U.S. Dollar Index Disguises Global Inflation Threat

Currencies / Inflation Oct 17, 2012 - 03:58 AM GMTBy: Jonathan_Kosares

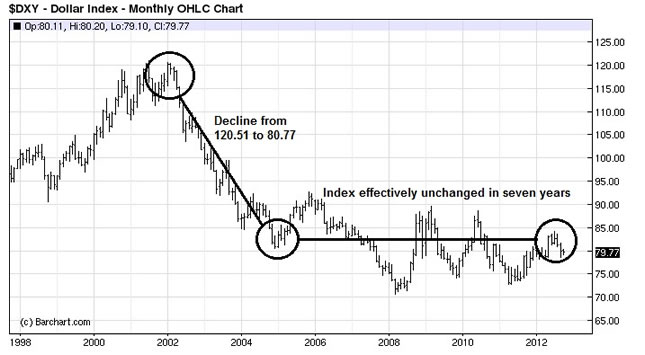

When the U.S. Dollar Index peaked at 120.51 in January of 2002, few suspected that it was on the brink of a one-directional correction that would ultimately erase a third of its value. In fact, in just three short years, the dollar index shed, on average, a point a month before ultimately hitting a low of 80.77 in January of 2005. This sharp decline in the dollar index coincided with, and largely fueled, the first few years of the now decade-old bull market in gold.

When the U.S. Dollar Index peaked at 120.51 in January of 2002, few suspected that it was on the brink of a one-directional correction that would ultimately erase a third of its value. In fact, in just three short years, the dollar index shed, on average, a point a month before ultimately hitting a low of 80.77 in January of 2005. This sharp decline in the dollar index coincided with, and largely fueled, the first few years of the now decade-old bull market in gold.

Those participating in the gold market in those first few years were taught ‘at a young age’, so to speak, that the dollar and gold were inseparably linked. If one wanted to know what was going on with gold, one would look no further than the dollar index. If the index fell, gold would rise, and if it rose, gold would fall. Even today, financial media outlets still ‘explain’ the daily movements of the gold price in this same context of corresponding activity in the dollar index. If the dollar index is so important to predicting and explaining the value of gold, then how does one explain that seven years after hitting the low of 80.77, the dollar index is still trading in the same range - just above 80 today - yet gold has quadrupled?

Simply put, the long accepted inverse correlation between the dollar index and the gold market is flawed and needs to be abandoned. Not just because it fails to explain the last seven years of gold’s performance, but it stands to only become more irrelevant, and even potentially misleading, moving forward.

Here’s why:

Generally, individuals equate the dollar index to some representation of the value of the dollar. With financial media coverage on the dollar focusing on the performance of the dollar index, it’s hard not to fall into that trap. And it is partially true. The dollar index is meant to be a strength/weakness indicator for the dollar in terms of the other major currencies. If the index rises, the dollar is strengthening against those currencies. Conversely, if it declines, the dollar is weakening against those currencies. But what matters to main-street is not whether the dollar is ‘strong’ or ‘weak’ because, in reality, those words are nothing more than impractical rhetoric. What matters is the value of a dollar in terms of what a consumer can buy with it. What is important is not confusing this practical understanding of the dollar’s value with the nebulous data embodied in the dollar index.

A quick example:

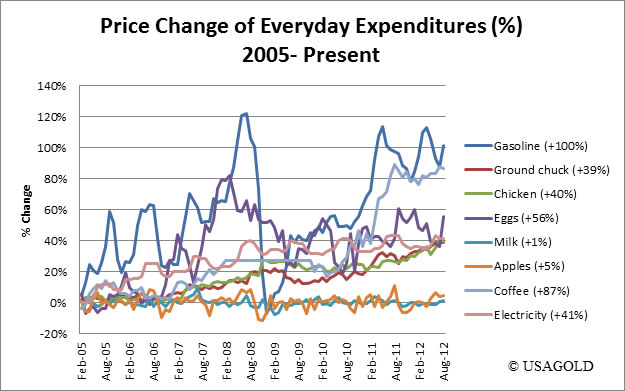

According to the Bureau of Labor Statistics (BLS), approximately 35% of the average American’s income is spent on housing. The next two largest expenditures are for transportation (16%) and food (14%). Given the share the cost of energy has in both housing and transportation expenditures, it cannot be disregarded as a significant outlay for Americans, though it isn’t given its own place in BLS reports. In looking at a graph of various food and energy prices (both gas and electricity) since January of 2005, it is clear that the dollar has lost considerable value against a sizeable swath of everyday expenditures. This tells a decidedly different story than seven years of a functionally unchanged value in the dollar index.

A simple gut check will tell you that this is a consistent theme across nearly all goods and services, not just what’s listed here. On average, the items charted above are 45% more expensive than they were in January 2005, with gasoline costing double. So, in just seven years, the dollar has lost about one-third of its spending power, its practical value, when measured against some of the most common goods purchased by the average family. On a side note, food and energy are the two components specifically excluded from core CPI as they are said to be ‘too volatile’, offering some insight into how incomplete core CPI figures are as a practical measure of inflation.

And if you want to see where the dollar has really lost ground during this period, look no further than gold. Gold has quadrupled since January 2005, suggesting that in terms of its spending power against gold (which happens to be one of the only vehicles that has kept up with, and actually outpaced, food and energy inflation), a 2005 dollar is currently worth 24 cents.

If you would like to broaden your view of gold market, we invite you to sign-up for our regular newsletter and receive quality commentary like what you are now reading. It's free of charge and comes by e-mail. You can opt out at any time.

The dollar index, financial media will tell you, is maintaining persistent strength, largely due to constant failures and disruptions in the Euro Zone, affecting the value of the euro and pushing ‘safe-haven’ flows into US Treasuries. Every now and then we still hear some ‘strong dollar’ rhetoric. What’s taking place behind the scenes is a full-fledged currency war, as countries seek to lower the value of their currency to relieve debt burdens and encourage economic growth through export markets. In essence, currencies appear to remain somewhat constant in value vis-a-vis one another, masking the across-the-board devaluation in terms of their individual spending power.

The net result is that the dollar index remains tightly bound in its range, as do all of the other currencies, yet all devalue against real goods and services. As currency wars ramp up, the nominal values applied to currencies in this model will become increasingly irrelevant and misleading. In fact, one could argue, given its decline across so many areas, that a collapse in the value of the dollar is already taking place, and it is being disguised, not displayed, by the dollar index.

Which brings us to gold. Anybody who believes the next leg of the bull market in gold needs to see a decline in the value of the dollar index as its impetus ought to rethink their analysis. Whether the dollar index falls to 70 or rises to 90 is of little consequence to the gold market. So long as international devaluation policies remain in place, the gold bull market will continue. The value of the dollar index will be nothing more than a representation of who is winning the war…a sort of scoreboard for the ongoing ugly contest between government-issued currencies.

Addendum: A couple of interesting quotes drawing on the theme of this article came out over the weekend: First, Ben Bernanke:

“However, since mid-2008, in fact, before the intensification of the financial crisis triggered wide swings in the dollar, the real multilateral value of the dollar has changed little, and it has fallen just a bit against the currencies of the emerging market economies."

Second, Brazilian Finance Minister Guido Mantega:

“I have been arguing that ‘currency wars’ will only compound the world’s economic difficulties. Trying to grasp larger shares of global demand through artificial means has many side effects. It is a selfish policy that weakens the efforts for concerted action.”

By Jonathan Kosares

Jonathan Kosares graduated ***** laude from the University of Notre Dame with a dual major in Finance and Computer Applications. He has been with USAGOLD since 2002, and currently holds the position of Executive Vice President of Sales and Marketing. He is the moderator of the USAGOLD RoundTable series, has authored numerous articles on the gold market and manages client activity for the high net worth division as well as the USAGOLD Trading and Storage Program.

This newsletter is distributed with the understanding that it has been prepared for informational purposes only and the Publisher or Author is not engaged in rendering legal, accounting, financial or other professional services. The information in this newsletter is not intended to create, and receipt of it does not constitute a lawyer-client relationship, accountant-client relationship, or any other type of relationship. If legal or financial advice or other expert assistance is required, the services of a competent professional person should be sought. The Author disclaims all warranties and any personal liability, loss, or risk incurred as a consequence of the use and application, either directly or indirectly, of any information presented herein. Opinions expressed by contributors are strictly their own and publication here does not represent endorsement by USAGOLD.

Editorial questions and comments: editor@usagold.com |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.