America's "Safest Long Term Investment" Is Gold - Gallup

Commodities / Gold and Silver 2012 May 02, 2012 - 07:54 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,652.50, EUR 1,257.71, and GBP 1,020.44 per ounce.

Gold’s London AM fix this morning was USD 1,652.50, EUR 1,257.71, and GBP 1,020.44 per ounce.

Yesterday's AM fix was USD 1,661.25, EUR 1,253.02 and GBP 1,024.70 per ounce.

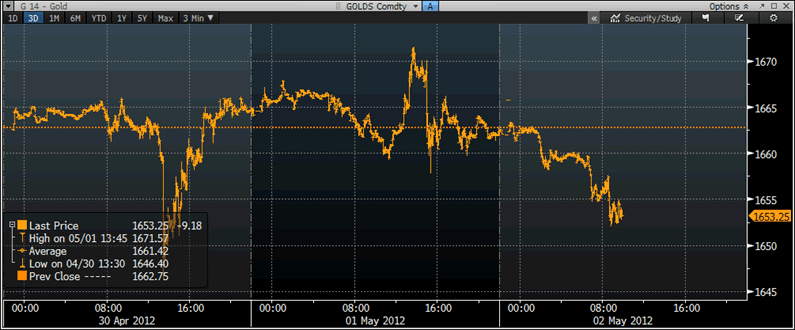

Gold fell $4.40 or 0.26% in New York yesterday and closed at $1,661.70/oz. Gold rose to over $1,670/oz in early US trading prior to selling capped price gains and the price then fell back to the $1,660/oz level.

Gold gradually fell during trading in Asia and this weakness has continued in European trading where gold looks set to test the $1,650/oz level or $1,646/oz, the price low after the $1.24 billion sell trade on Monday.

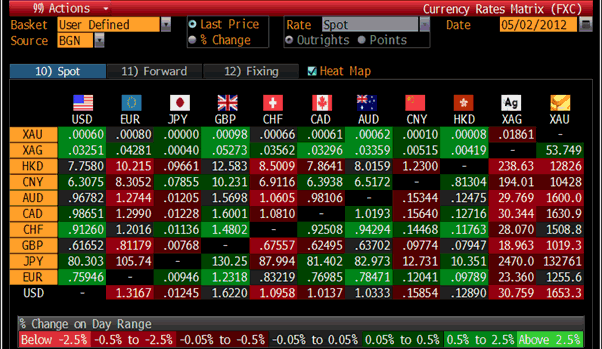

Cross Currency Table – Bloomberg

Gold’s weakness yesterday may have been due to the positive manufacturing data in China and the US leading to traders being hesitant to commit to the long side.

The slowdown in demand from India and data showing holdings in ETFs dropped to the lowest level in 3 months and US Mint monthly gold coin sales fell in April falling to the lowest level since June 2008 may have may have also tempered enthusiasm.

However, central bank demand is likely to be continuing at these levels and central banks are almost certainly still buying on the dips. Bullion coin and bar demand and ETF demand is likely to pick up in the coming weeks when the global debt crisis deteriorates again.

Data from Europe this morning was very negative with Italian industrial production (PMI) falling off a cliff, German manufacturing shrinking, Irish exports faltering on slower global growth, the Greek economy still floundering and Spanish unemployment figures appalling.

The Chairman of the White House Council of Economic Advisers, Alan Krueger, said yesterday that the European crisis poses “some risk” to the US and global economy. Four US central bankers said that more stimuli probably won’t be needed. The Fed bought $2.3 trillion of bonds in two rounds of so-called quantitative easing from December 2008 to June 2011 thereby debasing the dollar.

HSBC Securities on April 29 downgraded its forecast for average gold prices this year to $1,760/oz from $1,850/oz, with analyst James Steel citing “a steep reduction in market expectations of further quantitative easing or other monetary stimulus.”

America's “Safest Long Term Investment” Is Gold - Gallup

Americans feel “gold is the safest long term investment” today, a Gallup survey has found.

Gold was favoured over four other types of investments perceived as the best long term choice for American investors today.

28% of the American public choose gold as their favoured investment of choice today.

Gold in USD – 3 Days (3 Minute) – Bloomberg

Real estate followed in second place, with 20% seeing it as the best long term investment.

Paper assets were less popular with savings accounts and certificates of deposits (CDs) tied with stocks and mutual funds at 19%.

Bonds came last at 8%.

This suggests that the American public may not be as uninformed when it comes to investing as is often suggested.

According to Gallup, "investing in gold has gained in popularity in recent years as low interest rates have made traditional savings instruments less attractive, and instability in the stock and real estate markets has undermined the mass appeal of those options."

"Meanwhile, the rising trajectory of the price of gold over the past several years apparently offers more of the returns and stability investors seek."

While some may find the Gallup poll findings worrisome from a contrarian perspective, it is not.

Gold ownership remains very low amongst the public in most of the western world.

The poll’s findings suggest that this may change in the coming months and years.

While surveys often show that people are favourably disposed towards and instinctually trust gold, there remains a massive lack of knowledge about how to “invest in” or buy gold for financial insurance reasons. This lack of knowledge and awareness leads to the low levels of gold ownership in the western world today.

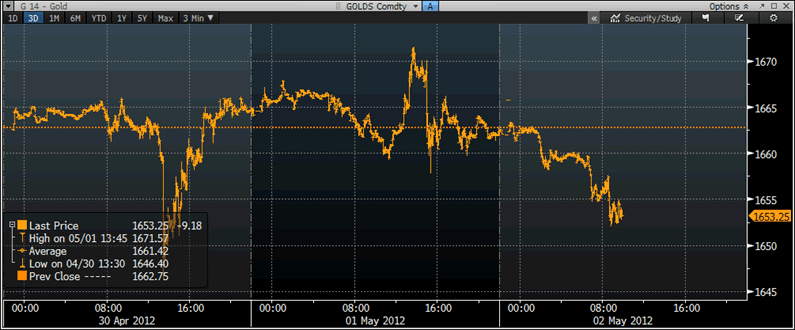

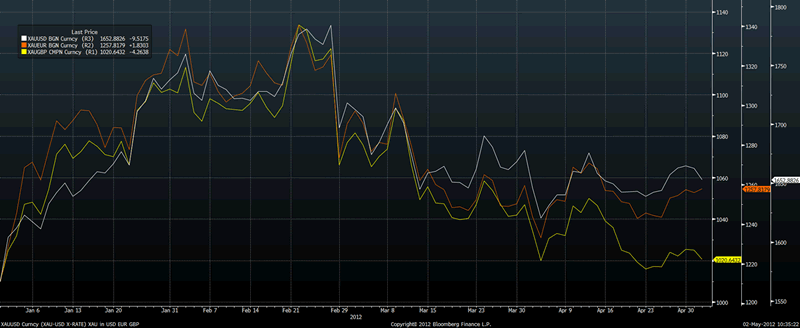

Gold in USD (White), EUR (Orange) and GBP (Yellow) YTD – Bloomberg

The non-specialist financial media continues to rarely, if ever, cover gold. When it does cover gold it is often in a negative light – with frequent suggestions that it is a “bad investment” and a “bubble”. Also, gurus or experts are often allowed to voice their negative opinions on gold without seeking plurality of opinion and getting the other side of the argument.

There are rarely comprehensive articles looking at the best, most cost-effective and safest ways to own gold as there are with other asset classes such as bank deposits, bonds and equities.

This will change in the coming years when there is less of a bias against gold and a realisation of the importance of gold as a diversification, and gold is treated and covered in the same way that equities, bonds and cash are covered today.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.