Has Gold Finally Bottomed ?

Commodities / Gold and Silver 2012 May 22, 2012 - 01:01 PM GMTBy: Clive_Maund

"Has gold finally bottomed?" That is the big question we are going to attempt to answer in this update. Last week it bounced sharply after it arrived at the strong support at its September and December lows. This was a development that was easy to predict and it was predicted on the site hours before the bounce started.

"Has gold finally bottomed?" That is the big question we are going to attempt to answer in this update. Last week it bounced sharply after it arrived at the strong support at its September and December lows. This was a development that was easy to predict and it was predicted on the site hours before the bounce started.

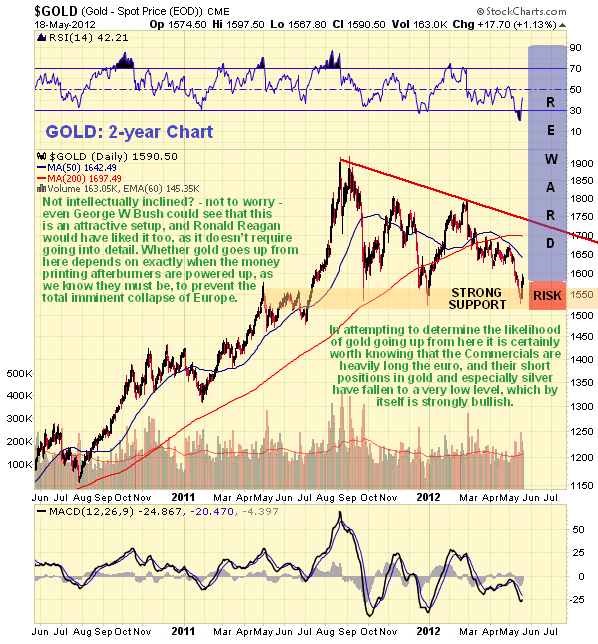

On its 2-year chart we can see that by dropping down to its December lows, gold aborted the potential Head-and-shoulders continuation pattern that had earlier looked like it was completing. That, however, does not mean that some other reversal pattern is not in the process of completing. Gold's immediate fate depends on whether the gathering deflationary forces can be beaten back by another tidal wave of printed money. Europe is teetering on the edge of an abyss and it is thought that the powers that be are summoning up a veritable tsunami of QE is order to avert the collapse into chaos that now threatens. The key question here is timing - how long are they going to leave it - how long can they afford to risk waiting - until they intervene with this QE tsunami? If the markets don't see light at the end of the tunnel soon in the form of this impending QE they are likely to crash as deflation impacts - if it becomes obvious that the QE is on its way, then we are likely to see a recovery in commodities generally and the Precious Metals in particular, and given the magnitude of the inflation that this QE is likely to stoke up, coming on top of all the other stimulus, this recovery could mark the start of a huge upleg in commodity prices.

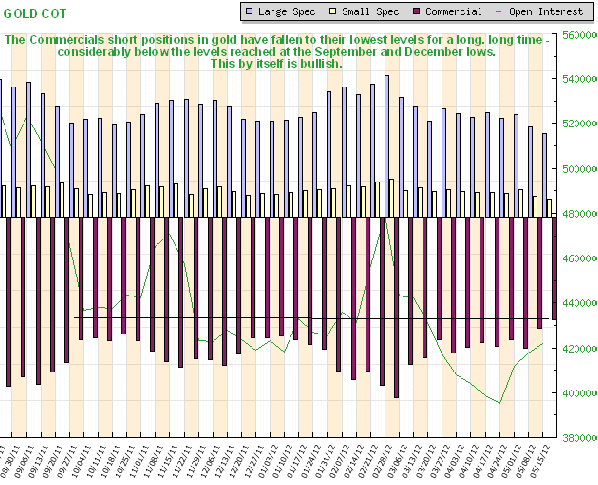

While it is not easy to tell when exactly this QE is likely to be forthcoming, there are some other means we can employ to determine its likelihood soon. In addition to the normal technical indicators which show gold to be oversold and in position to commence another upleg, barring an out market crash, we can observe what the Smart Money is doing by reference to their positions as revealed by the latest COT charts.

Gold's COT chart reveals that the Commercials have scaled back their short positions to their lowest levels for the period shown by this chart, which dates back to last August, and they are thus at lower levels than those at the lows of last September and last December. By itself this is clearly a bullish indication, and here we should note that the latest COT chart for silver is much more startlingly bullish. This is a reliable sign that we may well have just seen the bottom for this cycle.

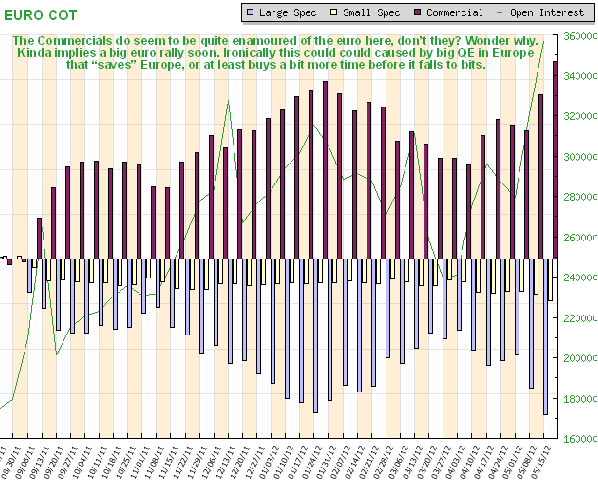

It is therefore interesting to observe that the Commercials have ramped up their long positions in the euro to massive record levels - levels which considerably exceed those attained in January just before a heavy dollar selloff ensued. Unless it's different this round, this does not bode well for the dollar going forward at all.

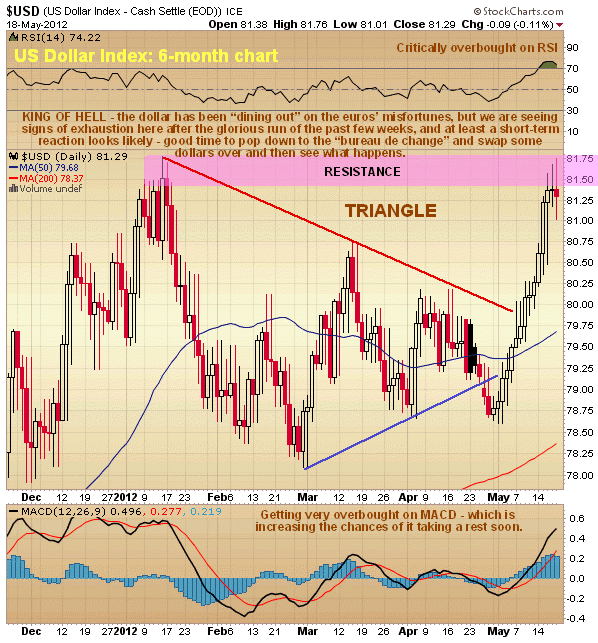

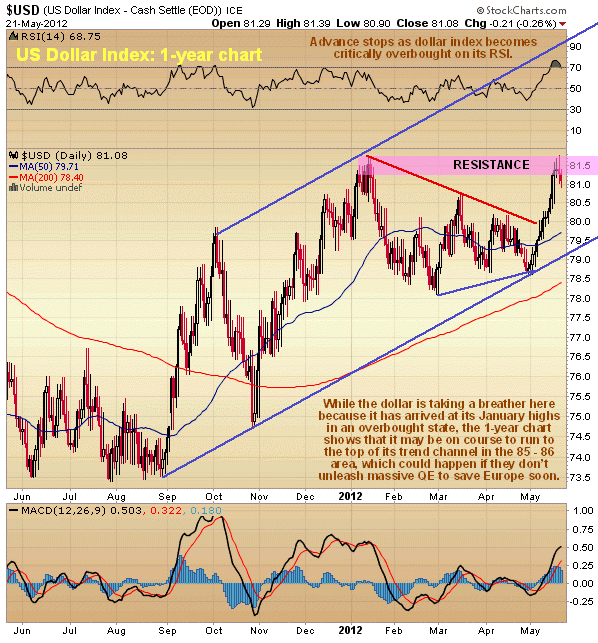

As we know, the dollar has capitalized handsomely on the euro's predicament, and it has soared in recent weeks, despite the grave and appalling state of affairs prevailing in the US with regards to its own debt situation. On its 6-month chart we can see that after breaking out from a Triangle pattern the dollar index has staged a very impressive rally to arrive at a first target at the resistance at its January highs in a critically overbought state short-term, which is why we have been looking for it to stall out and possibly react back, and as pointed out above the Commercial's huge long position in the euro makes a reaction morte likely.

On the other hand, the 1-year chart for the dollar shows that it has the potential, after digesting its recent gains, to run to the top of the large trend channel shown on the chart, which means it could get as high as 85 - 86. Should this occur it is obvious that it will be very bad news indeed for the markets, as such a development would involve the forces of deflation bursting onto center stage.

With everything now depending on how bad things get before the rulers of Europe open the floodgates on the biggest torrent of QE the world has ever known, which will send gold and silver to the moon, but before which they COULD crash the nearby support and drop further, you might think that there is no way to play the current situation, in which case you would be wrong. The most important point to take note of at this juncture is that we have an exceptionally favorable risk/reward profile for those going long gold and silver here, as the strong support at the September and December lows has just been validated by last week's strong bounce off it - so you can buy here and set either intraday or closing stops beneath it, and it will be even better if prices react back towards last week's lows again in the near future. If the deflationary scenario prevails near-term you get taken out for a minor loss. If it becomes obvious that the huge QE is in the pipeline, then both gold and silver will soar, and the upside from here is relatively unlimited - and the COTs are pointing to this scenario prevailing.

Finally it's worth reminding you all that gold stocks are now extraordinarily cheap compared to gold itself, as made plain by the XAU index over gold chart going back 20 years - this chart is now showing low readings that are approaching the extremes at the depths of the market selloff late in 2008 at the height, or rather depth, of the financial crisis at that time, which, incidentally, is a sideshow compared to what will happen shortly if they don't get on with it and unleash the great QE rescue, which is not designed to solve the crisis, only postpone it a little longer, at the expense of stoking up an inflationary firestorm. So does this mean that it's time to go storming in to fill your boots with gold stocks - not necessarily, because if they don't get on with it and do the QE soon, then markets will crash and PM stocks could get dragged even further into the mire, but what this chart does definitely tell us is to stand ready to wade in and pick up bargains immediately the QE is telegraphed. This will be an unmistakable event that should cause a truly dramatic rally, particularly across the commodities sector. With honorable exceptions, juniors should continue to be avoided. Many of them are now in the habit of using routine stock dilution to keep their offices going and their coffee machines on the go, and their token rigs turning, but due to their stock prices having dwindled to almost nothing, they will be obliged to dilute even more aggressively to keep going, so it doesn't look like there is much relief in sight for the beleagured holders of these stocks. The lesson here is to stick with producers, especially those that are set to ramp up production.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2012 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.