Gold and Silver Surge on Fed 'Currency Debasement 3' (QE3)

Commodities / Gold and Silver 2012 Sep 14, 2012 - 10:21 AM GMTBy: GoldCore

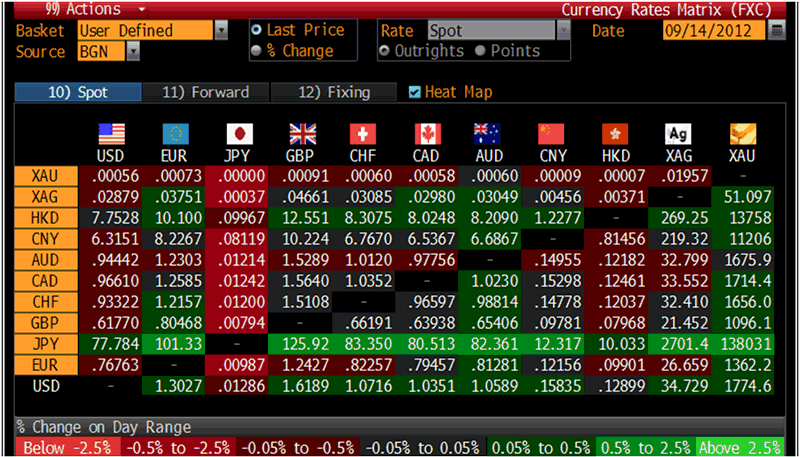

Today’s AM fix was USD 1,772.50, EUR 1,359.70 and GBP 1,093.53 per ounce.

Today’s AM fix was USD 1,772.50, EUR 1,359.70 and GBP 1,093.53 per ounce.

Yesterday’s AM fix was USD 1,730.50, EUR 1,339.81 and GBP 1,073.64 per ounce.

Silver is trading at $34.64/oz, €26.53/oz and £21.43/oz. Platinum is trading at $1,700.20/oz, palladium at $695.75/oz and rhodium at $1,050/oz.

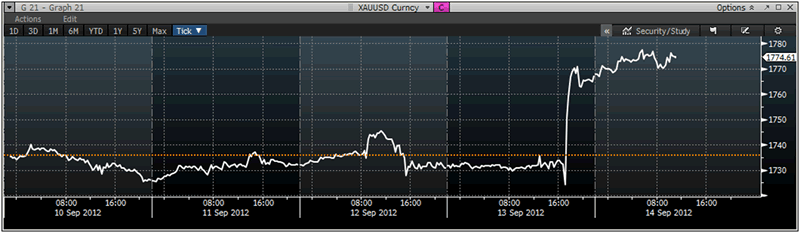

Bernanke’s announcement of further money printing and ultra loose monetary policies saw gold and silver surge in all currencies yesterday. Gold rose $34.30 or 1.98% in New York and closed at $1,732.00. Silver soared to a high of $34.781 and finished with a gain of 4.34%.

XAU/USD Currency – (Bloomberg)

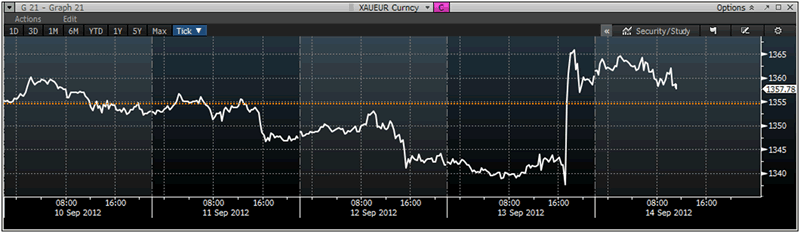

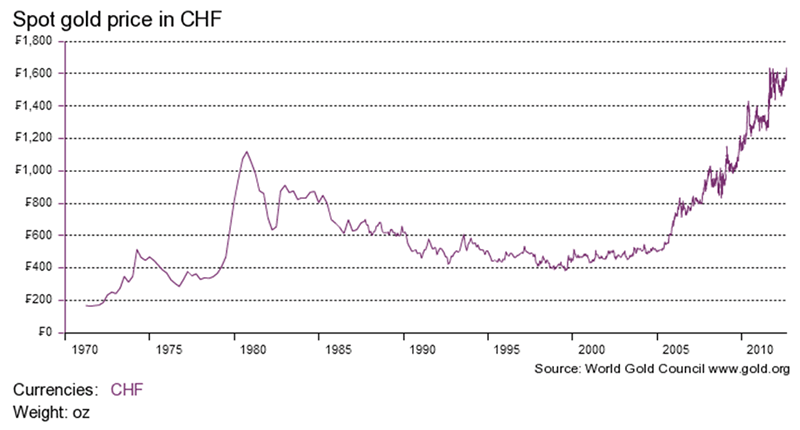

Gold surged to a 6 month high in dollars, to very close to new record highs in euros and importantly to an all time record nominal high in Swiss francs (see chart below). Gold climbed as much as 2.2% in the “safe haven” Swiss franc to 1,657 per ounce.

Platinum topped $1,700 an ounce for the first time since March and silver and palladium also hit their highest prices in 6 months, as the Fed announced an open-ended debt buying program and promised to keep interest rates near zero until at least mid-2015.

XAU/EUR Currency – (Bloomberg)

Commodities and oil surged alongside equities. Oil rose to $100 a barrel in New York for the first time since May after the Fed news while unrest in the Middle East and North Africa fanned concern that supplies will be threatened.

Commodities are set for the longest run of weekly gains since 2010. The Fed decision is fuelling expectations raw-material use will rise.

The Standard & Poor’s GSCI Spot Index of 24 raw materials gained nearly 1% to 692.62, the highest level since April 4. It is set for a 2.3% increase this week, a seventh weekly advance and the best run since October 2010.

Bernanke took the plunge yesterday by embarking on QE3 or what would be better described as “Currency Debasement 3”.

Improving the U.S. job market and therefore economy was the reason given for the extremely radical measures. However, the scale of the open ended monetary commitments suggests the Fed is worried about another Great Depression and an economic collapse.

The move was described as "stunningly bold" by some analysts as it is "open ended" with Bernanke pledging to print or electronically create, with no time limit, an extra $40 billion every single month until the labour market improves.

This is the frightening vista we have been warning of for some time. It means that should the US economy enter a recession and or depression, which still seems very likely, that the Fed will continue printing money and debasing the dollar thereby leading to dollar devaluation and inflation - potentially virulent inflation on a par with or worse than that seen in the 1970's.

We had long said that QE3 was inevitable - the question was when rather than if. Indeed, we had said that given Bernanke's closeness to Wall Street we expected that QE4, QE5 etc. were likely.

The "open ended" nature of this new round of QE as enunciated yesterday means that the Fed could if it wished or believes it is necessary print unlimited quantities of dollars.

The consensus continues to be that Bernanke and the Fed's actions in addressing U.S. economic ills are bold and progressive. The same consensus holds that the ECB’s (hindered by the Bundesbank and the will of the German people) failure to print euros 'bazooka' style is regressive, negative and risky.

The consensus is mistaken again and in time the more prudent monetary policy stance of the Bundesbank, while painful in the short term, will be seen as having been the monetarily responsible course of action.

Printing money is easy with central bankers just pressing a few buttons on a keyboard and electronically creating billions and indeed trillions of dollars, euros and pounds today.

Mining for gold and other precious metals is far from easy and gets harder every year.

Miners are having to go deeper and deeper into the ground to attempt to extract the precious metal from declining ore grades. Peak gold has been reached in South Africa and may have been reached globally.

The poor miners in South Africa who are wielding machetes today will testify as to just how very hard it is to mine for the earth’s precious metals – despite the huge advancement in technology seen in recent years.

Blood, sweat and tears are involved in extracting small amounts of gold from the earth's crust.

Bernanke's 'QE3', which should be known as 'Currency Debasement 3' means that the dollar, the euro, the pound and all fiat currencies in our current fiat based monetary system will continue to fall in value versus gold, silver and the precious metals.

On a slightly more mundane and less important note, today European Finance Ministers are meeting in Nicosia, Cyprus.

The Fed action is manifestly bullish for inflation hedging assets such as equities and gold and bearish for cash in all its forms and bonds.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

Cross Currency Table – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.