Japan and U.S. Give Green-light To Nuclear Power, Uranerz Uranium Miner

Commodities / Uranium Jun 20, 2012 - 02:01 AM GMTBy: Jeb_Handwerger

Stealthily and without much publicity from the media, developments in the nuclear industry are moving ahead. While the Western nations are beset by their own economic problems they continue to dither about the very source of cheap, inexpensive industrial energy namely the uranium miners.

Stealthily and without much publicity from the media, developments in the nuclear industry are moving ahead. While the Western nations are beset by their own economic problems they continue to dither about the very source of cheap, inexpensive industrial energy namely the uranium miners.

We note with interest the recent ok by the Nuclear Regulatory Commission for the construction of two nuclear facilities in South Carolina at a cost of $11 billion. These plants are on top of the green-light given over two months ago to two plants in Georgia. All this is occurring after a lapse of over thirty years in such construction. Likewise, Japan has decided to restart nuclear reactors for the first time since the once in a millennium disaster at Fukushima in March of 2011. The Japanese economy clearly can not afford to abandon nuclear power. This may be impacting the long term uranium price which is beginning to budge higher. We may soon start seeing uranium miners breaking out of long 15 month bases

The Western Press continues to be mesmerized by the daily featuring of the latest affairs of Pop Tarts and Hollywood Junkies. Meanwhile, Asian nations are tending to the business of providing safe inexpensive, latest generation nuclear reactors for their populations.

Moreover, the aforementioned American nuclear plants are coming to us courtesy of the Japanese Unit of Westinghouse- Toshiba, using a whole new generation of the latest nuclear technologies.

Over in such countries such as Vietnam, Malaysia, China and India amongst others are going full speed ahead in providing a safe, inexpensive source of energy for their developing nations. Interestingly, Cameco (CCJ) recently offered to purchase unused uranium from the shutdown of the Japanese antiquated nuclear reactors. Tokyo declined the offer. The Japanese Prime Minister is on record for reviving nuclear in Japan. Could it be that Japan has intentions of a nuclear renaissance using Toshiba to work at home constructing next generation reactors which are safer and economic?

Industry has learned from the past mistakes. The specific failure at Fukushima was due to the loss of power, resulting in the failure to actively circulate cooling water.

The new age reactors have the ability to provide the passive system of cool water that does not require electrically powered pumps. The new reactors are bidding farewell to outmoded forty year old designs to which the media choose to be completely oblivious.

China waits off stage in need of uranium. Fukushima is not slowing down China's nuclear appetite. A nuclear power industry was held April 6th in Shenzhen attracting over 300 companies all over the world.

Homage was paid to Fukushima, but it did not deter these companies from continuing the development of nuclear energy. In fact at the opening ceremony the Chairman of the Chinese Nuclear Association stated, "The accident at Fukushima does not suggest any end to the nuclear renaissance. It may be a catalyst to continuing the safe development of the industry." Among the over 300 companies attending were Areva, Hitachi and an assortment of mainland companies.

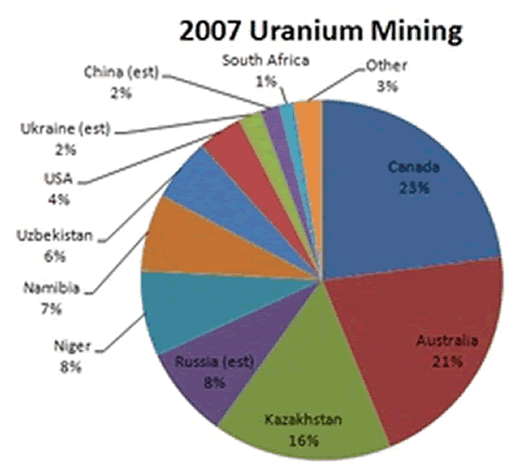

Prime Minister Harper has returned from China with a deal that brings almost $3 billion dollars worth of energy deals which includes uranium from Cameco's motherlode in the Athabasca Basin to satisfy China's insatiable hunger for its domestic expansion into the construction of nuclear power plants.

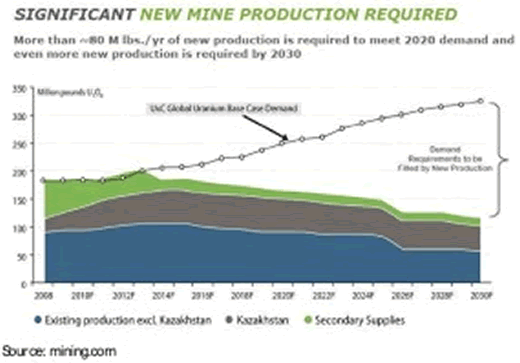

Recently, Denison Mines announced an important merger with Energy Fuels. The stated intention is to form the largest U.S. pure play uranium producer operating in a country that consumes 55 million pounds a year, but produces less than 4 million pounds of uranium. This represents an ongoing significant shortfall in the supply demand equation.

Were it not for the Russian's supplying uranium to the U.S. as part of the "Megatons to Megawatts" arrangement slated to end in 2013, we would be experiencing major power failures. This is only delaying the inevitable day when in 2013 the Russo-American agreement expires. This can only result in a growing world interest in the American nuclear mining industry.

Enter center stage Uranerz Energy (URZ) who is strategically located in the Powder River Basin in Wyoming surrounded by the big boys, Uranium One and Cameco.

Uranerz is making excellent progress with mine construction on the plant and well fields. Uranerz could be producing 6-800 thousand lbs by the end of the year.

Uranerz's ace up their sleeve is that their operations use in situ recovery methods that require lower capital costs and use more environmentally friendly methods. Unlike costlier conventional mines, Uranerz could produce uranium in the mid $30's.

The company could be the next major U.S. uranium producer at a time when new uranium supply is critical. The company has a strong treasury, a partnership with Cameco and off take agreements with some of the largest U.S. utilities, which indicates that Uranerz may be best of breed of near term U.S. producers.![]()

Cameco is raising a warchest of $1 billon to acquire junior uranium miners such as Uranerz who are trading at bargain basement discounts. Uranium miners are incredibly cheap due to the Fukushima Disaster and a weak resource market. Rio Tinto made its first acquisition since 2007 outbidding Cameco to buy Hathor for a premium. Could this be a signal that the big boys are just beginning to acquire high quality junior miners located in mining friendly jurisdictions?

We believe major sovereign funds and miners will continue to make strategic investments in this beaten down sector. Cameco already had sufficient cash to operate and this raise may indicate that they are ready to make major moves. Cameco's CEO Tim Gitzel recently said, We are making deals and we continue to scour the world and if we see something that fits for us, we'll move very quickly."

Disclosure: Long URZ and DNN

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.