Stock Markets Sucker Punch?

Stock-Markets / Stock Markets 2012 Sep 20, 2012 - 03:47 AM GMTBy: Brian_Bloom

To be useful, technical analysis of investor behaviour requires a suspension of prejudice; which is an extremely difficult outcome to achieve.

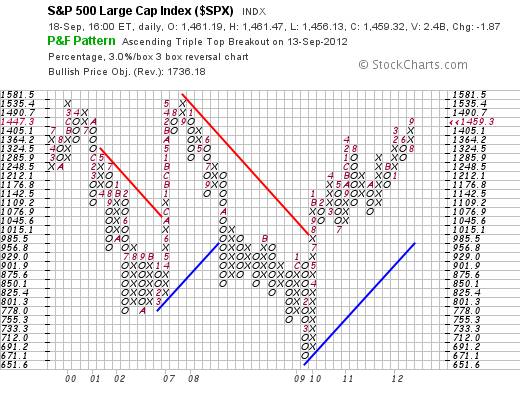

The chart below – of the S&P 500, courtesy stockcharts.com – has given a strong buy signal. At face value, this makes no sense. The world economy is in a mess. How can the world’s largest stock market be giving buy signals?

Chart #1 – Point & Figure Chart of Standard and Poor 500 Index

The most reasonable explanation flows from a reaction to the stated policy objectives of the central banks (Fed and ECB) that they will stand behind sovereign debt by printing money to buy ever more amounts of it and they will continue to “stimulate” the economy by keeping interest rates low. i.e. Monetary inflation will drive prices up and interest rate policy will keep the cost of capital down.

This is cloud cuckoo-land reasoning. The problem with this approach is that it gives rise to negative real yields on investment and, therefore, wealth preservation will become a function of making paper capital profits. The reality is that the longer this “solution” is implemented, the more real wealth will be destroyed.

From the perspective of retired people this is a terrifying prospect. A point will inevitably be reached when a retired person – unable to live on the interest on his/her investments – will be forced to dip into capital. And this begs the question: What will happen when the capital runs out?

Clearly, if one exits the work-force (for whatever reason) then one’s ability to survive in an environment of fixed income and price inflation is cast in doubt. Eventually, the numbers will become impossible to resolve because both individuals and governments will have to borrow more and more money; and the central banks will have to print more and more money just to get the nominal economy to stand still. Eventually, the ever accelerating treadmill of life will prevail and the exhausted runners will be flung off that treadmill in ever increasing numbers.

Let’s look at the runners – those who remain in the workforce.

Their financial survival will be dependent on their pricing power. A successful corporate lawyer, for example, will be able raise his hourly rate to compensate for price inflation. But what will an ordinary worker do? His pricing power will be undermined by the fact that high unemployment renders competition for jobs ever fiercer. Therefore, no worker will have the negotiating power to ensure that his income rises at a rate that is sufficiently robust to compensate for price inflation.

When one looks at the combined purchasing power of retired, unemployed and ordinary workers who have no pricing power one discovers that demand at the margin will inevitably shrink at an accelerating rate. i.e. The velocity of money will slow and the volume of goods and services purchased will contract regardless of what nominal GDP appears to be doing. In short, the recently announced policies of the Fed and the ECB may be likened to a Mafia style “kiss of death”. Visibility of this problem is emerging for all to see because the numbers of unemployed, underemployed and retired are large and growing.

There is only one way to genuinely stimulate any economy and that is to stimulate value-add activity. If a previously unemployed seamstress, for example, produces a shirt, then she is adding value. But the question arises as to whether anyone wants/needs that shirt. If everyone who can afford to buy shirts has a dozen shirts in their wardrobe then the production of yet another shirt does not add value from the perspective of potential customers.

The value-add cycle slows down when market demand for a particular product/service hits saturation point.

Now let’s look at product life-cycles – in particular, let’s look at the recently released Apple 5 iPhone as an illustrative example. Does the world really “need” a version #5 of this technology?

Well, if you’re into the latest gadgetry then, of course, you absolutely have to have one. But you will also have to have version #6 as soon as that comes out and version #7. Eventually, at the margin, version #8 will not be sufficiently compelling to customers and Apple as an organisation will collapse – unless it can come up with a brand new gadget. What’s the probability of that happening “ad infinitum”?

Well, according to the chart below, investors seem to believe that it will continue to happen – at least for the foreseeable future. Since 2000, the share price of Apple Inc has risen from around $8 to around $700 and yet another technical buy signal has recently been given.

As observed above, technical analysis requires a suspension of prejudice. You don’t have to believe that the buy signal is sensible, you just have to act on it.

Chart # 2: Point & Figure Chart of Apple Inc.

But, perhaps a more important question is this: Can one make money on the financial markets by suspending logic and common sense?

And the answer is: Absolutely! Right up to the point where you are wiped out.

The harsh reality is that Commerce and Industry (and the economy) depend on value-add activity for their long term survival, and “value-add” is a function of addressing needs.

In today’s world, the poor tend to have needs and the rich tend to have wants. The core economy will be sustained by corporations that address the needs of the masses. It will not be sustained by corporations that satisfy the wants of the rich. Why? Because the rich are in the minority. They do not have sufficient buying power to drive the entire economy. Now this may sound like communism or socialism to some. In fact it is neither. The conclusion flows from logic and common sense. Either humanity adapts its behaviour to cope with reality, or the world economy will collapse and take everyone down with it – rich and poor alike.

So where are the greatest needs?

The need to embrace ethical behaviour on the part of decision makers would be a great starting point, followed by:

- New and more powerful energy paradigm/s than fossil fuels

- New employment generating technologies that hang of the new energy paradigm/s

- Basic food and clean water

- Low cost housing

- Education that is appropriate to a modern day world

- Low cost transportation, including mass transportation

- Traffic arteries and other traffic infrastructure

- Low unit cost health services

From another perspective, the idea of “gifting” any/all of the above to the poor is anathema. For economic activity to be sustained, there needs to be an exchange of values. Therefore, the poor need to add value too. And, in the absence of education, the only possible value they can offer is manual labour.

But the numbers are against us. In a world of automation where (say) 5 billion of the planet’s 7 billion population have nothing but manual labour to offer, how will the global economy survive? (The term “global economy” is used advisedly. Those who think that any particular country can survive and prosper in a vacuum do not understand the extent to which international trade stimulates domestic economies)

There is only one sensible response to this question of economic survival: Our values must change or humanity will experience a significant contraction in its numbers which, in turn, will put a downward pressure on international trade. The concept of economic “growth” in first world countries no longer makes sense in world where “wealth” is generated by selling iPhones to those with high disposable income, and by trading financial instruments that add no value; and where a shrinking proportion of the population is economically active. In our own self-interests, we have to ensure that the poor are given the opportunity to participate in the global economy. Clearly, a condition precedent to this will be to ensure that the masses are appropriately educated. Well, if the absence of education is thought of as a need, then education may be thought of as an exportable, value-add asset; and the revenue to pay for the acquisition of this asset will flow from the export of primary goods such as farm output and minerals by those needing the education. Clearly, the primary obstacle to be overcome in this case is the corruption of officialdom in third world countries where the education is most needed.

To achieve this latter objective will require that the values of the world shift to re-embrace the concepts of ethics and morality. As I argue in my latest fact-based novel, The Last Finesse, ensuring such an outcome should be one of the primary objectives of the United Nations.

Yes, some (many?) will see this type of reasoning as idealism. In plain language, my response is that the global economy has reached a point in its history where it can no longer be stimulated by central bank intervention or by political jawboning. Unless and until we can get our heads around this simple concept, we might be well advised to ignore “buy” signals in everything except those counters where value-add is part of the ethos of the underlying business enterprise. In simple language, a point is ultimately reached in human history where idealism and pragmatism intersect; and we have reached that point.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2012 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.