Inflation and Hidden Gold Taxation Historical Case Studies

Commodities / Gold and Silver 2012 Apr 20, 2012 - 07:19 AM GMTBy: Dan_Amerman

The number one reason investors buy gold is to protect against the government policies that create inflation. However, the government has "rigged the game" in such a way that the higher the rate of inflation, the more of a gold investor's net worth ends up with the government instead of the investor.

The number one reason investors buy gold is to protect against the government policies that create inflation. However, the government has "rigged the game" in such a way that the higher the rate of inflation, the more of a gold investor's net worth ends up with the government instead of the investor.

An examination of three historical case studies of long-term gold investment during a time of substantial inflation shows how under existing law and tax rates, the US federal government used the 1-2 combination of inflation and taxes to not only take all gold investor profits, but to confiscate part of the investors' starting net worth as well. These three real world analyses explore gold acting as a perfect inflation hedge, gold experiencing asset inflation, and gold experiencing asset deflation.

This isn't theory, nor is it speculation. This is actual history, and it is likely to be the future as well in the United States and other nations. The government's "game" is more sophisticated than most investors realize, and it is deeply ironic that many unsuspecting precious metals investors trying to protect themselves from government-created inflation are playing right into the government's hands when it comes to wealth confiscation under existing law.

The above notwithstanding, there is a strong case to be made that this is one of the best times in history to be buying gold or silver. But to realize those gains in practice, investors first need a thorough understanding of how the game has been rigged, before they can find ways of overcoming the problems. Through examination of the after-inflation and after-tax results of what happened in the past, these three case studies provide vital information for investors who want to prepare for the future with eyes wide open.

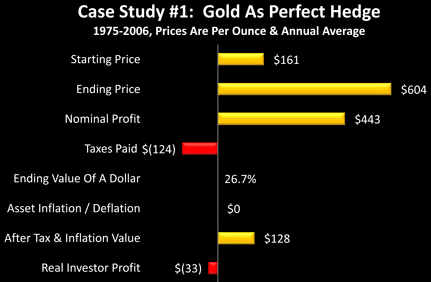

Case Study #1: Gold As A Perfect Inflation Hedge

The years from 1975 to 2006 are an example of gold acting as a perfect inflation hedge over a 31 year period. In 1975, the average price for gold was $161 an ounce (London market, per Kitco). By 2006 the average price had climbed to $604 an ounce, which on the surface looks to be a dazzling $443 per ounce profit, or a 275% return.

Until we adjust for what a US dollar was worth at the time - which by 2006 was only 27 cents, compared to what it would buy in 1975 (based on the Consumer Price Index). When we multiply our $604 price per ounce by 27% to account for the loss in purchasing power, we are back to $161 an ounce. Gold precisely maintained its value in inflation-adjusted terms, which is exactly what it is supposed to do over the long term.

However, it is crucial to take into account that the same government whose policies created the inflation, quite deliberately doesn't recognize inflation when it comes to paying taxes. The way that the government has set up the rules is that a dazzling $443 per ounce profit has been earned, and investors must pay the government its share of those (illusionary) profits.

Another issue is that banks and brokerage firms make their money off of your money, which is supposed to be supporting either the stock market, or available for borrowing by the government as well as banks and corporations. When too many people take their savings out of the "system" and buy gold instead, then bank and brokerage profits go down and there is a weakening of support for both government bonds and the stock market, which then potentially leads to lower bonuses for bankers and corporate executives.

The government is quite responsive when the profits of major campaign contributors and its own cost of borrowing are threatened, and in the United States, gold is therefore taxed at a punitive "collectibles" tax rate which is almost twice the normal long term capital gains tax rate of 15%, in order to discourage such "socially undesirable" investments that benefit no one but the saver.

When we take the $443 per ounce in illusionary profits that are the result of the inflation that occurred between 1975 and 2006, and we pay the government its punitive 28% tax rate on our attempt to preserve the value of our savings against that inflation which its policies created, then we must pay $124 per ounce in taxes. This leaves us with $480 per ounce after taxes. And when we adjust for the 73% destruction of the value of a dollar, the purchasing power of the gold we bought for $161 an ounce is down to $128 an ounce.

This means that we have lost 18% of our net worth in after-tax and after-inflation terms, and every cent of that loss has gone directly to the government in the form of inflation taxes. For those who are not already aware of how this works, my tutorial "Hidden Gold Taxes: The Secret Weapon Of Bankrupt Governments" (linked below) contains a much more thorough, step by step explanation.

http://danielamerman.com/articles/GoldTaxes1.htm

What the period from 1975 to 2006 shows is that the playing field is rigged against gold investors as a quite deliberate matter of government policy. The holding period in question was a good one for gold investors. The year 1975 was a relatively cheap time to buy in, for $161 an ounce was much less than where gold would go thereafter. Then a major round of inflation did happen. And 2006 was not a bad year to close out, as the $604 average price was 36% above the 2005 average of $444 per ounce, and more than twice the price of five years before, when gold had averaged $271 an ounce.

The years between 1975 and 2006 were chosen for this case study because they are the best long-term example of gold doing what gold is supposed to do in modern times. This shows what would have happened in the real world if a well informed investor had correctly anticipated that inflation would get worse, bought in early and cheap, and then held that gold as a safe refuge right through the biggest bout of inflation in the modern era, as stock and bond investment returns were slaughtered all around them. It then assumes this investor sold out at the highest nominal price for gold that had been seen in a quarter century, for gold had not averaged over $600 an ounce on an annual basis since 1980.

This was exactly the way that gold as a refuge from monetary inflation over the long term is supposed to work - but as we can see, it still wasn't good enough. That is because the government has written the rule book in such a way that high inflation allows it to confiscate gold investor net worth in the form of real taxes paid on illusory profits.

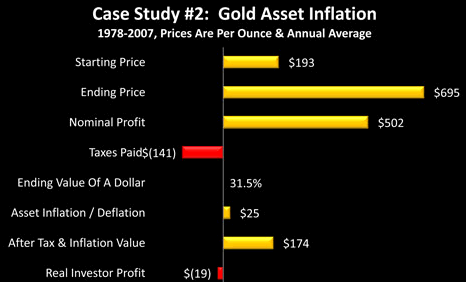

Case Study #2: Gold & Asset Inflation

For the gold investor to have a shot at truly coming out ahead with a simple gold-only strategy, there needs to be asset inflation in gold . Asset inflation and asset deflation are determined by looking at investment performance in inflation-adjusted terms. The destruction of the value of the dollar is netted out, in order to determine whether the purchasing power of the asset itself rose or fell.

For a real world case study of long-term asset inflation in gold, we will look at the years 1978 to 2007, during which average annual gold prices rose from $193 an ounce to $695 an ounce. This was a climb of $502 an ounce, which was an increase of 260%.

This time when we adjust for inflation, the value of the dollar fell by 69% over a 29 year holding period. When we discount the $695 per ounce price in 2007, we come up with $218 an ounce in 1978 dollars, which translates to a real increase of 13% over the $193 per ounce we paid.

Gold did not merely keep up with monetary inflation - the increase in price exceeded what was needed to keep up with the destruction of the value of the dollar. Thus, this is an example of gold experiencing genuine asset inflation. Whether we look at gold going from $193 an ounce to $218 in 1978 dollars, or from $613 to $695 an ounce in 2007 dollars, both perspectives are equally valid, and the bottom line is we are up 13% in after-inflation terms.

Now, let's take a look at taxes on our earnings. Which means we have to return to a rigged playing field, where we aren't paying taxes on a 13% profit, but on a 260% profit. The rules have been set up so that government tax schedules don't see the inflation-adjusted increase from $613 to $695, they very simply see our buying gold for $193 an ounce, and selling it for $695 an ounce, for a profit of $502 per ounce. The difference between our $82 in real profits (in 2007 dollars), and the $502 in tax return profits, is $420 in illusory income that is every bit as taxable as the real income.

Another way of phrasing this, using real world numbers, is that the government has set up the rules so that when we outwit the government and turn the government's inflationary policies into a $82 per ounce genuine profit in our pocket, we not only have to pay taxes on every $1.00 of those profits, but we also have to pay taxes on another $5.12 in illusory income that doesn't actually exist in real terms.

When we take that 5.1 to 1 ratio of illusory to real income and we tax it at the punitive rate which the government uses to discourage people from making "socially undesirable" gold investments that undercut senior executive banking bonuses and overall stock market wealth, then we are left with less than what we started with.

Once we have paid the government its share of the $502 in nominal profits, which is $141 per ounce (28%), then we are left with $554 an ounce after-tax. When we then discount for a 1978 dollar only being worth 31 cents by 2007, we have $174 an ounce on an after-inflation and after-tax basis, meaning we are down 10% from where we started. In other words, had we bought gold in 1978 and sold in 2007, then the government would have taken 100% of our gold asset inflation profits, and helped itself to 10% of our starting net worth as well.

To add further perspective, a normal long-term capital gains tax of 15% on an ordinary gain of $82 would have been $12.30. But because they were being taxed on illusionary profits at a punitive tax rate, long-term gold investors would have paid $141 , which is more than 11 times as much in taxes.

Unfortunately - because of the way the government has rigged the game - it can get much worse than that for gold investors.

The higher the degree of inflation - the more illusory dollars of profit which gold asset inflation must generate before real after-tax profits are earned. The above historical ratio of 5.1 to 1 could easily be 10 to 1, 20 to 1, or higher, given the much greater inflationary dangers of today. The higher the tax rate - the more damage that is done by inflation taxes. And the higher the tax rate - the less money there is left after taxes have been paid on real profits, to offset the taxes on illusory profits. Indeed, I think many investors would be shocked to learn just how much asset inflation is required to offset the 1-2 combination of potentially soaring rates of inflation and potentially higher future tax rates.

Now one might think that having understood the relationships above for many years now, that I would have been urging that people avoid precious metals as investments. However, the reverse is true, and I have been a public advocate of purchasing gold over the last several years. I believe we are currently in a building inflationary crisis, and historically speaking, when an inflationary crisis is still ramping up, gold asset inflation can easily outstrip the rate of monetary inflation by an amount where investors can come out ahead. And as expected, asset inflation has been so rapid that investor net worth has still been rising even after punitive tax rates are paid, albeit not as much as it would under a more fair tax schedule.

That said - real investment returns over the longer term are not based on inflation or the price of gold alone, but upon the three way interaction between monetary inflation, asset inflation (or deflation), and government tax policies. Monetary inflation is not the number one determinant of real gold investor returns - as what look to be powerfully positive returns on the surface, have historically often turned out to be negative returns when everything is taken into account. To achieve the results we want over the medium and long term in times of high inflation - there is no substitute for understanding all the factors, while the price of not understanding can be very high indeed.

Case Study #3: Gold & Asset Deflation

The public is often told that the question is whether we will experience inflation or deflation. This is a gross oversimplification, however, that can be quite dangerous for investors who believe it to be true. Implicit in the assumption that it must be one or another, is that you can't have both together. The idea is that if we are experiencing inflation, then we are protected from deflation, and if we are experiencing deflation, then we are protected from inflation.

Intuitively, that seems to be an obvious and necessary truth. But when we dig a level deeper and look at actual history, it is dead wrong. S imultaneous monetary inflation and asset deflation are the norm for times of financial crisis (with paper currencies), and the combination can be particularly toxic when we factor in inflation taxes. To explore how this has historically impacted gold investors, we will take a look at 1980 and 2008 - two historically notable years of financial crisis.

Click here to continue reading the article

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2012 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.