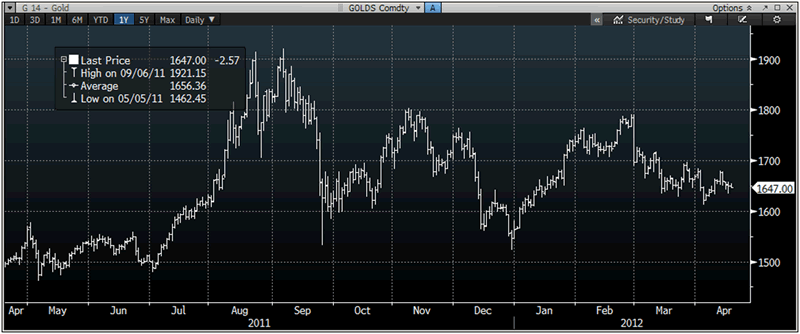

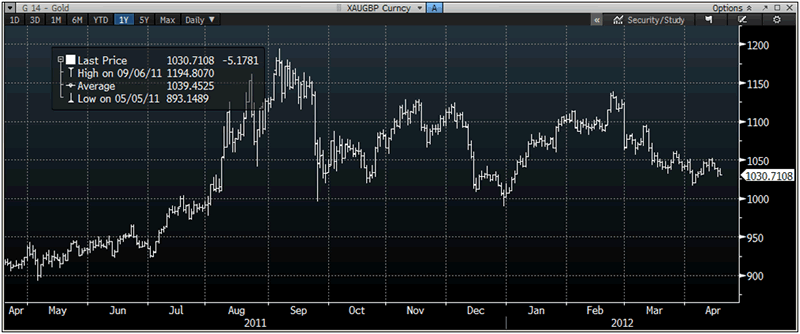

Gold’s London AM fix this morning was USD 1,646.50, EUR 1,258.41, and GBP 1,030.80 per ounce. Friday's AM fix was USD 1,652.00, EUR 1,255.51 and GBP 1,035.54 per ounce.

Gold’s London AM fix this morning was USD 1,646.50, EUR 1,258.41, and GBP 1,030.80 per ounce. Friday's AM fix was USD 1,652.00, EUR 1,255.51 and GBP 1,035.54 per ounce.

Silver is trading at $31.61/oz, €24.16/oz and £19.78/oz. Platinum is trading at $1,577.25/oz, palladium at $656.90/oz and rhodium at $1,350/oz.

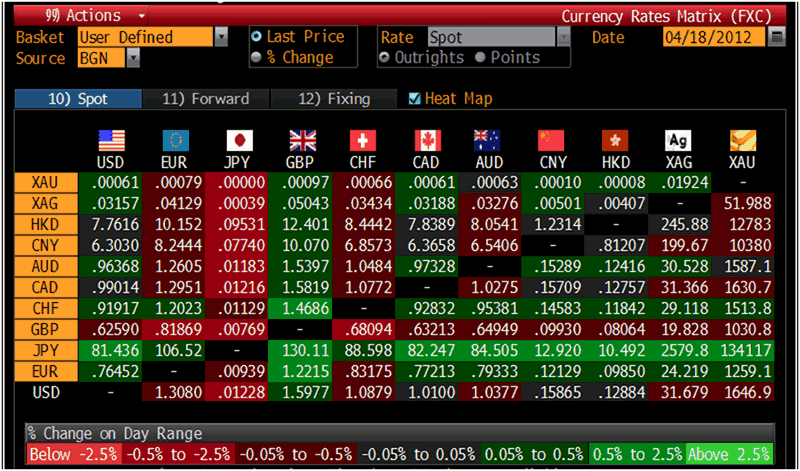

Cross Currency Table – (Bloomberg)

Gold fell $1.50 or 0.09% in New York and closed relatively unchanged at $1,650.20/oz yesterday. Gold traded sideways prior to gradually creeping up in late Asian trading. It then gave up those gains in European trading and is nearly unchanged from yesterday’s close in New York.

Gold remained relatively unchanged from yesterday as Spain’s debt auction eased some worries about the eurozone debt crisis. Although this is another temporary respite as the euro may remain under pressure ahead of Madrid’s long term debt sale later this week.

Investors appear more focused on Europe even though US industrial output numbers and housing starts were low. A surprise jump in German business sentiment lifted riskier assets including equities.

Gold 1 Year Chart – (Bloomberg)

India’s central bank is further debasing the Indian rupee which will lead to further safe haven demand for gold, and is still the world’s largest buyer of gold.

India has had its first rate cut in 3 years and was cut by a higher than expected 50 basis points to 8%.

This comes despite inflation being higher in March compared to last month surging to 9.47%.

The recent tax increase on gold was a futile attempt to curtail gold demand – as Indian policy makers realised accelerating inflation would lead to further gold demand.

Wedding season is at its peak in India now and Akshaya Tritiya, a large gold buying festival, happens later this month. There are forecasts of a 25% increase in demand during the Hindu festival next week after demand was curtailed during the gold jewellers strike (see Other News below).

Deepening negative real interest rates in India and the risk of an inflation spiral will see Indian demand remain robust and it may even accelerate if inflation deepens - contrary to suggestions that Indian gold demand will fall precipitously.

IMF: Risk of Collapse of Euro and “Full Blown Panic in Financial Markets”

The Eurozone could break up and trigger a “full-blown panic in financial markets and depositor flight” and a global economic slump to rival the Great Depression, the IMF warned yesterday.

In its World Economic Outlook report, the International Monetary Fund said the collapse of the crisis-torn single currency could not be ruled out.

It warned that a disorderly exit of one member country would have untold knock-on effects.

"The potential consequences of a disorderly default and exit by a euro area member are unpredictable... If such an event occurs, it is possible that other euro area economies perceived to have similar risk characteristics would come under severe pressure as well, with full-blown panic in financial markets and depositor flight from several banking systems," said the report.

"Under these circumstances, a break-up of the euro area could not be ruled out."

“This could cause major political shocks that could aggravate economic stress to levels well above those after the Lehman collapse," said the report.

Risk Averse Central Banks Favour Gold Over Euro

The risks outlined by the IMF are real and are being taken seriously by central banks who are becoming more favourable towards diversifying foreign exchange reserves into gold.

Central bank reserve managers responsible for trillions of dollars of investments are shunning euro assets and questioning the currency’s haven status because of the region’s sovereign debt crisis, research has found, according to the FT.

Among the most conservative of investors, central bankers have tended to keep much of their fx reserves in high quality euro and dollar denominated assets, such as government bonds.

However, a survey of reserve managers at 54 central banks responsible for portfolios worth $6 trillion, almost half the world’s total, signals that the sovereign debt crisis has sparked a reversal of that trend.

More than three-quarters said the sovereign debt crisis has had a profound impact on their reserve management strategy, with their central banks pulling back from eurozone counterparties and reconsidering attitudes toward the single currency.

Signifying the mood of caution among the world’s central bankers, 71% of those polled said gold was a more attractive investment than it had been at the start of last year. Central banks made their largest purchases of gold in more than four decades last year and have continued to buy the precious metal in the early months of 2012.

Central bank demand is set to continue and may accelerate as the global debt crisis deepens in the coming months.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

XAU/GBP 1 Year Chart – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.