Gold Primary Trend Continues To Advance

Commodities / Gold and Silver 2012 Sep 10, 2012 - 12:12 PM GMTBy: Submissions

Education: that which reveals to the wise, and conceals from the stupid, the vast limits of their knowledge- Mark Twain

Education: that which reveals to the wise, and conceals from the stupid, the vast limits of their knowledge- Mark Twain

Gold continued to make good headway during the week in spite of warnings that it was overbought and/or a risky venture. The yellow metal began the week on Tuesday at 1,687.60 and closed on Friday at 1,737.60. There were attempts to sell it along the way and they were met with strong buying as has been the custom. In this world of hype and misinformation there is only one real port in the storm, and that’s gold. That didn’t change this week. Gold moves higher in spite of the rhetoric to the contrary and in spite of the fact that few understand what moves it, and even fewer own it. I listen to pundit after pundit call tops to the bull market and yet they forget that the general public doesn’t own any gold. Then they’ll tell you that the public will never buy gold. I maintain that if the public was stupid enough to buy into the NASDAQ craze, and they were, they’ll be smart enough to buy gold.

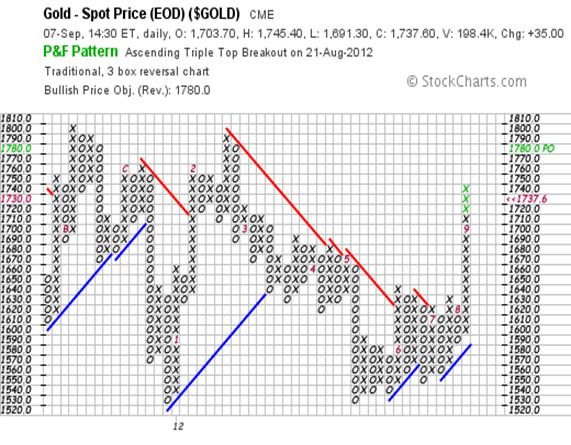

This week saw significant advances in the price of the yellow metal as it continued the breakout above the critical 1,671.50 resistance that began the week before:

That resistance will now become support in the event of a reaction. The spot gold closed out the week at 1,737.60 and even tested the next level of critical resistance at 1,746.20 on Friday.

What interests me now is the big picture. As you can see in the daily chart below, gold began the previous move higher at 865.00 and ran all the way up to 1,923 before running out of gas:

Here you can see that gold became extremely overbought on four separate occasions, and I know that gold is extremely overbought right now. I also know that sooner or later we’ll see a reaction to alleviate that situation and then it will continue on to make higher highs. Once gold topped last year it retraced almost exactly 38% of the gains from the move up off of the 2009 low. Critical support at 1,522.20 was tested on two separate occasions and then we saw a significant higher low in June at 1,547.60.

Since that higher low it’s been all up hill! It consolidated between 1,547.00 and 1,645.00 and then broke out; first above the critical Fibonacci resistance at 1,671.50 and then above psychological resistance at 1,700.00. Is gold extremely overbought? Yes! Will it experience downside reactions? Yes! Will some of them be scary? Yes! Will gold continue higher? Yes!!! Before the end of the year I fully expect gold to make a new all-time high as it prices in reality. The reality is that we will see QE3 but it won’t stop there. Finally,

you can see that gold is a lot closer to reaching the bullish price target of 1,780.00 than it was just two weeks ago.

As good as gold looks, silver looks even better. In fact I will go so far as to say that silver is now leading gold higher. Take a look at the daily chart for gold’s poor cousin:

Silver exploded through critical Fibonacci resistance at 31.91 and closed out the week at 33.68. Like gold it is extremely overbought but unlike gold it is also extremely overbought on a weekly chart, so that is something to be concerned about over the short run. Silver has no real resistance until it reaches 37.95 and support is down at 31.91 so I will just sit tight and buy more once I see a decent reaction.

The gold and silver bugs have the wind at their back and now it seems that gold stocks have finally joined the party. Take a look at this chart of the HUI:

I haven’t been a fan of gold stocks since 2007 but I do own Buenaventura listed on the NYSE and I own Goldcorp, Royal Gold and Silver Wheaton, all listed on the Toronto Exchange and denominated in Canadian dollars. The fact that they are in Canadian dollars will become important now that the US dollar has turned down. I continue to hold them because they are good companies, and they pay a cash dividend. I think cash flow will be at a premium by early next year and I like getting that check deposited into my account on a regular basis.

Finally, I am now absolutely convinced that gold, silver and the HUI are all on their way to new all-time highs. I really don’t expect gold to stop until it hits US $2,400, and it could move as high as US $3,150. All of this will occur sometime next year. Silver will double from here and could do even more. The catalyst will be unlimited quantitative easing, more than likely a war with Iran, and a significant decline in the US dollar. What ever happens in Europe won’t be good, but that’s just frosting on the cake. Asia won’t be of any help and could hurt if China decides to take Iran’s side, and it very well might. Russia is another wild card that could join in with Iran. The US is an aging dinosaur and we are about to experience a significant climate change. Gold is your protection, but of course there will be the challenge of trying to hang on to it. Most of my clients feel that confiscation won’t be an issue, but there is a legal precedent. Roosevelt did it in 1933! My advice is to hide it well and tell no one about it.

Giuseppe L. Borrelli

www.theprimarytrend.com

analyst@theprimarytrend.com

Copyright © 2012 Giuseppe L. Borrelli

- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.