Apple's iPhone, Germany, the Fed: Why It's All Irrelevant to Stock Market Trend

Stock-Markets / Elliott Wave Theory Sep 14, 2012 - 10:51 AM GMTBy: EWI

A lot of people know that R.N. Elliott discovered the Wave Principle.

A lot of people know that R.N. Elliott discovered the Wave Principle.

Yet few are aware that Elliott made another observation during his years of studying the stock market.

As the Wave Principle forecasts the different phases or segments of a cycle, the experienced student will find that current news or happenings, or even decrees or acts of government, seem to have but little effect, if any, upon the course of the cycle. It is true that sometimes unexpected news or sudden events, particularly those of a highly emotional nature, may extend or curtail the length of travel between corrections, but the number of waves or underlying rhythmic regularity of the market remains constant [emphasis added].

R.N. Elliott, R.N. Elliott's Masterworks, pp. 158-159

What a stunning insight: Even major news does not alter the market's main wave pattern! This seems to defy logic because most people believe that news and events are the very things that drive the stock market.

Yet, it was barely 100 years ago when most people believed that only birds could fly.

And even then, most people would never believe that a steel-encased object weighing nearly a million pounds (Boeing's 747) could get airborne and fly at 500 miles per hour.

Yet, natural law is what governs airplane flight, the buoyancy of metal ships, the incandescent light bulb, radio transmission over the air and, yes, the Wave Principle.

Natural law is inherent in the pattern of stock prices. That's why outside events do not materially influence the pattern's behavior.

This is particularly relevant today: Recent news covered Apple's new iPhone, which is expected to boost U.S. GDP; the European Central Bank's pledge to make "unlimited bond purchases"; Germany's Supreme Court approving the eurozone's permanent bailout facility; and the expected Federal Reserve announcement on whether to initiate more quantitative easing.

None of this will have an effect on the market's overall price pattern.

Charts of the Dow Industrials reveal that changes in interest rates, the deficit, the price of oil, terrorist attacks, Fed announcements and even wars do not change the market's main trend.

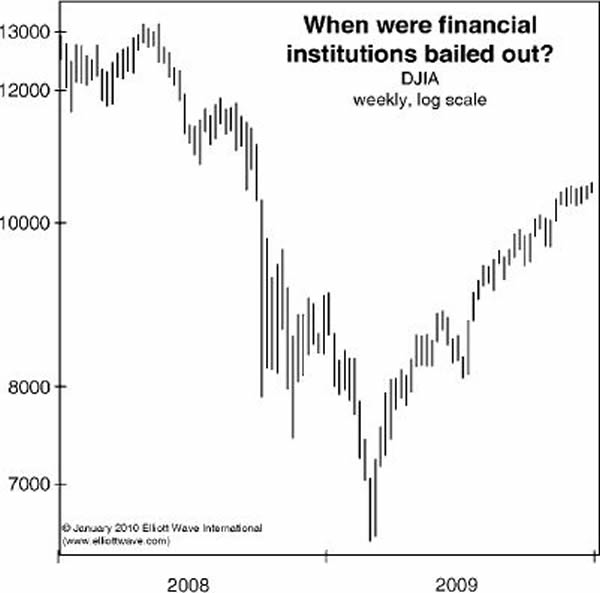

How about government bailouts of troubled financial institutions during the 2007-2009 financial crisis?

Please try to pick out on the chart below when those bailouts occurred.

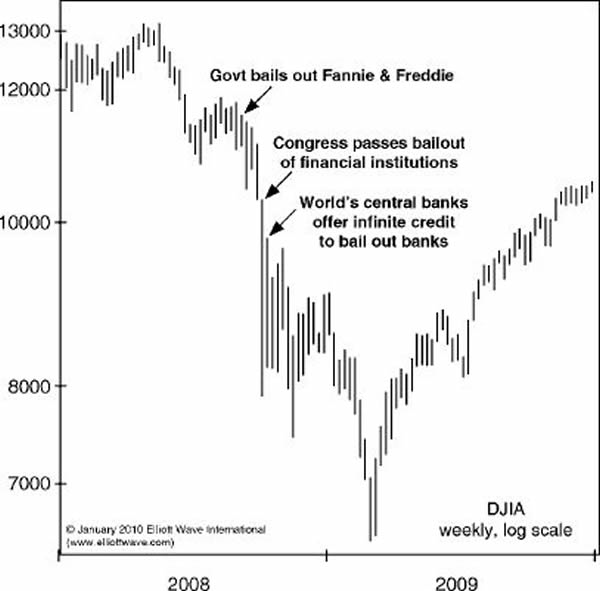

According to the exogenous-cause model, these historic pledges and bailouts should have had immediate results. ... According to the economists' beliefs, the only rational place for them to have taken place would be at the bottom of the market. The minute the authorities began flooding the market with liquidity is the minute it should have turned up.

[The chart below] shows that in fact these actions took place in the early portion of the biggest stock market decline in 76 years. These actions did not push stock prices back up. The market finally bottomed months later, at a time when nothing along these lines happened.

The Elliott Wave Theorist, March 2010

Now, look at this labeled chart to see how you did.

In the 70 years since R.N. Elliott observed that news does not alter the market's wave pattern, his insight has been proven time and again.

It's wise to keep your market eye on what really matters: the Wave Principle.

R.N. Elliott drew a chart by hand 70 years ago and the final label is the year 2012! Amazingly, today's wave analysis confirms that his decades-ago analysis may be precisely on target.

The herd keeps looking to irrelevant outside events to aid their investing decisions. It's time to break away from the herd and start investing independently. EWI is here to help ...

Learn to Think Independently You'll get some of the most groundbreaking and eye-opening reports ever published in Elliott Wave International's 30-year history; you'll also get new analysis, forecasts and commentary to help you think independently in today's tumultuous market. Download Your Free 50-Page Independent Investor eBook Now >> |

This article was syndicated by Elliott Wave International and was originally published under the headline Apple's iPhone, Germany, the Fed: Why It's All Irrelevant to the Market's Trend. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.