U.S. Government Budget Deficit Sorting Out America's Fiscal Cliff Issue

Politics / US Debt May 25, 2012 - 03:23 AM GMTBy: Asha_Bangalore

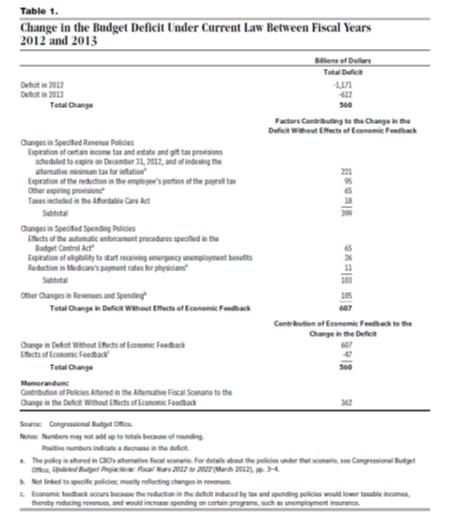

Under current law, the federal budget deficit in fiscal year 2013 will show a drastic decline from fiscal year 2012 as a result of scheduled increases in taxes and reductions in government spending. The Congressional Budget Office (CBO) estimates that the federal budget deficit of $1.17 trillion in fiscal 2012 will shrink to $612 billion in fiscal 2013. This sharp reduction of the federal budget deficit is referred to as the “fiscal cliff” in the financial media and macroeconomic discussions. The economic impact of these likely changes in the federal budget deficit is the subject of intense debate at the present time. The objective here is to highlight the impending changes in federal taxes and spending, with the help of CBO’s summary presented in Table 1, and attempt to understand the economic consequences of these changes.

Under current law, the federal budget deficit in fiscal year 2013 will show a drastic decline from fiscal year 2012 as a result of scheduled increases in taxes and reductions in government spending. The Congressional Budget Office (CBO) estimates that the federal budget deficit of $1.17 trillion in fiscal 2012 will shrink to $612 billion in fiscal 2013. This sharp reduction of the federal budget deficit is referred to as the “fiscal cliff” in the financial media and macroeconomic discussions. The economic impact of these likely changes in the federal budget deficit is the subject of intense debate at the present time. The objective here is to highlight the impending changes in federal taxes and spending, with the help of CBO’s summary presented in Table 1, and attempt to understand the economic consequences of these changes.

Source: http://www.cbo.gov/sites/default/files/cbofiles/attachments/FiscalRestraint_0.pdf

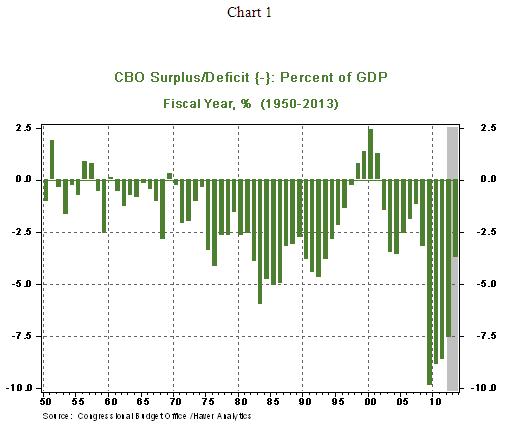

According to the CBO’s calculations listed in Table 1, the federal budget deficit as a percentage of gross domestic product (GDP) would stand at 3.8% of GDP in 2013 versus 7.6% of GDP in 2012 (see Chart 1) -- this is the largest reduction during a single fiscal year in the entire post-war period (forecasts of the federal budget deficit in 2012 and 2013 as a percentage of GDP are the last two shaded data points in Chart 1). As a result of the large decline in the budget deficit, the CBO estimates that real GDP would drop 1.3% in the first half of 2013 and register a 2.3% increase in second half of 2013, with real GDP in calendar year 2013 posting only a 0.5% increase.

By contrast, private-sector and the Federal Reserve’s predictions of real GDP growth in 2013 are markedly different. It is possible that the private sector and Fed are discounting the ramifications of the current law to some extent. The Fed’s April 2012 projections show economic growth of 2.7% – 3.1% in 2013 on a Q4-to-Q4 basis. The May 2012 Blue Chip consensus is a 2.5% increase in real GDP for 2013. The current Northern Trust forecast of a 3.2% increase in real GDP during 2013 is tied to the performance of bank credit; our previous commentaries have expounded at length about the relationship between real GDP growth and bank credit growth.

The CBO’s forecast does not incorporate the outcome of U.S. elections in November, an important game-changer. Aspects of the current law are bound to be retained, diluted or modified, depending on not only who is president but also by the composition of both the House and Senate.

A few aspects of the legislative provisions listed in Table 1 have received more attention than others. It is worthy to explore these to appreciate the complexity of the issue at hand. Let us split the impending changes in federal taxes and spending into three categories stimulus measures, income tax cuts, and other taxes and spending – and examine each independently for purposes of simplicity.

Stimulus Measures: The Middle Class Tax Relief and Job Creation Act of 2012 extended the 2.0% cut in payroll taxes of employees through December 31, 2012; it has been in effect since January 1, 2011. Expiration of the tax cut is estimated to raise federal tax revenues by $95 billion. This act also extended emergency unemployment benefits until December 31, 2012. Both political parties have shown a willingness to let these stimulus measures expire. Therefore, if economic data are of palatable strength in the months ahead, payrolls tax cuts and extended unemployment benefits could expire. The sum total of these two items is $116 billion ($95 billion +$21 billion), which is roughly 1.0% of total consumer spending.

Income Tax Cuts: Personal income tax rates as per the Economic Growth and Tax Relief Reconciliation Act of 2001, the Jobs and Growth Tax Relief Reconciliation Act of 2003 and the American Recovery and Reinvestment Act of 2009 are set to expire in December 2012. Tax payments of individuals will be affected from the beginning of 2013, when tax withholding rises. In addition, the Alternative Minimum Tax (AMT) adjustment expired in December 2011; if a temporary patch is not enacted, an increase in tax liabilities will be a part of the 2012 income tax returns filed in the early months of 2013. The probability of not enacting an AMT patch is very low; tax revenues are expected to advance if this provision is allowed to expire. With regard to the income tax cuts, the outcome of the elections will play an important role. If President Obama is re-elected, the prospect of a partial expiration of income tax cuts – particularly that of wealthy households – is high.

However, if Mitt Romney wins the election, there is a strong likelihood that the personal income tax cuts in place will be made a permanent feature of the tax code. The CBO estimates that these two provisions and a few other smaller changes in taxes would raise revenues by $221 billion (see Table 1) in 2013. This is the largest component of change listed in Table 1 and probably the most controversial. Ultimately, the income tax component of current law is subject to the political fortunes of the two parties and thus any economic impact established now will have to be revised after elections, as the possible directions it may take are far too many.

Other Taxes and Spending: The Budget Control Act includes automatic spending cuts to trim discretionary spending and mandatory items of federal expenditures. The tally for this category is roughly a $65 billion reduction in spending, with defense expenditures as a large item of cutbacks. Again, election results will influence the nature and magnitude of defense outlays. The scheduled reduction in Medicare payments to physicians is estimated to lower federal government spending $11 billion in fiscal 2013. This has been an unresolved matter for an extended period; the odds favor a staggered reduction of payments to physicians in 2013 as opposed to a complete cut in one go.

In closing, there are too many unknowns to pin down the economic impact of the anticipated reduction in spending and tax increases. However, we can organize our thoughts about what the “fiscal cliff” entails and the likely direction of the economic impact.

Key Points to Keep in Mind about the Fiscal Cliff

- The CBO’s forecast is a benchmark and a mechanical extrapolation of the current law without practical considerations. Nevertheless, it is good point of reference to organize thoughts about possible outcomes. The baseline case of the Fed and the private sector, as seen in forecasts listed in Table 2, are noticeably different from that of the CBO. The typical caveat is that all forecasts – including that of Northern Trust – are subject to change as economic reports trickle in.

- Between now and January 2013, financial markets will remain significantly volatile, with political exchanges prior to the elections adding temporary spice to swings in the marketplace. The main drivers of market behavior should be: economic developments in the United States, China, Brazil and India, and do not forget the turmoil in the eurozone.

- It is also important to note that the CBO’s forecast does not reflect the Fed’s likely monetary policy actions. The Fed will step in to provide additional financial accommodation if economic conditions call for action. These actions will counterbalance fiscal restraint, if it occurs.

- In the event of deficit reduction (all or some listed in Table 1), the relative scarcity of new government bond issues will be supportive of lower bond yields compared with an alternative scenario of an increase in the federal budget deficit, holding other things constant.

- A smaller federal budget deficit implies lower cost of credit because of reduced participation of the government in credit markets – a positive aspect not alluded to in discussions about the fiscal cliff.

- If the federal government recycles the increased tax collections as spending, the only change is the origin of expenditures, not the level. In other words, the federal government spends the tax collections instead of the private sector.

- If the federal government’s borrowing drops and it spends less, then GDP should advance at a slower pace, holding other things constant. But, reality implies things are seldom constant. Recent evidence about reductions in government expenditures and the performance of the economy do give important direction. For example, real federal government spending fell at an annual rate of 7.0% and 6.0% in the fourth quarter of 2011 and first quarter of 2012, respectively. Despite the decline in federal government spending, real GDP of the U.S economy increased 3.0% and 2.2%, respectively. Therefore, if private sector momentum is retained, the degree to which overall GDP is affected will be related to the magnitude of the decline in government spending and the likely positive private sector offsets in the economy.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.