Gold Stock Investors Prepare for a White Knuckle Ride

Commodities / Gold & Silver Stocks Jun 15, 2012 - 03:32 AM GMTBy: Bob_Kirtley

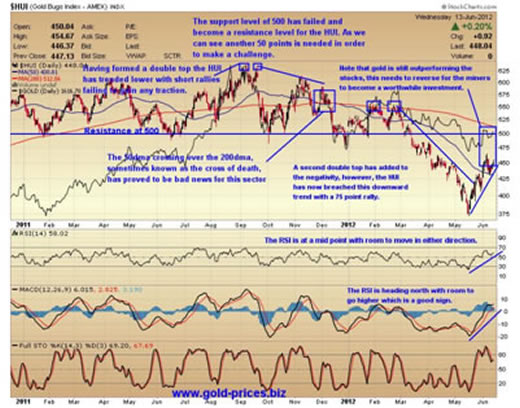

In the early days of this bull market in precious metals we all did well as most mining stocks sprang to life and made considerable gains. The quality producers made spectacular gains and the turkeys made moderate gains. It has changed a lot since then, the mining indices such as the HUI* were outperforming gold prices by leaps and bounds, however, for the last few years they have failed to keep pace with gold and indeed still lag behind as evidenced by the chart below.

In the early days of this bull market in precious metals we all did well as most mining stocks sprang to life and made considerable gains. The quality producers made spectacular gains and the turkeys made moderate gains. It has changed a lot since then, the mining indices such as the HUI* were outperforming gold prices by leaps and bounds, however, for the last few years they have failed to keep pace with gold and indeed still lag behind as evidenced by the chart below.

As a reward for taking on all the inherent risks involved in the process of mining we require the stocks to outperform gold by a ratio of three or four to one. This sort of reward does not exist at the moment so the metal itself is a better proposition. For those who do not wish to hold the metal and wish to 'play' this bull, then there are alternatives such as the gold funds which have proved to be very popular with investors, partly due to the ease in which they can be entered and exited at the push of a button. A large position in a gold producer is not so easy to exit and may take a little time to recoup an investors funds.

Yet the situation is tantalizing in that these stocks have been badly beaten down at a time when they are generating large amounts of cash. There is also the mantra emanating from many of the big names in this industry to buy now as they will never be this cheap again. For the average retail investor doing research as and when time permits, the pressure to make acquisitions right now is well and truly on. We feel the same pressure but we are also aware that a number of rallies by the stocks have come to nothing. Some call these moves head fakes or suckers rallies as the immediate euphoria that surrounds one of these rallies makes it rather difficult to sit on ones hands and observe. Doing nothing when everyone around you is backing up the truck is nerve racking at times, but that is what we have done for well over a year now, in that we have not increased our exposure to the mining sector. We are pleased with this strategy as the producers are cheaper now than they have been for some time. Our preference has been to look for leverage via the options route as it suits us to do so, but it is not everyone’s cup of tea.

Going back to the chart we can see that what was once was a support level of 500 has failed and become a resistance level for the HUI. As we can see a gain of 50 points or 11% is needed in order to make a challenge. Also note a second double top which has added to the negativity on the HUI. More recently we can see that the HUI has now breached this downward trend with a 75 point rally, which is a positive move. The RSI is heading north with room to go higher which is also good sign. Finally we have shown the price of gold behind the HUI so that you can see the divergence and form your own opinion as to where next.

In our view gold is still outperforming the stocks and this needs to reverse for the gold producers to become a worthwhile investment. We are in no rush to commit any more of our funds at this stage, but the landscape is changing and that speed of change would appear to be accelerating so its not a time to take ones eye off the ball.

This weekend we have the Greek election, regardless of who wins it does appear that a re-negotiation of loan terms is required as the current austerity measures are creating an enormous amount of civil unrest. The question is will Germany step up and help the Greeks with some form of easing or is it time for Greece to exit the Eurozone. Either way it is a calamitous situation for the markets to handle.

The bailout for Spain has failed to calm the markets and their 10yr yields flirted with 7% level. Pressure is building on the Italians, however their auction of €4.5 billion ($5.62 billion) in medium and long-term debt was well supported, although Italy's 10-year government bond yield was up three basis points at 6.23%. Eurozone is struggling along with apparently no real solution to the heavyweight burden of debt that they are trying to carry.

The situation is aptly summed up by Nigel Farage in this clip regarding Europe when he points out that Italy will provide 20% of the funds for Spain for a return of 3% whilst having to borrow the money at 7%, as he says ”The Euro Titanic has now hit the iceberg and sadly there simply aren’t enough lifeboats”

In the short term it may pay to wait a little while longer before increasing your exposure to the producers, however, in the longer term gold and silver will continue to rise as fiat currencies are recognized for what they are: worthless.

With that in mind, a trade for the longer term would include a slow but steady transfer of your assets into this sector, which should pay off handsomely in a few years from now.

However, it will be a white knuckle ride with volatility being the 'norm' as the stupidity of our political leaders hits your screen with monotonous regularity.

Go gently and take good care of yourselves.

Footnote:

*The HUI is The AMEX Gold BUGS (Basket of Unhedged Gold Stocks) Index represents a portfolio of 15 major gold mining companies. The Index is designed to give investors significant exposure to near term movements in gold prices - by including companies that do not hedge their gold production beyond 1 1/2 years.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.