Vice Presidential Candidate Paul Ryan Boon or Bane for U.S. Dollar?

ElectionOracle / US Presidential Election 2012 Aug 16, 2012 - 12:06 PM GMTBy: Axel_Merk

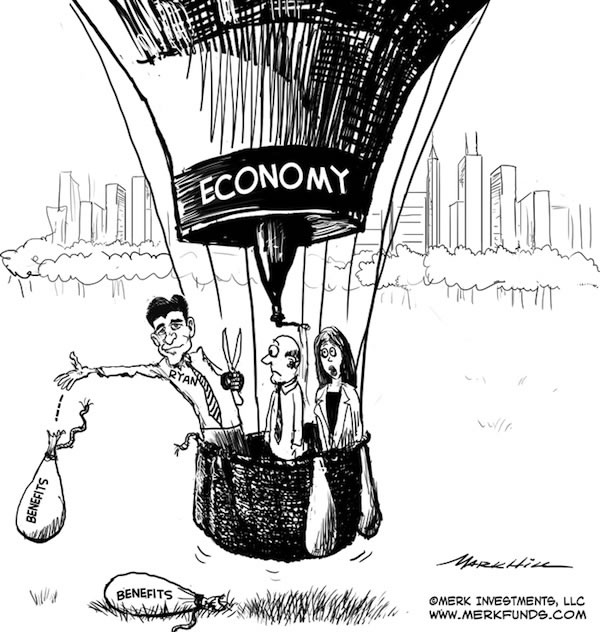

Good news: Vice Presidential candidate Paul Ryan may put the focus of the presidential campaign on the sustainability of the U.S. budget. Bad news: Ryan’s plan delivers some tough medicine; if the European experience is any guide, “austerity” makes bad politics. What are the implications for the U.S. dollar?

Good news: Vice Presidential candidate Paul Ryan may put the focus of the presidential campaign on the sustainability of the U.S. budget. Bad news: Ryan’s plan delivers some tough medicine; if the European experience is any guide, “austerity” makes bad politics. What are the implications for the U.S. dollar?

The Ryan budget addresses a key Achilles heel of the U.S. budget: Medicare. Make no mistake about it: no matter who wins the election, Medicare as we know it won’t be around for the next generation. Why? Because economists agree that the debt to GDP ratio would explode to unsustainable levels: there are not enough rich people in the US to tax to “fix” the problem. The basic problem: the U.S. healthcare system (before and after the healthcare reform) defines entitlements, but essentially does not have a fixed budget. Not surprisingly, costs are out of control, as the private sector is incentivized to deliver ever more services, ever more expensively.

What happens when the market recognizes that budgets may be unsustainable can be seen in weaker Eurozone countries: the cost of borrowing rises, bonds fall. Unlike the Eurozone, however, the U.S. has a significant current account deficit; as such, a crumbling bond market might put substantially more pressure on the U.S. dollar than the Eurozone debt crisis has put on the euro.

The Ryan plan wants to bring down the size of government to 20 percent of the economy by 2015 (compared to 23 percent in the President’s budget). The plan will prevent the looming tax increases, but may increase other taxes (“closing loopholes” is the politically acceptable way of selling tax increases to the public) as the tax code is simplified. The plan also does not cut defense spending.

Given that entitlement spending (Social Security, Medicare and Medicaid) will continue to rise in the coming years, if for no other reason than those in or close to retirement won’t see cuts to their benefits, substantial cuts elsewhere are necessary to meet the plan’s objectives. Unlike other long-term budget projections so commonly adopted by politicians, the cuts are not back-loaded, but gradually phased in.

All in all, it is not surprising Paul Ryan may excite part of the Republican base. Purists point out that he is no Ron Paul, the Congressman and former presidential candidate who has suggested draconian cuts to the defense budget, as well as the elimination of more departments than former presidential candidate Rick Perry might be able to list.

In some ways, Ryan is an Obama of the political right, promising to bring America back on the right path. However, as is so often the case anywhere in the world, the change people vote for might not materialize.

They will try to start with a repeal of Obamacare, a key element of the Ryan plan. We have little doubt that should Romney/Ryan win, they will introduce a bill to repeal the healthcare bill; however, political realities exist beyond winning the White House. As always, campaign promises should not be taken at face value. If Republicans don’t control the Senate after the election – key to getting major legislation passed - Romney/Ryan may very well claim to have kept a campaign promise and blame Congress for not acting. The faces may change, but the politics don’t.

As indicated, both Romney and Ryan want to preserve defense spending. They express a willingness to keep spending on programs that are deemed valuable and important. Funny how every politician always wants to cut wasteful spending, but preserve the good type of spending. What falls into what bucket is in the eye of the beholder. Trouble is that, when all is said and done, money is spent, be it on “good” or “bad” programs.

And it’s not just defense. Romney has spoken out on preserving student loan subsidies. Student loans are not merely a problem for a few starving students, but is quickly ballooning into a burden affecting even the upper middle class. From the first quarter of 2005 until the first quarter of 2012, total student debt has grown from $363 billion to over $900 billion. As delinquency rates have also been rising, politicians on the left and right are eager to help out.

Now tell those whose benefits get cut that sacrifices are necessary to make the budget sustainable for future generations. Cutting benefits in a democracy is rather difficult. After all, there will be plenty of valid political arguments that the cuts are hitting the wrong people and that “my” benefit is the one worth preserving. As a result, a change in tone tends to be more likely than a change in substance. We have in the past argued that real reform in the U.S. may not come until the bond market provides the appropriate “encouragement” – except, of course, that such encouragement means major pain, coupled with turbulent markets. And, as indicated, a misbehaving bond market might also have dire consequences for the greenback.

It is fine to hope to get a sustainable budget that broadly spreads the pain (so as to not further polarize American politics); however, hope is no investment strategy. Our baseline scenario is that the market may continue to give the U.S. the benefit of the doubt, i.e. not dump U.S. Treasuries en masse. That base line scenario also suggests continued sluggish growth, with a continued heavy hand of the Federal Reserve. Incidentally, Paul Ryan has also spoken out against what he calls a “bail out” of U.S. fiscal policy by the Federal Reserve (Fed). That’s because the Fed’s Treasury purchase programs have helped finance the deficit.

Should the U.S. economy show signs of more earnest growth, all bets are off for the bond market. A lot of yield chasers have piled into the long end of the yield curve, i.e. long-term bonds. In the event that the market prices in more economic growth, we expect a bond selloff. The canary in the coalmine might have been the bond selloff early in the year. We consider it entirely possible that good economic news can trigger a chain reaction that will put the Treasury markets into the driver’s seat, letting policy makers once again appear to be running around like headless chicken, as we have unfortunately seen all too much in recent years (from politicians across the political spectrum, as well as central bankers). The muddle through grinding might with hindsight be considered the easy part; the tough time may come once all the money that has been printed actually “sticks”. While Fed Chairman Bernanke claims he can raise rates in 15 minutes, we remain skeptical that the Fed can continue to micromanage the economy given all the leverage and liquidity that is in the global economy.

When we look at the world, we like to plan scenarios and assign probabilities. The baseline scenario suggests more of what we have been experiencing, loose monetary policy, attempting to inflate our way out of our challenges: a “kicking the can down the road” scenario with the bond market giving policy makers the benefit of the doubt, a gradual erosion of purchasing power, weak dollar and strong gold. But just as the baseline scenario of any budget blueprint might be more dream than reality, there are plenty of things that can go wrong. Even the most prudent plan cannot ignore the reality that there is too much debt in the world; when push comes to shove, politicians have tended to favor inflation over austerity

Please sign up to our newsletter to be informed as we discuss global dynamics and their impact on currencies. Please also follow me on Twitter to receive real-time updates on the economy, currencies, and global dynamics.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.