Secrets of the Spanish Banking System That 99% of Analysts Fail to Grasp

Interest-Rates / Eurozone Debt Crisis Apr 30, 2012 - 12:46 PM GMTBy: Graham_Summers

Spain is a catastrophe on such a level that few analysts even grasp it.

Spain is a catastrophe on such a level that few analysts even grasp it.

Indeed, to fully understand just why Spain is such a catastrophe, we need to understand Spain in the context of both the EU and the global financial system.

The headline economic data points for Spain are the following:

- Spain’s economy (roughly €1 trillion) is the fourth largest in Europe and the 12th largest in the world.

- Spain sports an official Debt to GDP of 68% and a Federal Deficit between 5.3-5.8% (as we’ll soon find out the official number)

- Spain’s unemployment is currently 24%: the highest in the industrialized world.

- Unemployment for Spanish youth is 50%+: on par with that of Greece

On the surface, Spain’s debt load and deficits aren’t too bad. So we have to ask ourselves, “Why is unemployment so high and why are Spanish ten year bills approaching the dreaded 7%?” (the level at which Greece and Portugal began requesting bailouts).

The answer to these questions lies within the dirty details of Spain’s economic “boom” of the 2000s as well as its banking system.

For starters, the Spanish economic boom was a housing bubble fueled by Spain lowering its interest rates in order to enter the EU, not organic economic growth.

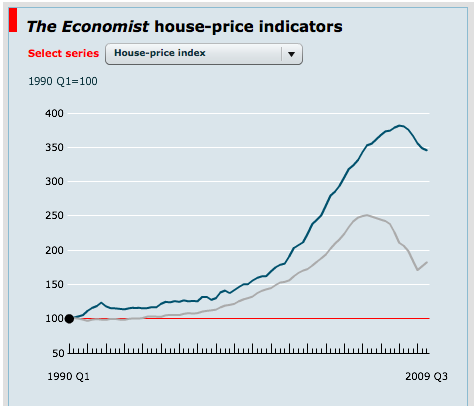

Moreover, Spain’s wasn’t just any old housing bubble; it was a mountain of a property bubble (blue line below) that made the US’s (gray line below) look like a small hill in comparison.

In the US during the boom years, it was common to hear of people quitting their day jobs to go into real estate. In Spain the boom was so dramatic that students actually dropped out of school to work in the real estate sector (hence the sky high unemployment rates for Spanish youth).

Spanish students weren’t the only ones going into real estate. Between 2000 and 2008, the Spanish population grew from 40 million to 45 million (a whopping 12%) as immigrants flocked to the country to get in on the boom. In fact, from 1999 to 2007, the Spanish economy accounted for more than ONE THIRD of all employment growth in the EU.

This is Spain, with a population of just 46 million, accounting for OVER ONE THIRD of the employment growth for a region of 490 million people.

This, in of itself, set Spain up for a housing bust/ banking Crisis worse than that which the US faced/continues to face. Indeed, even the headline banking data points for Spain are staggeringly bad:

- Spanish banks just drew €227 billion from the ECB in March: up almost 50% from its February borrowings

- Spanish banks account for 29% of total borrowings from the ECB

- Yields on Spanish ten years are approaching 7%: the tipping point at which Greece and other nations have requested bailouts

As bad as these numbers are, they greatly underestimate just how ugly Spain’s banking system is. The reason for this is due to the structure of the Spanish banking industry.

Spain’s banking system is split into two tiers: the large banks (Santander, BBVA) and the smaller, more territorial cajas.

The caja system dates back to the 19th century. Cajas at that time were meant to be almost akin to village or rural financial centers. As a result of this, the Spanish country is virtually saturated with them: there is approximately one caja branch for every 1,900 people in Spain. In comparison there is one bank branch for every 3,130 people in the US and one bank branch for every 6,200 people in the UK.

Now comes the bad part…

Until recently, the caja banking system was virtually unregulated. Yes, you read that correctly, until about 2010-2011 there were next no regulations for these banks (which account for 50% of all Spanish deposits). They didn’t have to reveal their loan to value ratios, the quality of collateral they took for making loans… or anything for that matter.

As one would expect, during the Spanish property boom, the cajas went nuts lending to property developers. They also found a second rapidly growing group of borrowers in the form of Spanish young adults who took advantage of new low interest rates to start buying property (prior to the housing boom, traditionally Spanish young adults lived with their parents until marriage).

In simple terms, from 2000 to 2007, the cajas were essentially an unregulated banking system that leant out money to anyone who wanted to build or buy property in Spain.

Things only got worse after the Spanish property bubble peaked in 2007. At a time when the larger Spanish banks such as Santander and BBVA read the writing on the wall and began slowing the pace of their mortgage lending, the cajas went “all in” on the housing market, offering loans to pretty much anyone with a pulse.

To give you an idea of how out of control things got in Spain, consider that in 1998, Spanish Mortgage Debt to GDP ratio was just 23% or so. By 2009 it had more than tripled to nearly 70% of GDP. By way of contrast, over the same time period, the US Mortgage Debt to GDP ratio rose from 50% to 90%. Like I wrote before, Spain’s property bubble dwarfed the US’s in relative terms.

The cajas went so crazy lending money post-2007 that by 2009 they owned 56% of all Spanish mortgages. Put another way, over HALF of the Spanish housing bubble was funded by an unregulated banking system that was lending to anyone with a pulse who could sign a contract.

Indeed, these banks became so garbage laden that a full 20% of their assets were comprised of loan payments being made by property developers. Mind, you, I’m not referring to the loans themselves (the mortgages); I’m referring to loan payments: the money developers were sending in to the banks.

To try and put this into perspective, imagine if Bank of America suddenly announced that 20% of its “assets” were payments being sent in by borrowers to cover mortgage debts. Not Treasuries, not mortgages, not loans… but payments being sent in to the bank on loans and mortgages.

This is the REAL problem with Spain’s banking system. It’s saturated with subprime and sub-subprime loans that were made during one of the biggest housing bubbles in the last 30 years.

Indeed, to give you an idea of how bad things are with the cajas, consider that in February 2011 the Spanish Government implemented legislation demanding all Spanish banks have equity equal to 8% of their “risk-weighted assets.” Those banks that failed to meet this requirement had to either merge with larger banks or face partial nationalization.

The deadline for meeting this capital request was September 2011. Between February 2011 and September 2011, the number of cajas has in Spain has dropped from 45 to 17.

Put another way, over 60% of cajas could not meet the capital requirements of having equity equal to just 8% of their risk-weighted assets. As a result, 28 toxic caja balance sheets have been merged with other (likely equally troubled) banks or have been shifted onto the public’s balance sheet via partial nationalization.

On that note, I fully believe the EU in its current form is in its final chapters. Whether it’s through Spain imploding or Germany ultimately pulling out of the Euro, we’ve now reached the point of no return: the problems facing the EU (Spain and Italy) are too large to be bailed out. There simply aren’t any funds or entities large enough to handle these issues.

Those investors looking for actionable investment ideas could also consider our Private Wealth Advisory newsletter: a bi-weekly detailed investment advisory service that distills the most important geopolitical, economic, and financial developments in the markets into concise investment strategies for individual investors.

To learn more about Private Wealth Advisory… and how it can help you navigate the markets successfully…Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2012 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.