Currency Market Strategy and Forecasts for February 2008

Currencies / Forex Trading Feb 06, 2008 - 09:08 PM GMTBy: Ashraf_Laidi

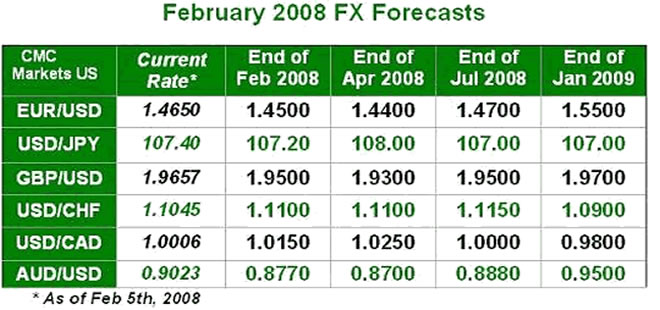

We expect the dollar and the yen to emerge as the broad winners in February, dragging the European and antipodean currencies (AUD, CAD, NZD) lower amid deepening signs of a slowdown in the Eurozone and the UK , and further reduction in global risk appetite. We do not anticipate the Fed to be forced into an inter-meeting rate cut this month partly due to Fed Chairman Bernanke's scheduled Congressional testimony on the economy next Thursday, which will act as the next driver of market interest rates.

We expect the dollar and the yen to emerge as the broad winners in February, dragging the European and antipodean currencies (AUD, CAD, NZD) lower amid deepening signs of a slowdown in the Eurozone and the UK , and further reduction in global risk appetite. We do not anticipate the Fed to be forced into an inter-meeting rate cut this month partly due to Fed Chairman Bernanke's scheduled Congressional testimony on the economy next Thursday, which will act as the next driver of market interest rates.

Renewed sharp losses in equities will inevitably trigger speculation of an inter-meeting move, but the Fed is expected to hold off as the past 225-bps cuts have yet to take effect into the full economy. We expect another 125-bps in fed funds rate cuts for the year.

Yen Propped by Risk Reduction

The yen continues to assume the role of the only currency to maintain persistent downside pressure on the greenback mainly due to recurring bouts of risk appetite reduction in an increasingly shaky global investor confidence. The recent recurrence of broad yen gains during disappointing US data (even against European and antipodean currencies) is likely to persist throughout the month. The currency impact of escalating chances for a Japanese recession will be offset by renewed reduction in risk appetite.

One way to highlight the extent of shaky confidence in US equity indices is the fact that most "up days" in the broad indices resulted from announcements rather than earnings or data. Such announcements included the Bush stimulus package, M&A announcements, talk of capital injections in struggling bond insurers, words of confidence by the same insurers that they have enough capital and other doses of psychological boosts of confidence. Nonetheless, it is increasingly apparent that markets have grown increasingly prone to earning outlooks and expectations rather than earnings announcements of the past quarter. The threat of MBIA's downgrade by S&P and Fitch has not been alleviated and neither has the resulting downgrade of insure debt. The next test of confidence in yen pairs will be gauged ahead of the next retest of the 1,300 level in the S&P.

USDJPY is seen supported at 104 during the month, while EURJPY and GBPY are seen extending losses towards 150 and 104 respectively. This week's upcoming G7 meeting should have limited effect on currencies as finance ministers and policymakers mull the extent of the global slowdown.

Euro Declines Ahead Despite Hawkish ECB

The euro's sharp reversal in the aftermath of Friday's dismal US payrolls manifests the market's unwillingness to test the $1.50 target on technical and fundamental basis. Yesterday's release of the Eurozone services PMI showing a decline to 4 ½ year low at 50.6 in January from 52.0, and a contraction (below 50) in Germany, Italy and Spain, highlight the emerging downside risks to the regional economies and the deteriorating policy dilemma of the European Central Bank with inflation creeping up to 3.2% from 3.1%, well over the bank's preferred 2.0% target.

Playing the role of the "anti-dollar", the euro may be expected to regain its highs in light of increased evidence that the US economy is already in recession. But markets are expected to be more punishing to the single currency than the greenback as the ECB hawkishness is increasingly perceived to be untenable and even threatening to the 15-nation area. Eurozone retail sales fell for the third consecutive month in December, reaching their lowest level in the 11-year history of the series.

Thursday's press conference from ECB chief JC Trichet is likely to maintain the same hawkish rhetoric on inflation, but market's attention will focus on any change in the language pertaining to the bank's growth assessment, which it already regards as clearly on the downside.

Recall that Germany 's closely watched IFO business climate index rose unexpectedly to 103.4 from 103 in December (released on Jan 24), overshooting forecasts of 102. The surprise showing appeared as a rebuke to escalating calls on the ECB to join its US counterpart in slashing interest rates. But there were indications that most of the 7,000 companies responding to the survey have submitted their replies in January 15, thus missing the bulk of the deterioration in equity markets in the following week. This suggests that the January ZEW survey on investor sentiment and this month's release of the IFO survey would reflect more pessimism and trigger considerable euro declines.

Our $1.45 month-end forecast does not rule out lower levels before the end of the month, with a considerable possibility of the $1.43 being retested. We expect broad euro losses for the month, albeit at lesser extent against the pound, with support standing at 0.7360. EURJPY projected to reach 150, with resistance capped at 160.

Sterling Faces Renewed Selling

Thursday's well anticipated rate cut by the Bank of England will take down rates to 5.25%, a level that is higher than all G7 nations. But this will only persuade traders to expect further downside ahead as the UK economy weakens further. Last month's BoE decision to hold rates at 5.50% surprisingly had only one dissenter -- the usual dovish David Blanchflower -- but the decision was taken well before the latest damage to global equities. We continue to anticipate UK rates to reach 4.75% by year end.

Sterling 's superior yield advantage will continue to help the currency exploit short term bouts of risk appetite and post short-lived gains vs the dollar. But as was demonstrated time and again, such gains are seen as selling opportunity for the pair. Risk appetite reduction trades are negative for GBPUSD, GBPJPY and GBPCHF but relatively positive for GBPAUD and GBPNZD.

Loonie's Gains Short-Lived

The Bank of Canada's decision to cut interest rates by only 25 bps on the same day the Fed slashed rates by 75-bps suggests the BoC is neither in panic mode, nor expected to cut rates below 3.50% from the current 4.00%. A consolidative oil price between $70 and $90 into the next 3 months will reduce the role of the oil premium to the loonie. We expect one more BoC cut in the next 3 months as the central bank balances between preventing considerable widening in the interest rate differential and containing inflationary pressures.

By Ashraf Laidi

CMC Markets NA

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.