Trading Apple Stock Using Options Short Strangles

Companies / Options & Warrants Oct 17, 2012 - 04:06 AM GMTBy: J_W_Jones

My last missive dealt with a simple trading plan for XOM using the straightforward easily managed and easily understood strategy of selling naked puts and either allowing assignment of the stock and entering a covered call campaign or closing the position after extracting most of the premium initially received. Continuing on the theme of basic strategies, I would like to look at a different high probability strategy applicable to AAPL.

My last missive dealt with a simple trading plan for XOM using the straightforward easily managed and easily understood strategy of selling naked puts and either allowing assignment of the stock and entering a covered call campaign or closing the position after extracting most of the premium initially received. Continuing on the theme of basic strategies, I would like to look at a different high probability strategy applicable to AAPL.

The reason for focusing on basic option trades is quite simple: they consist of few moving parts, are easy to enter and manage, and the statistics underlying their probabilities of success are straightforward.

While the available option strategies are protean and can be tailored to fit a wide variety of market conditions, it is easy to get confused with these multi-legged constructions.

I encourage the novice option trader to understand fully these basic approaches and recognize that many of these are the core of more advanced strategies.

I want to emphasize again that traders should focus their trading on the most liquid of the options series available. Life as an option trader is sufficiently difficult that there is no need to introduce the additional complications of dealing with liquidity traps.

Let us take a look at the current situation in AAPL. This stock has incredibly liquid options, trading well over $1 million in daily option volume over the last several weeks. Another manifestation of liquidity, the size of the bid / ask spread, is only a few cents. Finally, there is robust open interest in a wide variety of the option strikes. This is a liquid trading vehicle, and it in fact has THE most liquid options of any individual common stock.

The strategy on which I would like to focus has as its essential element the simultaneous selling of both an out-of-the-money call and put resulting in establishing a high probability short strangle.

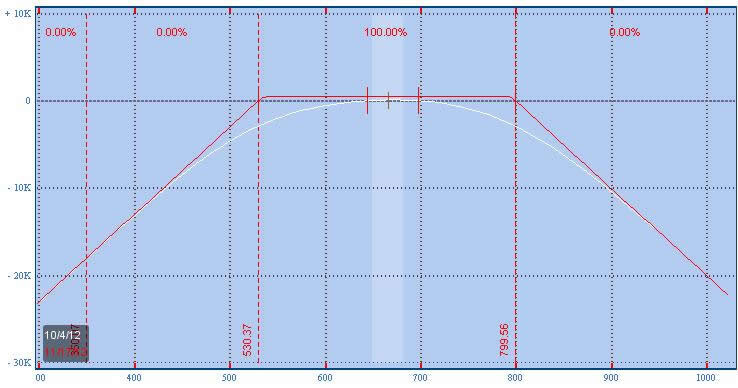

The trade has potentially unlimited risk on the upside and risk of AAPL trading to $0 on the downside. However, at a practical level risk is controlled by two essential characteristics; the trade is taken in small size relative to the total portfolio, and the specific options sold have in excess of 90% probability of expiring worthless.

Let us consider the specifics. The first thing to consider in premium selling strategies is the current state of the implied volatility of the underlying asset in question. AAPL is one of a small number of stocks that has its own ticker symbol for the implied volatility, symbol VXAPL. The current status is displayed below:

As can be seen above, the current implied volatility is mid-range, meaning options are neither particularly rich nor poor in valuation.

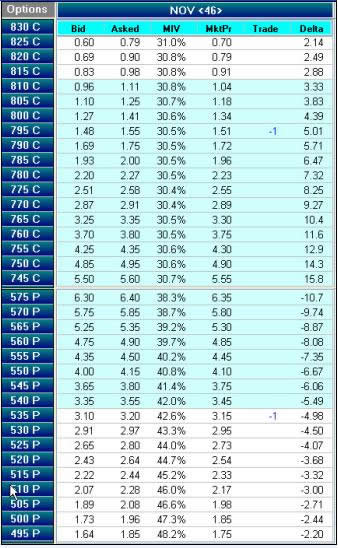

Now, let us consider a specific trade. Below is displayed the current option chain for AAPL. We will be selling options with a delta of around 5. The delta is roughly equivalent to the probability of expiring in-the-money. Therefore, the option has an estimated 95% probability of expiring out-of-the-money.

Since we are selling both the call and the put, the probability of both being out of the money is 0.95*0.95 = 0.90. The position therefore has a 90% probability of expiring out-of-the-money while keeping the entirety of the premium received when it was entered.

The trade is capital intensive, requiring approximately $6,700 of margin encumbrance per 1 lot in a Reg T account. Substantially less capital is required in a Portfolio Margin account, approximately one-third of that amount. On the basis of this maximum potential initial margin, the trade has an annual yield of 57%.

While the nuances of trade management are beyond the scope of today’s missive, suffice it to say that prudent management is not to allow the position to incur a loss greater than the initial credit received. The trade can be actively managed by closing the “good” side and rolling the strikes up or down to receive additional credits as price action permits.

Last week we discussed the elusive “free money” trade. This Is not it either, but is simply a high probability trade constructed in a liquid trading proxy. It is important that this trade be entered with only a small portion of total portfolio value.

Remember that probabilities only are realized over a growing series of specific encounters. It is imperative to retain sufficient capital in reserve to allow enough subsequent entries that probabilities are allowed to be realized.

Happy Option Trading!

If you are looking for a simple one trade per week trading style then be sure to join www.OptionsTradingSignals.com today with our 14 Day Trial.

If you are looking for a simple one trade per week trading style then be sure to join www.OptionsTradingSignals.com today with our 14 Day Trial.

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.