SPX Turns Down, The "Bernanke Put" Won't Happen Here

Stock-Markets / Stock Markets 2012 Jun 25, 2012 - 03:23 AM GMT -- VIX has now completed a 77.9% wave [2] correction. A normal Fibonacci correction would be .78.6%. It appeared that the VIX may have made its correction low on June 11, its Primary Cycle low. However, The Master Cycle opted for an early low on June 21, which was three weeks earlier than the normal low. This is very bullish for the VIX, since it presumes 4 months of rally may follow.

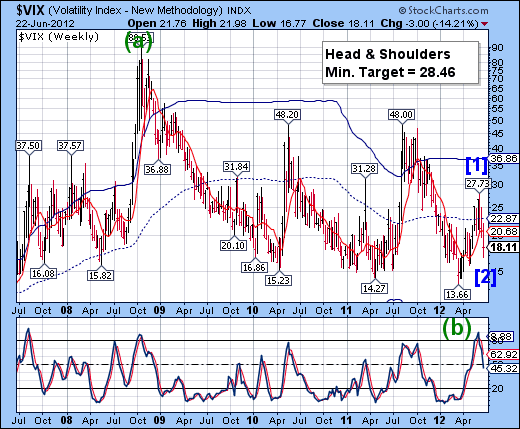

-- VIX has now completed a 77.9% wave [2] correction. A normal Fibonacci correction would be .78.6%. It appeared that the VIX may have made its correction low on June 11, its Primary Cycle low. However, The Master Cycle opted for an early low on June 21, which was three weeks earlier than the normal low. This is very bullish for the VIX, since it presumes 4 months of rally may follow.

SPX turns down, makes a reversal pattern.

-- After making a 62% retracement, SPX reversed back down from its high. The reversal pattern in place at Friday’s close suggests that the decline may be already underway at the open on Monday. On Thursday after the close of markets, Moody’s announced credit rating downgrades on 15 of the largest banks in the country. What many investors don’t know is that the market may have known about the downgrade ahead of time, leading to the 2.25% sell-off in the SPX on Thursday before the announcement. Friday’s muted rally may have been to manage investors’ reactions and keep a further sell-off from occurring before the weekend. Monday may be another story altogether.

]

(ZeroHedge) (Thursday) wasn't the worst plunge in the stock market so far this year... It was the second-worst by a whisper. And just like that we are one third of the way down to Goldman's target. But everything is priced in? It seems that between the realization that global growth may actually be slowing (between China PMI and this morning's Philly Fed) and the recognition that there is no-QE-without-a-crash, markets began to lose steam early on this morning (led by energy names crushed by the biggest two-day drop in oil in over 9 months).

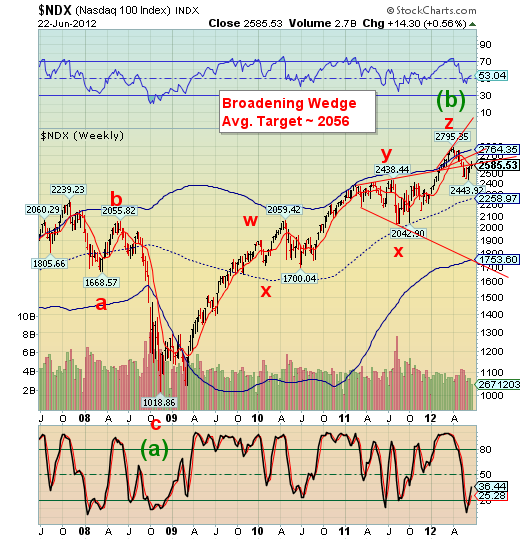

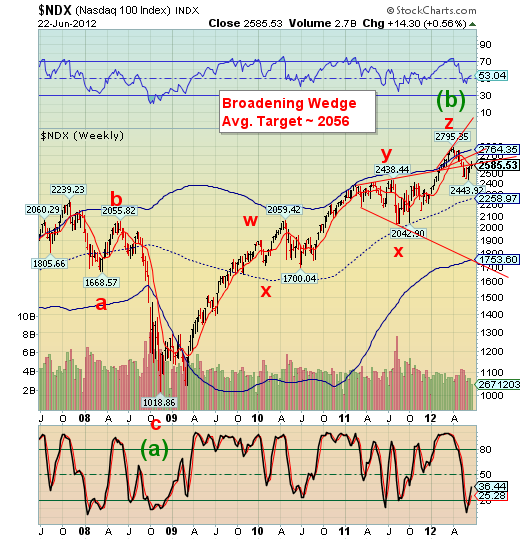

NDX overshoots a Fibonacci retracement, then reverses.

-- The NDX extended its retracement to 53.9%, then made a reversal pattern. The cycles now call for two or more weeks of decline through July 5 to July 9. This decline has the potential to take NDX to its Cycle Bottom at 1753.60 over the next two weeks.

(ZeroHedge) Critical of the market's reaction to the 'no new QE' news, Biderman and Bianco wholeheartedly believe yesterday's plunge was entirely due to the fact that the 'Bernanke Put' - that we have become so conditioned to expect - did not appear at the levels many expected.

The Euro broke through its neckline.

-- The endgame for the Euro is underway as it retraced near-Fibonacci 38.3% of its decline from 134.85. It has reversed from that high and breached the neckline of its Head & Shoulders formation at 126.50. The question is, now that it is under the neckline, will it subdivide into an orderly decline or will it crash? The Liquidity Cycle that my subscribers have been following suggest a solid decline through August to parity or below.

.

UPDATE: The Bundesbank, as usual, ready to pour some 'reality-based' cold-water on the situation (in Greece):

- *BUNDESBANK SAYS IT'S CRITICAL OF ECB COLLATERAL DECISION

- *BUNDESBANK SAYS IT WON'T ACCEPT COLLATERAL IT DOESN'T HAVE TO

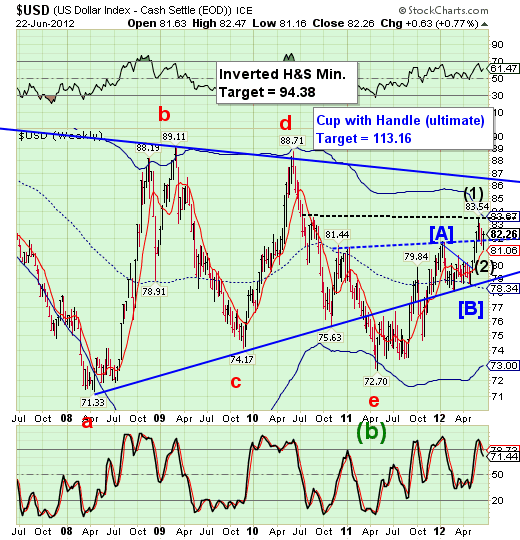

The US Dollar is a good parking place in troubled times.

-- The US Dollar rallied above the lip of a new Cup with Handle formation. This formation now has an 80% probability of meeting or exceeding its target. This is not as impressive as the inverted Head & Shoulders’ 83% success rate, but having the two together is reassuring for the uptrend.

(ZeroHedge) Deutsche Bank believes that markets are now addicted to stimulus and can’t function properly without it as they show that the periods between central bank balance sheet activity have actually been fairly poor/average periods for risk assets over the last three years.

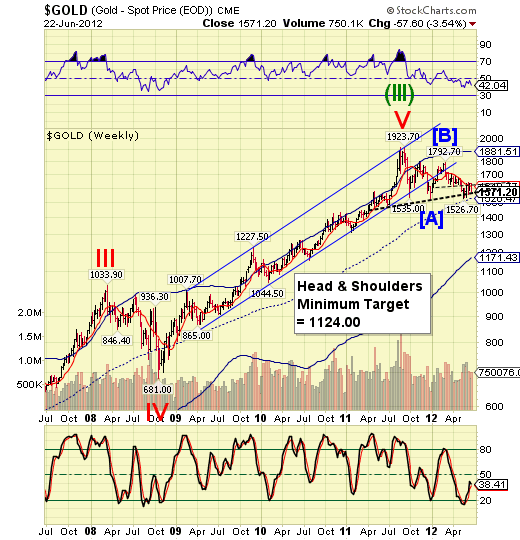

Gold is about to break its Head & Shoulders neckline.

-- Gold closed just above its Head & Shoulders neckline at 1570.00 after failing two attempts to rally above the higher neckline at 1640. Last week I suggested that, “the probability of a decline starting early next week is substantial.” It has now begun. The next goal is to break the massive neckline and begin a month-long decline that may find a low near gold’s Cycle Bottom at 1171.43.

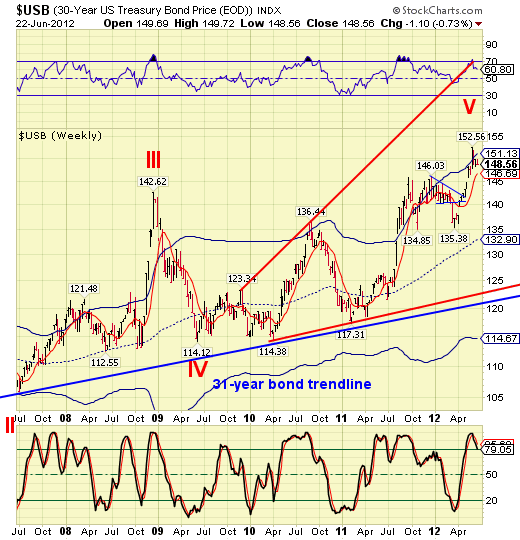

U.S. Bonds signal further decline ahead.

-- USB has made a reversal pattern below Cycle Top resistance and appears ready to decline further. A fall below the 10-week support line is likely to bring on a flood of selling. One more “safe haven” bites the dust.

(ZeroHedge) This one simple chart (see article) below shows what is possibly the biggest and most fundamental flaw in Bernanke's approach to spurring the economy, which to him, of course, means rising prices of risky assets, aka the stock market.

The chart above shows the return of two simple things: the return of 4.25% 30 Year Bond issued November 2010... and the S&P. Unfortunately, by the time the general public catches on, the advantage is gone.

Crude crosses its neckline.

-- West Texas Crude declined throught its Head & Shoulders neckline at 80.00 this week. This opens the (trap) door for a fall as far as Cycle Bottom support at 69.02 and possibly a massive crash in the coming Master Cycle low due in early August. Thye wave [2] consolidation is easy to miss, especially in the weekly chart. This decline may be similar, if not more intense than the 2008 decline.

(ZeroHedge) …there are quite a few big firms which may be happy to onboard the assets and the liabilities, knowing they wouldn't impair the right side of their balance sheet, while acquiring some good real estate and substantial reserves on the left, at a valuation that is the cheapest in the industry.

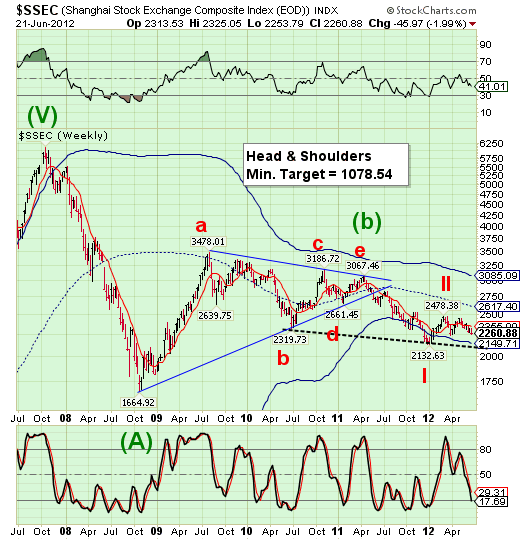

China sets up “currency swap” with Brazil.

--The Shanghai index gingerly declined below its 10-week moving average at 2355.09, which confirms the sell signal in Chinese stocks. The next level of support is the Cycle Bottom support at 2149.71, which would give way to the Head & Shoulders neckline at 2125.00. This may lead to a cascade of epic proportions as the Shanghai indes is about to lose over 50% of its value in a wave (iii) decline.

(ZeroHedge) "Brazil has provided a vote of confidence in China’s efforts to promote the renminbi as a reserve currency by becoming the biggest economy yet to agree a swap deal with Beijing. Brazil and China announced the R$60bn (US$29bn) local currency swap after a bilateral meeting between Wen Jiabao, the Chinese premier, and Dilma Rousseff, Brazil’s president, on the sidelines of the Rio+20 environmental summit in Rio de Janeiro."

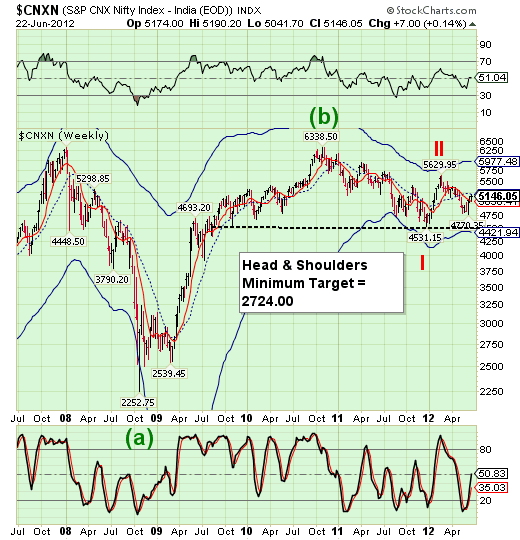

The India Nifty retraces to its mid-Cycle.

The India Nifty appears to have completed its retracement just beneath its weekly mid-Cycle resistance at 5191.71. It becomes bearish again once it declines below its 10-week support at 5050.41. The next objective is a test of the Head & Shoulders neckline and may bring downside acceleration to the India 50 index. The Cycles Model suggests that the decline in the CNX Nifty Index may continue through early August.

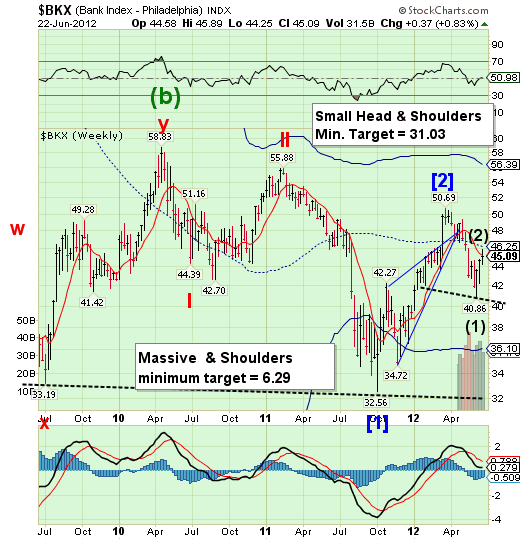

The Bank Index may be ready to resume its decline.

-- BKX overshot its Fibonacci retracement at 50% this week, but reversed back down beneath its 10-week moving average at 45.25. That puts BKX back on a sell signal and a probable decline to its smaller Head & Shoulders target at 31.03 in the next two weeks. The massive Head & Shoulders pattern may meet its target by early August. I expect to see the decline speed up considerably starting next week.

New York, June 21, 2012 -- Moody's Investors Service today repositioned the ratings of 15 banks and securities firms with global capital markets operations. The long-term senior debt ratings of 4 of these firms were downgraded by 1 notch, the ratings of 10 firms were downgraded by 2 notches and 1 firm was downgraded by 3 notches. In addition, for four firms, the short-term ratings of their operating companies were downgraded to Prime-2. All four of those firms also now have holding company short-term ratings at Prime-2. The holding company short-term ratings of another two firms were downgraded to Prime-2 as well.

(ZeroHedge) Matt Taibbi strikes again.

The Scam Wall Street Learned From the Mafia

How America's biggest banks took part in a nationwide bid-rigging conspiracy - until they were caught on tape.

Good luck and good trading!

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.